[ad_1]

So, you need to begin budgeting, otherwise you need to funds higher than you ever have earlier than. You don’t need random numbers on a spreadsheet—you need a plan to your spending that you would be able to truly follow so you possibly can take management of your cash for actual.

Initially, bravo! That call takes guts. We’re pleased with you! Secondly, you can follow your funds—it simply takes some work to make a practical, affordable funds. Let’s discuss how one can make that occur.

Why It’s Necessary to Persist with a Price range

Pay attention. You’ve bought massive hopes and desires—locations to go and targets to crush. And you are able to do all of it . . . however it all begins with a budget. And that funds will do you no good in case you set it and neglect it.

Your targets aren’t a gradual cooker, and your funds isn’t both. You don’t dump in numbers, click on a button, and stroll away. You’ve bought to maintain at it and hold with it.

Budgeting is telling your cash you are in cost. Sticking to the funds is exhibiting your cash you are in cost.

![]()

Easy methods to Persist with a Price range

There are tons of suggestions and tips to sticking to your funds each month. However following “tons” of ideas is difficult. So, we narrowed it right down to eight of the very best.

1. Maintain it actual.

Have you ever ever made a goal that absolutely set you up for failure? Like saying you’ll learn 10 books a month once you barely have any free time. Or promising to run 10 miles a day all yr once you’ve by no means run a meter. If you wish to succeed, you need to push your self—however you additionally need to be real looking.

The identical is true together with your funds. Push your self to spend higher and save extra—however be real looking once you arrange each single funds line.

Saying you received’t purchase any new garments all yr may not be real looking in case your winter coat is falling aside. However you can problem your self to skip eating places for a month and put the cash you save towards your present cash aim as a substitute.

If you hold it actual, you possibly can actually win.

2. Arrange auto draft.

Arrange computerized financial institution drafts so a few of your payments and financial savings deposits are paid straight out of your paycheck. That means, you don’t even contact the cash—and also you received’t be tempted to place that $200 to your emergency fund towards a brand new pair of footwear you need however don’t want.

3. Plan your meals.

Beat drive-thru temptations that bust your restaurant funds, and hold the money-grabbing munchies at bay. How? By planning your meals: breakfast, lunch, dinner and snacks. Then make a grocery listing—and follow that listing! Meal planning saves you from going overboard in your grocery and restaurant funds strains.

4. Assume weekly.

It’s possible you’ll need to break a few of your funds strains into weekly parts that will help you unfold out your spending. For instance: For those who give your self $300 for private spending, consider it as $75 every week.

For those who put $967 in your grocery funds (which is the common month-to-month spending for a household of 4), that’s like spending about $242 every week.1 Typically pondering in these bite-sized quantities makes it simpler to stay to your funds.

5. Test your social calendar.

Your BFF’s birthday is identical day yearly. Price range for it. You’re internet hosting e book membership subsequent month and must make a charcuterie board. Price range for it. Household’s coming in from out of city. You get the concept.

Start budgeting with EveryDollar today!

Sure, emergencies and surprises pop up that may rock your funds. However quite a lot of what we name “surprises” are literally simply poor planning. So, examine your social calendar once you’re making every month’s funds so you possibly can funds realistically for every month’s wants.

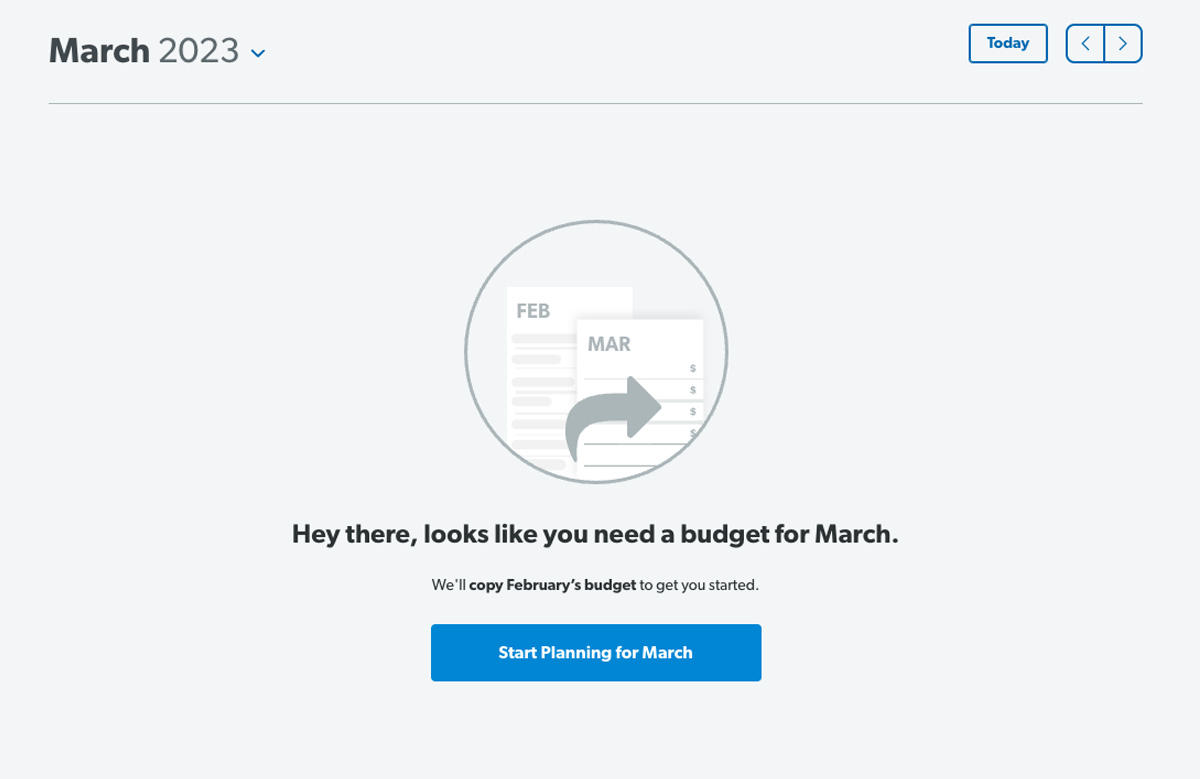

And don’t fear! You don’t need to construct every funds from scratch. Go forward and duplicate every part over from the earlier month, then solely make tweaks to the funds strains that will probably be affected by something developing.

