[ad_1]

Searching for a brand new journey? It’s straightforward to catch a case of latest automobile fever and get googly-eyed over the newest fashions.

However is shopping for a brand new automobile actually the best choice? What are the professionals and cons? Let’s speak about the actual value of latest vs. used vehicles—and tips on how to make the appropriate alternative to your finances.

Is It Higher to Purchase a New or Used Automobile?

Buying a used car is all the time the higher alternative financially. Why? As a result of 1) used vehicles are cheaper general and a couple of) they don’t drop as quick in worth as new vehicles do.

Model-new vehicles lose a large chunk of their unique worth within the first couple of years (even within the first hour). A used automobile, however, retains extra of its worth over time—which implies you’re not shedding as a lot cash as you do with a brand new automobile.

The selection between a brand new or used automobile might be the distinction between you driving the freeway to wealth or spinning your wheels in a unending cycle of funds.

However should you’re not prepared to surrender in your new automobile desires simply but, let’s dive somewhat deeper into the professionals of shopping for a used automobile over a brand new one.

The Professionals of Shopping for a Used Automobile

Used vehicles value much less.

This one could also be apparent, however the price ticket distinction between a brand new automobile and an excellent barely used one is large.

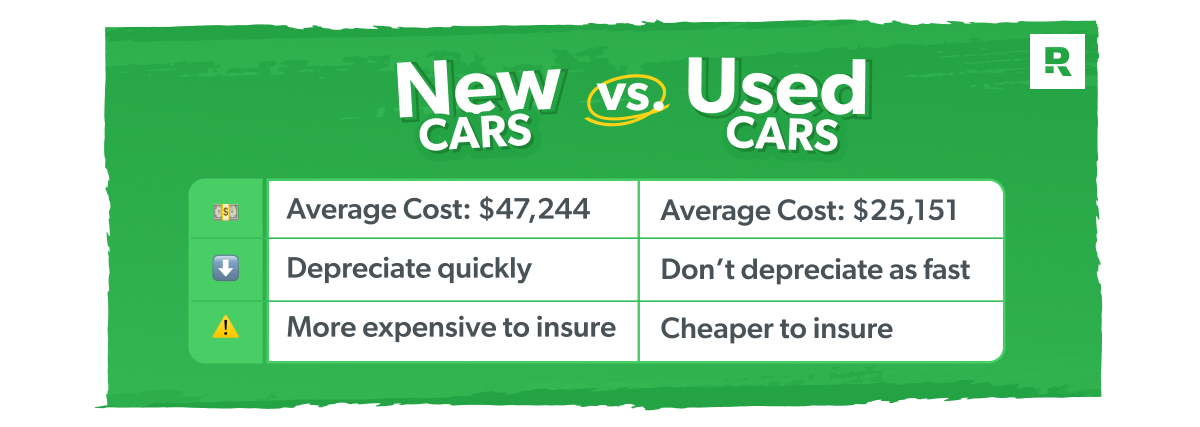

The typical transaction value for a brand new automobile is $47,244, whereas the typical used automobile is listed for $25,151.1,2 That’s principally half the price! It’s additionally normally simpler to negotiate a better price for a used automobile.

However much more necessary is how you purchase the automobile. And one of the simplest ways to buy a car is with cash (as in, with out a automobile mortgage). We all know, we all know. That may sound loopy, particularly should you’ve all the time had a automobile fee. However a automobile mortgage is the most expensive way to buy a car!

The typical rate of interest is 7.18% for a brand new automobile mortgage and 11.93% for a used automobile mortgage.3 Any time you are taking out a automobile mortgage, you’re forking over 1000’s of {dollars} extra—simply to curiosity!

So, earlier than you select a automobile, work out how much car you can actually afford.

Used vehicles don’t depreciate as quick.

Something with a motor loses its worth over time (that is known as depreciation). However like we talked about earlier than, new vehicles lose their worth a lot quicker than used vehicles do—and that may make it means too straightforward to finish up with an upside-down car loan (the place you owe greater than your automobile is price).

