[ad_1]

I really like sinking funds. What are sinking funds? They’re the proper solution to save up for any massive expense.

Whether or not you’re planning a visit to Disney World or shopping for a brand new sofa or perhaps a new automobile—sinking funds make it easier to pay money for all of it and keep away from the post-purchase remorse.

So, let’s dive in to how sinking funds work and the way to create one so you will get a head begin in your financial savings targets!

What Is a Sinking Fund?

A sinking fund is a strategic method to economize by setting apart a little bit bit of cash every month.

Right here’s how sinking funds work: Each month, you’ll save a sure sum of money for a particular function to make use of at a later date. That method, you’re saving up small quantities over time, as a substitute of getting to give you an enormous chunk of cash .

Sinking funds work nice for issues you’ll be able to’t or don’t wish to pay for in a single month’s funds, like:

- New tires on your automobile

- Christmas items

- Vet payments

- Marriage ceremony bills

- Aircraft tickets

- Birthday events

- College books and provides

- Garments for a special day

- Holidays

- Residence remodels

- Live performance tickets

You possibly can create a sinking fund for any financial goal, dream or expense you may have!

Sinking Fund vs. Financial savings Account

Sinking funds and financial savings accounts go hand in hand, however they’re not the identical factor. A savings account is the place you save your cash. And a sinking fund is how you save your cash.

When you’re attempting to save lots of for a brand new automobile, subsequent yr’s trip, your anniversary items, your child’s dance camp, and your Christmas presents all in the identical financial savings account, that’s lots to maintain observe of. Eventually, the traces will begin to blur.

So, as a substitute of simply throwing cash into your financial savings account, you’ll be able to create a number of sinking funds for particular functions. That method, you’ll know precisely whenever you hit your financial savings targets and the way a lot it’s important to spend in every class.

Sinking Fund vs. Emergency Fund

A sinking fund can also be totally different from an emergency fund. Very totally different.

A sinking fund is for these bills you already know are coming and might plan forward for—like your child’s soccer season or the bridesmaid costume you want on your good friend’s wedding ceremony.

An emergency fund, then again, is for unexpected expenses. For instance, the air conditioner goes out, you get a flat tire, or one in every of your youngsters chips a tooth.

You don’t have any method of realizing if these items are coming or after they’ll occur. However since you do know life occurs, it is advisable to have the cash put aside and able to use. Your emergency fund is your security internet between you and life.

So, a sinking fund is for the recognized, and an emergency fund is for the unknown.

And when you could also be tempted to dip into your emergency fund when the rug you actually need is on sale otherwise you’re attempting to snag ground tickets to a live performance, that’s not what it’s for. Solely use your emergency fund for actual emergencies. And use sinking funds for the whole lot else.

Advantages of Sinking Funds

It doesn’t matter what your money tendencies are—whether or not you’re a spender or a saver, a nerd or a free spirit—everybody can profit from a sinking fund.

Need to take your loved ones of 4 to the seashore for every week? There goes $1,500. Want a brand new roof? That’ll be $6,000. Then there’s your youngsters’ summer time camps, the washer it is advisable to change quickly, and that adult-sized scooter your husband simply has to have. (Simply my husband? Oh, okay. Cool.)

Every savings goal starts with a budget. Create yours today with EveryDollar.

And as a substitute of placing the whole lot on a credit card and making funds for months, you’ll be able to really save up and pay for things in cash—even the massive stuff. No sweat!

A sinking fund helps you:

- Save for something and the whole lot. Get as particular as you prefer to be sure you cowl each want and need in your record.

- Plan for large, extravagant enjoyable. This makes my spender coronary heart so completely satisfied. Improve your kitchen, take the trip of your dreams, put money into your hobbies, or give generously. Make room for enjoyable by telling your cash what to do, month after month.

- Ditch large-purchase guilt. Determine up entrance (along with your partner, when you have one) what you’re saving for and the way a lot cash you’d prefer to put aside. When it comes time to spend, you are able to do it with out fear or remorse—and most significantly, with out going into debt.

- Put together for these inevitable bills. If you see these tires are sporting skinny, begin saving for brand new ones. If you already know the home you simply purchased has an outdated roof, begin saving for a brand new one. These aren’t emergencies but, and should you begin saving up now, they by no means will likely be!

