[ad_1]

When you’re in faculty, you are in all probability targeted on so many issues. You are making an attempt to get good grades, set your self up for profession success, and win your intramural disc golf championship (hey, that is a giant deal too). As you retain up with all of these necessary issues, there’s one other one I don’t need you to overlook about: making good monetary choices.

Consider me, I get it—faculty isn’t simple. However being sensible with cash whilst you’re at school is simply as necessary to your future success as your diploma. And all of it begins with an excellent faculty finances.

Why Do I Want a School Finances?

To place it merely: If you don’t have a finances, you’re not in command of your cash. A finances is sort of a sport plan, and whenever you don’t have a sport plan, you’re extra prone to lose the sport. I need you to win with cash.

You will not be fully by yourself but, however there are nonetheless a number of bills it’s essential be ready for as a university pupil. That’s the place the finances comes into play.

Frequent Month-to-month Bills for School College students

Listed here are some widespread month-to-month bills that apply to most faculty college students.

- Meals: Whether or not you may have a campus meal plan otherwise you purchase your individual groceries, you’ll need to pay on your meals.

- Textbooks: When most college students see how a lot faculty textbooks can price, their jaws nearly hit the ground. However it can save you cash on textbooks if you recognize the proper sources (and we’ll go over them afterward).

- Transportation: Whether or not you may have a automobile, journey the bus, or hire a campus scooter, you’ll be paying for transportation. (This may embody routine upkeep, like oil adjustments and car insurance, along with fuel.)

- Housing: Whether or not you reside in a dorm or house, you’ll be paying hire.

- Leisure: You wish to have not less than a little little bit of enjoyable in faculty, proper? Leisure bills embody every part from going to the flicks with mates to taking flugelhorn classes (if that occurs to be the type of factor you’re into).

It’s additionally necessary to consider saving cash (a $500 emergency fund is an effective place to start out) and constructing the behavior of generosity. Simply since you don’t have some huge cash doesn’t imply you’ll be able to’t take into consideration serving to others (I like to recommend giving 10% of your revenue).

And don’t overlook about tuition. You may not be getting a month-to-month invoice for it (most college students pay their tuition earlier than the semester begins), however that doesn’t imply you don’t want to consider it. You’ll wish to get monetary savings for tuition each month—that’s one of many keys to avoiding student loans.

How one can Make a School Finances

Now that you recognize why you want a university pupil finances, let’s speak about how to make one. When you’ve by no means made a finances, don’t fear. You are able to do this! And as soon as we break it down, it received’t appear so overwhelming. Listed here are the steps to creating your faculty finances:

1. Write down your revenue.

A finances is solely a plan on your cash the place you determine—earlier than every month begins—how a lot you’re going to present, save and spend. So, step one to creating a finances is determining how a lot cash you must begin with.

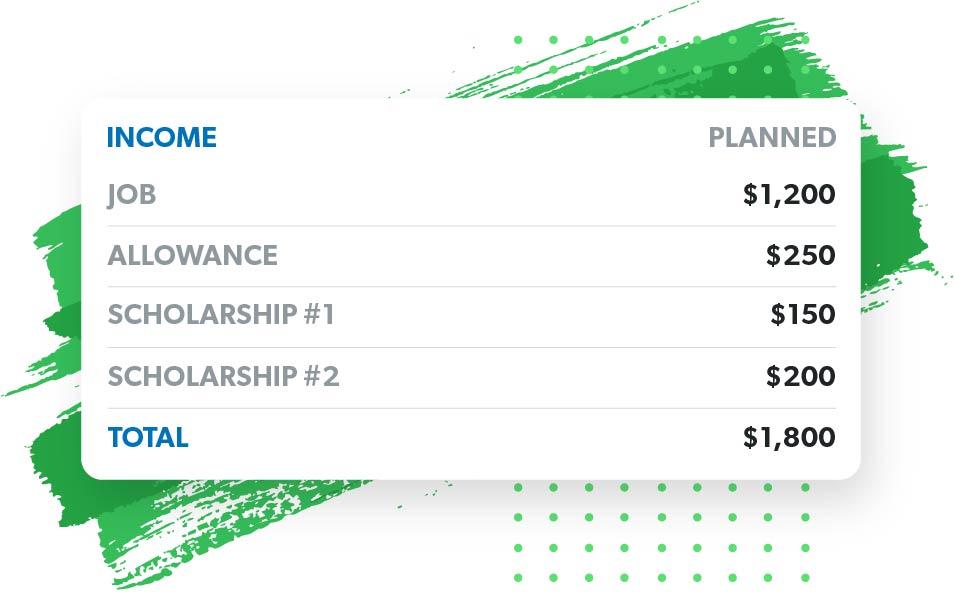

Add up how a lot cash you’ll have coming in through the upcoming month from all sources—together with the cash you’ll make from jobs or side hustles, any scholarships which can be paid to you immediately, and any cash you’ll obtain out of your mother and father (in the event that they make it easier to out in that approach).