6. Be taught to say no (or not now).

If you wish to purchase one thing, a funds doesn’t all the time say, “No means.” However it typically says, “Not right now.” As a substitute of caving in to impulse buys, save up for greater purchases, pay money, and set financial goals for your self.

And to be sincere, generally you do need to say no. That’s a part of being an grownup. It’s like saying no to social occasions so that you don’t drain your power and time. The identical goes for saying no to spending generally: You don’t spend so that you received’t drain your checking account.

Don’t fear about what everybody on social media seems to have. Some are mendacity. Some are in debt as much as their designer sun shades. And some actually do have their lives collectively. However these folks labored laborious for it—and that’s what you’re going to do too.

Work laborious defending your funds—saying no or not now when you could—as a result of being true to your self, your funds and your cash targets is extra helpful than something you can ever purchase.

7. Ditch the bank card.

Pay attention fastidiously—you don’t truly want a credit card. In actual fact, it’s typically a motivator to spend like loopy with the mindset that it’s tomorrow’s drawback. Hey. Guess what? “Tomorrow’s drawback” is a lame excuse, and also you’re higher than that!

If you wish to follow your funds, don’t use another person’s cash that comes with strings hooked up—like curiosity and charges. Pay off your debt and begin utilizing your actual cash—your money or debit card. That’s the way you keep away from “tomorrow’s issues” and begin knocking out tomorrow’s targets.

8. Discover an accountability companion.

Do your self an enormous budgeting favor and get an accountability companion. That’s somebody who’s encouraging sufficient to cheer you on and daring sufficient to name you out. Obtained a partner? Increase. You’ve bought a built-in accountability companion.

Get together with your accountability companion each month to examine in and arrange the following funds. For those who’re married—do that collectively and in particular person at a month-to-month budget meeting.

For those who’re working with a buddy or member of the family, you’re welcome to make your funds alone, however by no means skip the check-in. Your companion can’t hold you accountable in the event that they don’t know what’s occurring!

For those who aren’t certain methods to have a great funds assembly together with your accountability companion, try our free funds assembly information (the classic or the couples model).

Pay attention, there’s no disgrace in asking somebody that will help you hold your eye on the aim. Simply the alternative. There’s unimaginable energy in working as a workforce. So, get your self an accountability companion. In the present day!

![]()

Easy methods to Create a Price range You Can Stick To

Let’s begin with the fundamentals and discuss the way you bodily set up a budget within the first place.

Easy methods to Set Up Your Price range

Some folks by no means begin budgeting as a result of they’re anxious it’ll be tremendous tough. However it’s actually simply these 5 steps.

1. Add your revenue.

A funds begins together with your revenue. All of it. Which means your regular paychecks and any further revenue that comes your means by way of a aspect hustle, storage sale, freelance work, and so forth.

2. Record your bills.

Subsequent, listing out your bills. Begin with necessities like giving, saving, meals, utilities, housing, transportation, insurance coverage and childcare. Then, add within the enjoyable stuff like eating places, date nights and leisure. As a result of all of us want somewhat cash every month for issues we are able to purchase guilt-free.

Be sure you make funds strains for all of your monthly expenses, together with the big expenses you’re saving up for. And don’t neglect the simply ignored ones like haircuts, nutritional vitamins and pet care—take time to assume by way of every part you spend cash on each month.

3. Price range to zero.

This doesn’t imply you spend all of your cash and go away an empty checking account on the finish of the month. (Maintain somewhat buffer in there of $100–$300.)

It does imply you give all of your cash a job: giving, saving or spending. You make a spot within the funds for each single greenback you earn. It’s known as zero-based budgeting, and that is the way it works: Record all of your bills, subtract them out of your revenue, and in case you nonetheless have cash left over, chuck it at your present cash aim! Increase.

For those who don’t have sufficient to cowl all of your bills, return and trim your funds strains till your revenue minus your bills equals zero.

4. Observe your bills.

This step is essential. Observe. Each. Expense. If you spend cash, log that buy within the right funds line. That is the way you’ll control every part. Budgeting is how you propose. Tracking is how you retain up with the plan.

5. Price range each month earlier than the month begins.

To get forward, you could assume forward. That’s strong life recommendation—and a very good budgeting tip. You want a brand new funds every month. And you could set that up earlier than the month begins.

With EveryDollar, it’s straightforward. You possibly can copy this month’s funds to the following after which modify the place you could. Like we mentioned earlier than, you’ll take into consideration the distinctive spending developing (like your BFF’s birthday or that e book membership assembly) and transfer cash round to make room for it.

![]()

And there you might be! That’s the way you follow a funds—you funds with intention. You’re employed to push your self to make your targets come true whereas nonetheless residing in the true world. Since you can do each: You possibly can set real looking budgets that additionally get you from the place you might be right now to the place you need to be!

Begin with an EveryDollar budget, add these guts we all know you’ve got—and get after it.

[ad_2]

Source link