Saving strategically means enjoyable purchases will really be enjoyable, and irritating bills gained’t be an enormous deal.

Tips on how to Create a Sinking Fund

Now that you already know what sinking funds are, how they work, and why they’ll make it easier to, right here’s the way to create one in 4 straightforward steps.

Step 1: Determine what you’re saving up for.

An Alaskan cruise, a down payment on a home, Christmas presents, or a wedding reception. No matter you’re saving for, you wish to begin planning for it now—so it doesn’t sneak up on you and make you broke.

Step 2: Determine the place you’re going to retailer your sinking fund.

You possibly can select to open a separate financial savings account on your sinking fund. Simply be sure the account doesn’t have a minimal stability to keep up (like a cash market account). You don’t need month-to-month charges to chip away at your financial savings.

And should you use my favourite budgeting software, EveryDollar, you don’t want a separate financial savings account in any respect. EveryDollar will designate that cash for you in your funds so that you all the time know precisely how a lot is in that fund. (Extra on this in Step 4.)

Step 3: Determine how a lot it is advisable to save.

To determine how a lot to save lots of, take the overall quantity you wish to spend and divide it by the variety of months or weeks you may have left till it is advisable to make the acquisition.

If you wish to spend $1,000 on Christmas and it’s September, you solely have about three months to save lots of. Meaning you’ll want a line merchandise in your budget reminding you to stash away about $330 each month till December.

Step 4: Arrange your sinking fund within the funds.

A sinking fund will solely work if it’s in your month-to-month funds. So, whether or not you funds with a spreadsheet, in an app, or with a pencil and paper, put your sinking fund line merchandise within the funds!

Right here’s precisely the way to create a sinking fund within the EveryDollar budgeting app:

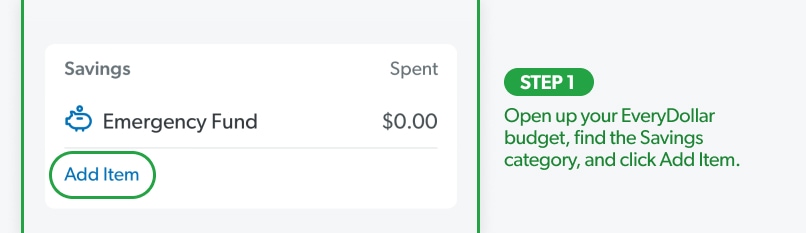

Open up your EveryDollar funds, discover the Financial savings class, and click on Add Merchandise.

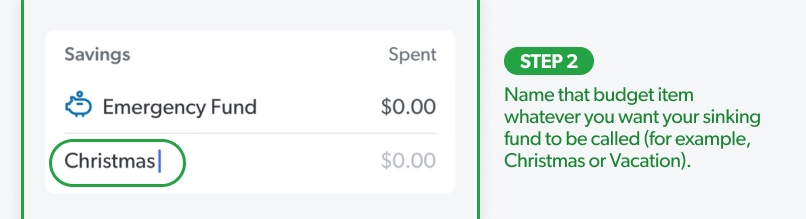

Then, identify that funds merchandise no matter you need your sinking fund to be referred to as (for instance, Christmas or Trip).

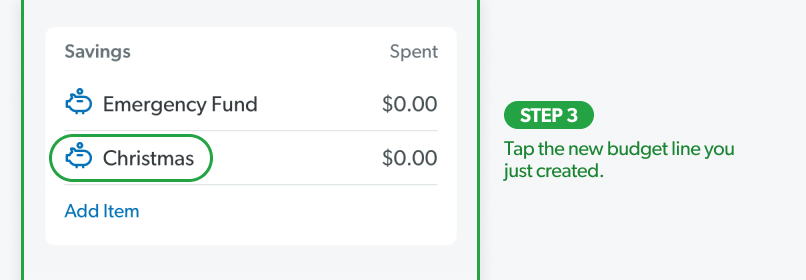

Subsequent, faucet the brand new funds line you simply created.

Subsequent, faucet the brand new funds line you simply created.

