[ad_1]

In a world of uncertainties, residing with the safety of an emergency fund is priceless. Whether or not you’re sitting on $1,000 in your starter emergency fund or about $15,000 in your fully funded emergency fund, you’ll have peace of thoughts understanding you’ve received cash saved for a wet day.

Why? As a result of it’s going to rain.

However you’re prepared.

Nonetheless, you would possibly surprise when to make use of your emergency fund. If one thing comes up, do you simply have to rethink priorities? Do you have to transfer issues round in your funds to create space for this new expense? Or is that this a legit emergency?

After all, in the event you can transfer issues round to cowl the expense, do this first. However bear in mind, it’s going to rain. There’s no disgrace in utilizing your emergency fund if you really want to. That’s what it’s there for.

When to Use Your Emergency Fund

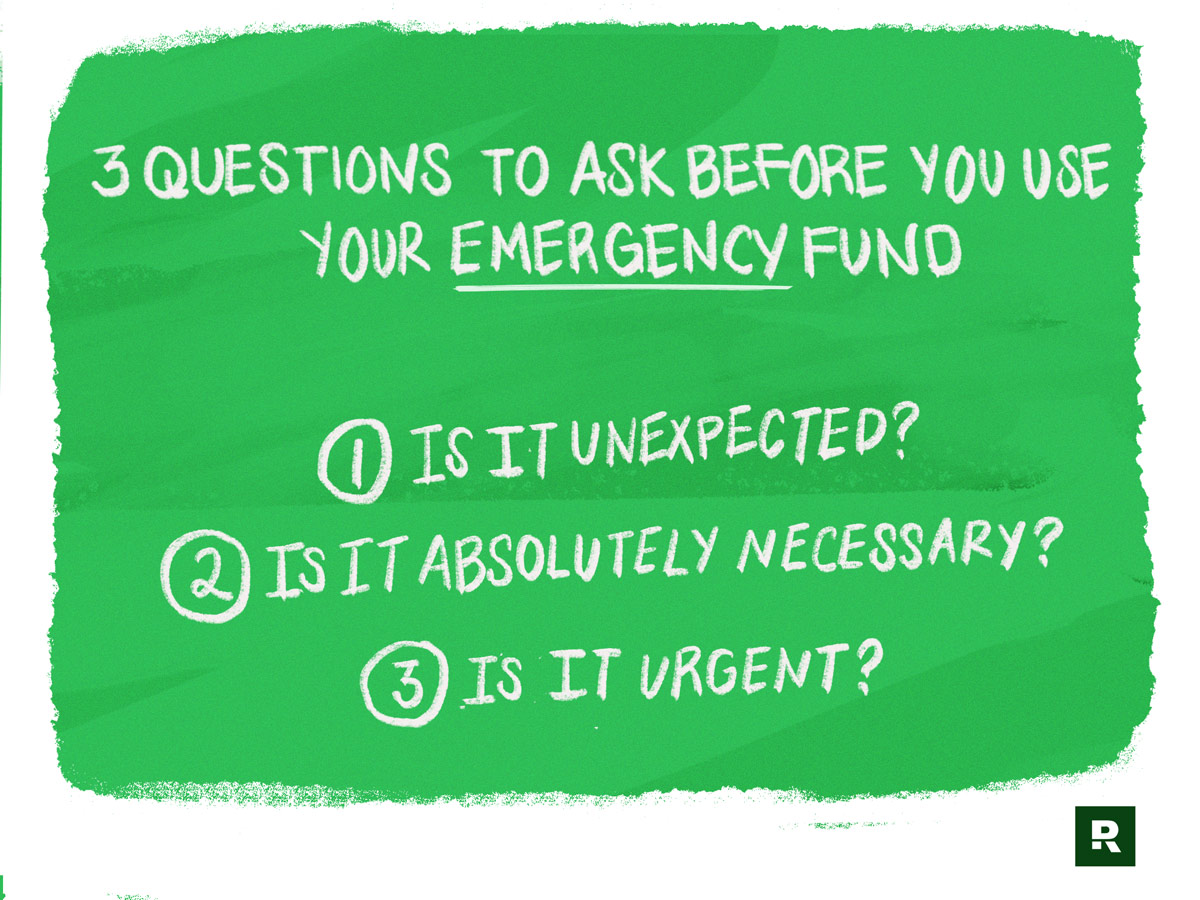

Ask your self these three inquiries to be sure to’ve received an actual cause to dip into your emergency fund.