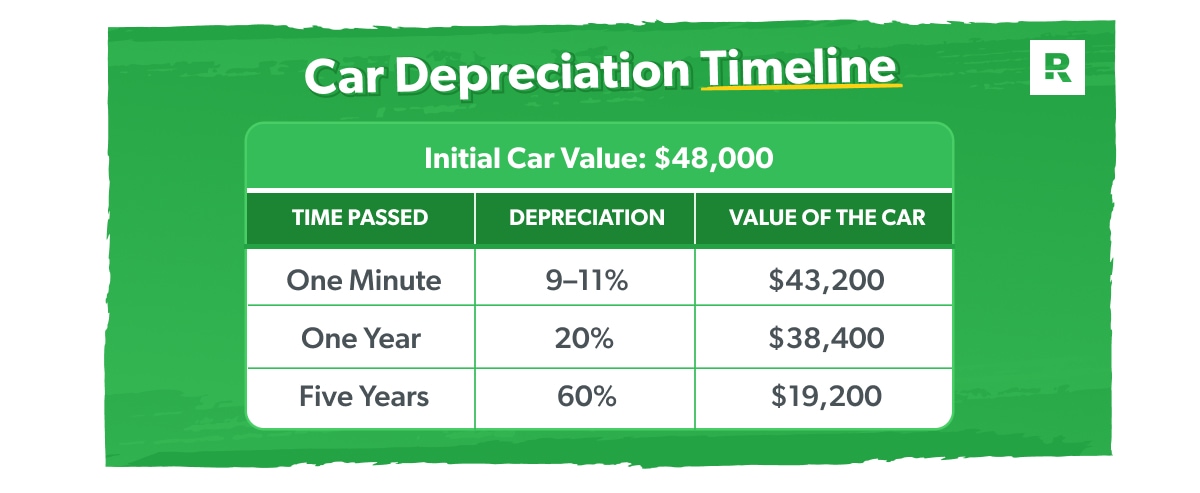

Right here’s a have a look at how shortly a brand new automobile loses its worth:

- After one minute: Should you purchase a shiny new $48,000 automobile, it loses about 9–11% of its worth the second you drive off the lot.4 You’re principally throwing $4,800 out the automobile window in the course of the drive dwelling! Ouch.

- After one yr: Quick-forward 12 months and that (no-longer new) automobile sitting in your driveway will likely be price not less than 20% lower than the day you acquire it.5

- After 5 years: You possibly can count on your automobile to lose round 60% of its worth after you’ve pushed it round for 5 years.6 On this case, that $48,000 automobile is now price solely about $19,200—if that!

Give it some thought: Simply by selecting a automobile that’s a pair years outdated, you’re letting another person tackle the brunt of depreciation—and also you’re getting a greater deal!

Should you purchase a $48,000 shiny new automobile, that automobile loses someplace between Sep 11% of its worth the second you drive off the lot. Quick ahead 12 months and that automobile will lose round 20% of its worth from the day you acquire it.

Used vehicles are cheaper to insure.

Not solely are used vehicles cheaper, however they’re normally less expensive to insure. Numerous automobile consumers neglect to issue car insurance into the equation after which undergo from sticker shock after they see their new premium.

Don’t let car insurance costs get you down! Download our checklist for easy ways to save.

The reality is, new vehicles value extra to restore or change—so that they value extra to insure (particularly if they arrive with fancy extras like backup cameras and blind spot sensors). And even with a few of the newest security know-how, insurance coverage firms hardly ever provide reductions to new-car drivers for having these options.

New-car drivers will spend roughly $1,838 within the first yr on automobile insurance coverage premiums.7 However should you purchase a five-year-old model of the identical automobile, it’s 27% much less to insure!8

New vehicles aren’t all the time extra dependable.

We all know security is an enormous concern. And one of the vital frequent arguments towards shopping for a used automobile (particularly if it’s a car for your kid) is that it’ll put on out sooner and gained’t be as dependable as the brand new ones rolling straight off the meeting line.

However new doesn’t all the time imply extra dependable. In truth, some newer vehicles (particularly fashions of their first yr of manufacturing) are among the many least dependable vehicles you may drive.