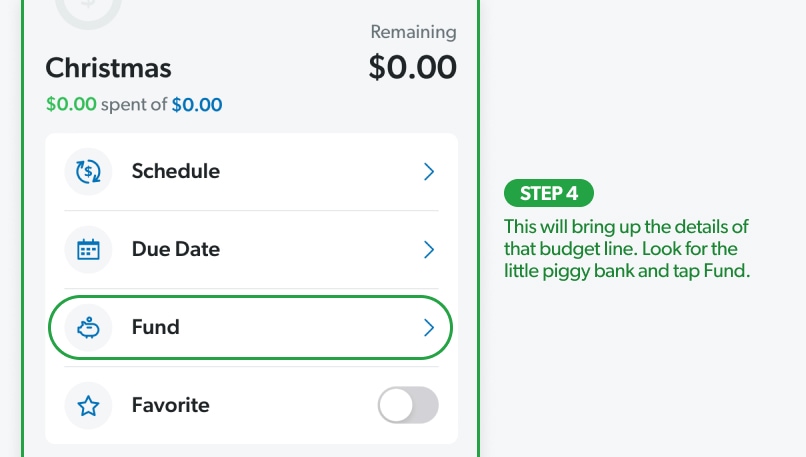

This may carry up the small print of that funds line. Search for the little piggy financial institution and faucet Fund.

This may carry up the small print of that funds line. Search for the little piggy financial institution and faucet Fund.

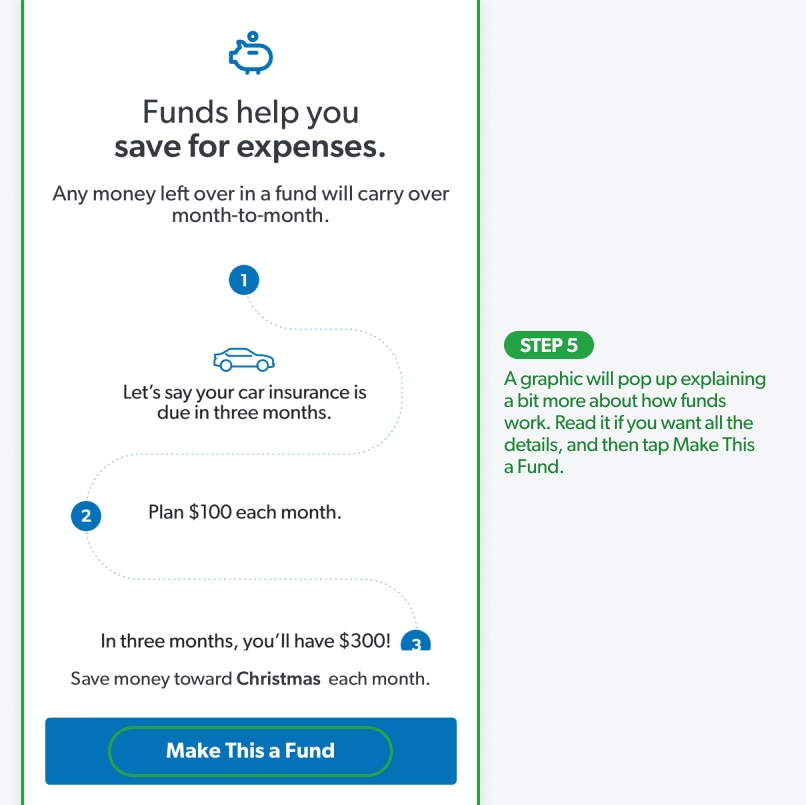

A graphic will pop up explaining a bit extra about how funds work. Learn it if you need all the small print, after which faucet Make This a Fund.

A graphic will pop up explaining a bit extra about how funds work. Learn it if you need all the small print, after which faucet Make This a Fund.