- Is it surprising?

- Is it completely mandatory?

- Is it pressing?

1. Is it surprising?

Seems Christmas occurs the identical time yearly. (It’s December 25.) And that semiannual automotive insurance coverage cost? Effectively, you recognize that’s coming too.

For those who’re not budgeting ahead for these anticipated bills, it’s time to begin. In any other case you’ll be tempted to make use of your emergency fund for one thing that’s not an emergency. It’s simply poor planning.

Listed here are some examples of the distinction between unexpected and anticipated bills:

Normally Surprising:

- Job loss

- Pay minimize or fewer hours

- Storm harm to your own home

- Automotive accident repairs

- Emergency medical bills

Ought to Be Anticipated:

You most likely seen “job loss” tops the record of often surprising bills. That’s the primary cause the totally funded emergency fund is ready at 3–6 months of bills—so a job loss doesn’t destroy your funds.

It offers you the safety of understanding you may nonetheless pay the payments whilst you search for a brand new job. A job loss is soul-crushing sufficient with out having to fret about the way you’ll hold the lights on.

If the life occasion or expense you’re is actually surprising, then it’s most definitely time to make use of that emergency fund.

2. Is it completely mandatory?

Most of us would say we all know the difference between a want and a need. However generally the road between the 2 will get a bit of blurry.

For instance, self-care is necessary. However a weekend getaway isn’t mandatory. Don’t use your emergency fund for that. A superb library ebook or a hike within the woods might be simply nearly as good for you. And each of these occur to be free.

Okay, if that appears too apparent, listed below are a couple of extra examples:

Wants:

- Lack of dependable transportation

- Greater-than-anticipated tax bill

- Surprising journey in time of household disaster

Needs:

- Automotive improve to newer mannequin

- Newest iPhone or expertise gadget

- Final-minute trip alternative

In case your automotive goes kaput, you want transportation—so use your emergency fund to buy something affordable and reliable you may pay money for.

However don’t dip into your emergency fund simply to improve your respectable automotive for one with one million bells and whistles. That’s not mandatory.

3. Is it pressing?

Ever had an employer who stated the whole lot in your to do-list was pressing? Or been round a child who wanted the whole lot proper now? It’s exhausting. And in the event you reside with that angle about your spending, you’ll quickly exhaust your emergency fund.

Don’t. Do. That. As an alternative, keep away from impulse buys and follow the artwork of endurance at any time when doable. Listed here are some examples of pressing vs. not pressing:

In all probability Pressing:

- Damaged AC in the course of summer season

- Sudden, out-of-state transfer

- A cracked tooth (due to a pesky popcorn kernel)

Can Wait:

- The sale of the century at your native Walmart

- A superb deal on footwear at a foul time in your funds

- Live performance tickets

Bear in mind—your emergency fund is all about long-term safety, not instantaneous gratification. Don’t apply it to a whim. But additionally, don’t be afraid to make use of it when you really want to.

Are you prepared for life’s emergencies? Learn how to get there with Financial Peace University.

Simply be sensible and ask these three inquiries to examine your self so that you don’t wreck your self (or your funds).

Know When to Use Your Emergency Fund Correctly

Hey, in the event you’re dealing with an actual emergency, don’t freak out if it’s a must to use your emergency fund. That’s what it’s there for! You labored exhausting to avoid wasting up this safety. Let it defend you.

Take a deep breath. Ask your self these three questions. Discuss it by means of together with your accountability accomplice. And transfer ahead in confidence. As a result of the solar will come again up and dry up all that rain.

Quickly you’ll be again in your EveryDollar budget rebuilding that emergency fund. However for proper now, deal with you and yours.

[ad_2]

Source link