Start budgeting with EveryDollar today!

In case your revenue varies and you’ll’t write down actual numbers, that’s okay—simply get as shut as potential. When you’ve received all of the numbers, write them down in your finances. Right here’s what that would seem like:

By the way in which, my favourite approach to hold monitor of my finances is with the free EveryDollar app. It makes establishing your finances tremendous simple—particularly if it’s your first time. The very best half? It does all the maths for you. And did I point out it’s free to make use of?

2. Record your bills.

Subsequent, you’ll wish to write down every part you spend cash on. The listing I discussed earlier is a superb place to begin, however you will have another bills that aren’t on the listing. Look again at your financial institution statements or receipts and take into consideration every part you spend cash on—then write these issues down in classes, like meals, hire, payments, transportation and so forth.

When you’ve organized your spending into classes, plan how a lot you’ll spend on every of them. I like to start out my finances with the proper perspective by placing giving and saving on the prime of my listing. (Plus, this helps me be certain that I don’t run out of cash earlier than I give and save.) Then I transfer on to the opposite classes.

Some bills, like hire and subscription funds, are the identical price every month. For others, like meals and transportation, you may have extra management over how a lot cash you’ll spend. To make this simpler, have a look at what you spent final month in every class.

3. Subtract your bills out of your revenue.

When you’ve assigned a greenback quantity to each class, it’s time for the enjoyable half: getting out the calculator. Okay, perhaps this isn’t tremendous thrilling (except you’re a math main), however it’s additionally not that tough.

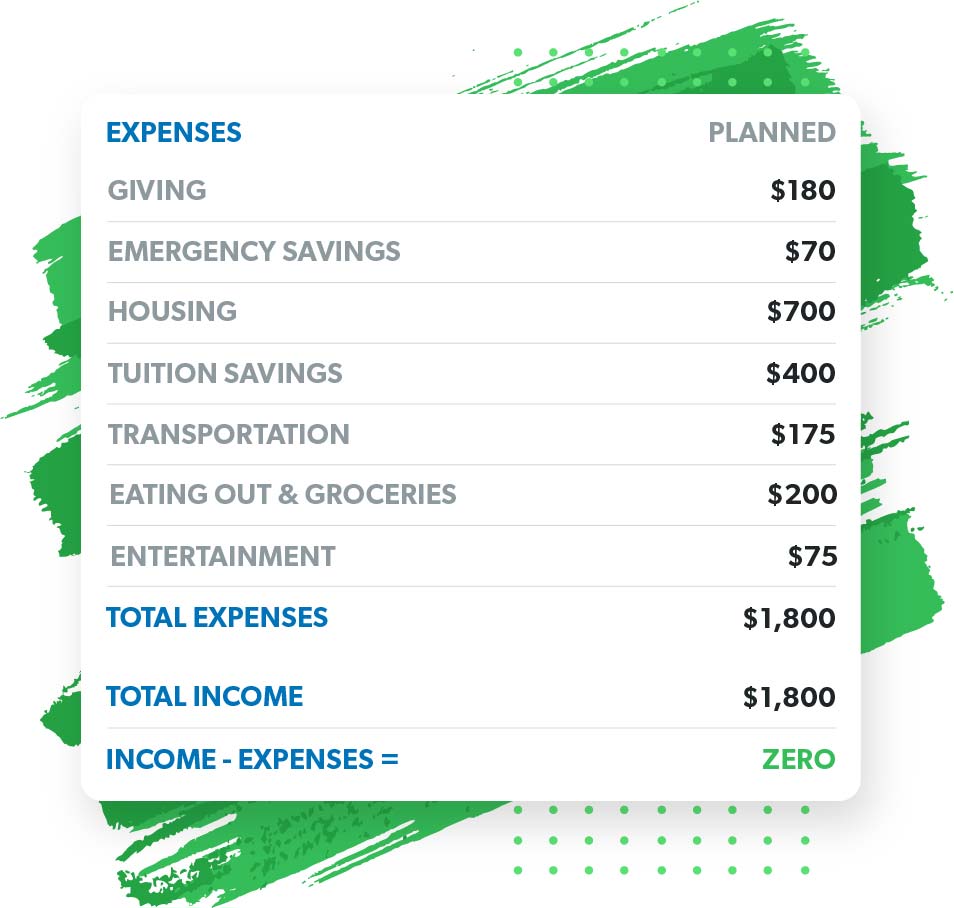

Add up all of the bills you simply listed, together with what you propose to present, save and spend. Then, subtract that complete out of your revenue. The aim is for that to equal zero. Why? As a result of a zero-based budget, the place your revenue minus your bills equals zero, is the greatest kind of finances. This implies each single greenback you earn has a job. When you do the maths and your distinction is zero, you’ll be able to go forward and transfer on to the subsequent step. If not, you’ll must make some changes to get there.