In keeping with J.D. Energy, “New automobiles have gotten extra problematic.”9 And their U.S. Preliminary High quality Research discovered a big decline within the high quality of latest vehicles being produced, particularly for automobiles with larger tech.

From defective airbags to troublesome transmissions, many drivers of newer mannequin vehicles find yourself making fixed journeys to the mechanic or getting manufacture recall notices for points that may be critical security hazards.

With a used automobile, however, you’ve a greater thought of what to anticipate as a result of it’s been on the highway longer. A automobile historical past report will let you realize about any main repairs or potential issues. You may as well search automobile boards and skim what different drivers need to say a few sure mannequin.

You can find used cars which might be nonetheless secure and reliable—and at a less expensive value! Should you want some further assurance, follow manufacturers like Toyota and Honda which have confirmed to be very dependable over time. Or you may slender down you search to solely licensed pre-owned automobiles which have already been inspected.

Backside line: Don’t use security as an excuse to purchase a automobile you may’t afford. All of it depends upon the kind of automobile you’re taking a look at and the way lengthy the automobile has been on the highway. Always do your research!

Price Comparability of Shopping for New vs. Used

Okay, let’s break down how a lot you actually pay for a brand new vs. used automobile.

Let’s say Tony and Jack are each seeking to purchase new automobiles. Tony goes the “regular” route and funds a brand-new truck, whereas Jack decides to save lots of up and purchase a dependable used automobile with money.

The typical new automobile mortgage is $40,366 with a 7.18% rate of interest.10 If Tony indicators up for a 60-month mortgage, he’ll find yourself paying a complete of $48,164 for a truck that’ll be price about $16,000 (if he’s fortunate) on the finish of the mortgage time period.

In the meantime, Jack discovered a four-year-old sedan with low mileage and loads of life left within the tank for $12,000, and he paid for it with money. Meaning he owns the automobile free and clear. No funds!

Even when Jack has to do some minor car repairs right here and there on his pre-loved journey, it’ll be nothing in comparison with how a lot Tony is shelling out towards insurance coverage and curiosity each single month. And simply because Tony’s truck is new, it doesn’t imply it gained’t find yourself within the store with its personal issues.

So, what might Jack do with an additional $800 every month that he’s not utilizing to repay the automobile? Properly, he might put all these financial savings towards upgrading his automobile down the highway. If he saves $800 each month, he might purchase a $20,000 automobile in about two years. In the meantime, Tony isn’t even midway by way of the mortgage on his truck (hope he actually likes it).

Is It Ever Okay to Purchase a New Automobile?

As a normal rule of thumb, the whole worth of your automobiles (something with a motor in it) ought to by no means be greater than half of your annual family revenue. As a result of, once more, you don’t need an excessive amount of of your cash tied up in issues that plummet in worth.

So, until you’re a millionaire, shopping for a brand new automobile doesn’t make monetary sense. And even then, most millionaires purchase used vehicles!

Within the largest study of millionaires, we discovered that the typical millionaire drives a four-year-old automobile with 41,000 miles on it. And eight out of 10 millionaire automobile consumers select to not have a automobile fee.

Financing new vehicles is how people stay broke. So, select used and pay in money. You need to personal your automobile as an alternative of it proudly owning you.

Save Up for the Automobile You Need

Whether or not you select new or used, the appropriate automobile is the one you pay for in money.

We all know you’re most likely pondering, I don’t have that sort of cash. Not but.

Saving up for the automobile you need takes persistence. However should you’re intentional about it, you will get a good automobile quicker than you suppose. And belief us, you’ll be so glad you went that route whenever you drive away in your paid-off journey, as an alternative of being tied right down to a automobile fee for years.

All of it begins with a budget. The EveryDollar budgeting app helps you save up for giant purchases—whereas additionally ensuring you cowl your month-to-month bills. You may as well see the place to chop again your spending so you may put extra towards your automobile fund.

What are you ready for? Go forward and create your free budget with EveryDollar at the moment. As a result of the earlier you begin saving, the earlier you’ll be behind the wheel of your new (to you) journey.

[ad_2]

Source link