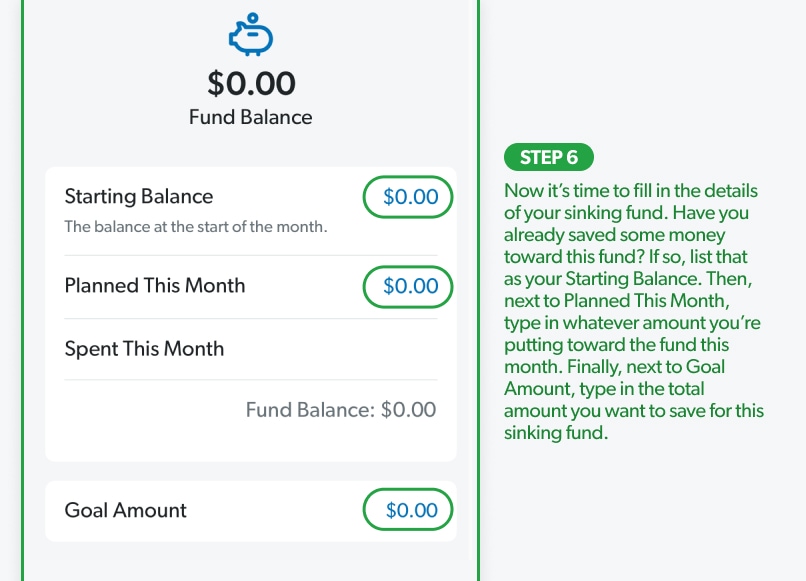

Now it’s time to fill within the particulars of your sinking fund. Have you ever already saved some cash towards this fund? If that’s the case, record that as your Beginning Steadiness. Then, subsequent to Deliberate This Month, kind in no matter quantity you’re placing towards the fund this month. Lastly, subsequent to Aim Quantity, kind within the whole quantity you wish to save for this sinking fund.

(Be aware, should you’re on the desktop model of EveryDollar, you’ll undergo just about the identical course of, however the whole lot will present up on the precise aspect of the display screen.)

Congrats! You’ve obtained your very personal sinking fund.

Now you simply must be sure you switch that quantity to your financial savings account for the month and track it in your budget every time you add cash to the fund. (You possibly can even add a due date should you want a reminder every month.)

Keep it up, and also you’ll be celebrating an all-cash Christmas this yr—or no matter your purpose is!

How Many Sinking Funds Ought to I Have?

Now that you already know simply how superb sinking funds are, you might wish to create one for the whole lot. However on this case, there can really be an excessive amount of of a superb factor.

When you’re attempting to juggle 1,000,000 sinking funds directly, you gained’t see a whole lot of progress with any of them. There’s solely a lot cash it can save you every month, proper? Relying in your present monetary targets, it is perhaps higher so that you can concentrate on saving for just some issues at a time.

Let me offer you an instance.

Right here’s what it might appear like to separate $600 per 30 days amongst six totally different sinking funds:

- $100 for trip

- $300 for a new-to-you automobile

- $50 for a yard makeover

- $50 for medical bills

- $50 for automobile repairs

- $50 for house repairs

On the finish of 1 yr, your sinking fund totals could be:

- $1,200 for trip

- $3,600 for a new-to-you automobile

- $600 for a yard makeover

- $600 for medical bills

- $600 for automobile repairs

- $600 for house repairs

Okay, now think about you’ve determined it’s time to interchange your automobile. You may have two decisions: Discover a used car you can afford for $3,600, or use $600 to make repairs to your current car and proceed to save lots of till your automobile sinking fund grows some extra.

However right here’s the third choice: When you skip the yard makeover and the holiday this yr, you’ll have $5,400 to spend on a brand new (to you) automobile. It’s all about what you select to prioritize.

So, if there’s one thing you already know it is advisable to pay for quickly or one thing you actually need, do the mathematics and resolve if it can save you for a number of issues and nonetheless hit your financial savings targets. Simply don’t unfold your self too skinny!

Don’t Let a Large Buy Sink You

See what a distinction a little bit strategic saving could make? As a substitute of panicking, you could be ready. As a substitute of going into debt, you’ll be able to pay in full. As a substitute of enjoying catch-up, you will get forward.

That’s the ability of a sinking fund (and a superb funds)!

We dwell in a tradition the place we buy now and pay later. We would like stuff instantly. And Amazon has made something longer than two-day transport appear to be a crime.

However when you have endurance and a plan, you already know what you gained’t have? Fear.

Saving up forward of time retains you from being pressured and broke—so begin creating some sinking funds right now!

[ad_2]

Source link