So, if the full of your bills is much less than your revenue, give that leftover cash one thing to do—perhaps you add it to financial savings or give it to a trigger you care about. And if the full is extra than your revenue, you may have two nice choices: increasing your income (belief me, there are many methods to make more money in faculty) or reducing again in your bills. We’ll go over some recommendations on how to try this a bit bit later.

Right here’s what your finances may seem like with the instance revenue we utilized in step one:

4. Monitor your spending.

Congratulations! You’ve made your first official faculty pupil finances. However you’re not fairly performed. As a result of you’ll be able to’t simply make a finances. It’s a must to follow it.

The most important key to sticking to your finances is tracking your spending. When you’re in search of a easy approach to monitor your spending with out always combing by means of your checking account, EveryDollar is ideal for that. It’s free to make a finances on EveryDollar, however the premium version permits you to join your checking account so your whole transactions will mechanically present up within the app. Tremendous simple.

How one can Reduce Again on School Bills

When you want some extra room in your finances, reducing again on spending is a straightforward approach to release some money. Listed here are a few of my favourite suggestions for saving money in college and the way college students can spend much less on month-to-month bills.

How one can Save Cash on Tuition

There’s one tried and true approach to in the reduction of on tuition prices that each pupil ought to take full benefit of: scholarships. I discuss to college students about scholarships so much, and I’ve discovered that lots of them assume you can’t get scholarships when you’ve began faculty. However that’s not true in any respect. There are many scholarships for college kids already enrolled in faculty. My recommendation is to start out researching scholarships you qualify for and apply to as many as you’ll be able to.

How one can Save Cash on Meals

Lots of faculties require meal plans, particularly in the event you stay on campus. If that’s your scenario, attempt to get as a lot bang on your buck as you’ll be able to. I do know faculty meals isn’t the very best, and consuming within the cafeteria isn’t as enjoyable as making a run to Taco Bell or Chick-fil-A. However attempt to eat within the cafeteria as a lot as potential—you’re already paying for it, so that you may as properly get your cash’s value.

When you don’t have a meal plan, strive buying groceries and consuming at house extra typically as an alternative of consuming out. That’ll prevent a ton of cash in the long term.

How one can Save Cash on School Books

Purchasing at your faculty’s on-line bookstore could be the best and most handy approach to purchase books, however it’s not often the most affordable. In actual fact, you may get used books for lots much less on websites like Chegg, eBay or Amazon. (Simply ensure you buy the proper model.) You can too avoid wasting cash by renting books as an alternative of shopping for them.

How one can Save Cash on Leisure

There’s an excellent likelihood your faculty affords a number of choices without cost leisure. Attempt speaking to older college students and asking about some methods to have enjoyable on campus with out reaching into your pockets. One other nice approach to in the reduction of in your leisure finances is to restrict the variety of music and TV streaming services you pay for. There are a number of nice free streaming services you need to use. And be sincere: Do you actually want Netflix, Hulu, HBO Max and Disney+?

How one can Save Cash on Housing

Deciding on the very best plan for faculty housing will be tough. In some instances, benefiting from on-campus housing is probably the most inexpensive choice. Different instances, finding a roommate and renting an house off campus is your greatest wager. Ensure you do your analysis and determine which selection is the very best on your scenario.

By the way in which, in the event you do stay on campus, turning into a resident assistant is an effective way to economize on housing. RAs monitor the dorms and assist with pupil actions, and in change, they sometimes get discounted housing and a money stipend on prime of that.

The Greatest Software for Making Your Finances

Budgeting will not be the best factor on this planet however, as you’ll be able to see, you are able to do it. Plus, there are many nice instruments on the market to make the method much more easy.

As I discussed earlier, my favourite device is EveryDollar. It was made by our superior group at Ramsey, and it’ll allow you to arrange your faculty finances in lower than 10 minutes so you may get again to finding out and taking part in guitar within the quad.

[ad_2]

Source link