[ad_1]

In case your monetary state of affairs has progressed to the purpose the place you’re contemplating chapter or debt consolidation, it’s necessary to find out about your choices and what you are able to do to seek out debt aid. When weighing debt consolidation vs chapter, it could possibly assist to know the fundamentals about every: what they’re, how they will influence your credit score rating, and which choice can be finest on your long-term monetary well being.

Let’s focus on debt consolidation and chapter, their professionals and cons, and what you are able to do to enhance your monetary state of affairs shifting ahead.

What Is Debt Consolidation?

Debt consolidation is the follow of taking a number of sources of debt and mixing (i.e., consolidating) them right into a single month-to-month cost. This helps make it simpler to maintain observe of debt funds and collectors.

There are a number of options for consolidating debt. For instance:

- Debt Consolidation Program (DCP). A debt consolidation program is a service supplied by a credit score counsellor or non-profit credit score counselling company the place they negotiate along with your collectors in your behalf to cease or cut back curiosity in your unsecured money owed and roll them right into a single month-to-month cost with a set finish date.

- Debt Consolidation Mortgage. A mortgage from a lender that’s used to repay excellent debt in order that the borrower can cut back the overall variety of collectors they should repay. That is helpful for debtors with excessive credit score scores who can get low-interest loans, because it can lead to a decrease general rate of interest on their debt (particularly when consolidating bank card debt).

- Consolidating Debt right into a Mortgage. As a mortgage secured with collateral (i.e., the house), mortgages typically have comparatively low rates of interest. So, debtors trying to decrease curiosity prices for his or her debt could determine to consolidate debt into their mortgage. This sometimes means breaking the present mortgage settlement and rolling their high-interest debt into a brand new settlement.

Completely different debt consolidation choices will match completely different wants. For instance, if in case you have a wonderful credit score rating, you would possibly wish to pursue a debt consolidation mortgage since you might be able to get a decrease rate of interest, improve your credit utilization ratio (the quantity of credit score you’re utilizing in comparison with the quantity of credit score obtainable to you), and simplify your debt reimbursement schedule. Nevertheless, such a mortgage would additionally generate a tough inquiry in opposition to your credit score and open a brand new line merchandise in your credit score report—briefly impacting your credit score.

Alternatively, in case your credit score rating is decrease and you can’t safe a debt consolidation mortgage, a debt consolidation program could be the higher various. Credit score Canada has years of experience in guiding Canadians on the trail to being debt-free via credit score counselling and DCPs.

What Is Chapter?

Bankruptcy is a authorized course of administered by a Licensed Insolvency Trustee (LIT) like Harris & Partners. Beneath a chapter declaration, you’d give up your belongings (minus these which can be exempt) to the LIT, who would then be charged to promote them off to repay your collectors.

On the finish of the method, the objective is to obtain a chapter discharge which might launch you from most types of debt. Some types of debt can’t be discharged via a chapter submitting. For instance, secured money owed resembling mortgages are usually not discharged via chapter as bankruptcies do not affect the rights of secured creditors. Additionally, little one assist and alimony funds are equally excluded from chapter discharges.

Pupil mortgage debt is a little bit of a singular case. Should you have been a full or part-time scholar throughout the final seven years, scholar mortgage debt cannot be discharged in a bankruptcy. Nevertheless, after seven years of not being a scholar, then the coed mortgage may be discharged via a chapter submitting—although the willpower of if you ceased being a scholar could also be calculated in a different way relying on the foundations on your province. Additionally, this time restriction could also be diminished to 5 years as an alternative if repaying the mortgage would end in undue hardship.

Bankruptcies have a powerful influence in your credit score rating. After submitting for chapter, your credit standing will probably be set to the bottom attainable stage (R9). A credit standing is a form of shorthand that lenders use to explain your debt reimbursement habits and an R9 ranking signifies that you’ve unhealthy debt, debt positioned in collections, or a chapter. This ranking will stay till the data is eliminated out of your credit score report. This may take six or seven years for a first-time chapter submitting and 14 years for subsequent filings.

The credit score influence of submitting for chapter implies that it ought to be the debt aid choice of final resort. In accordance with data from the Government of Canada, in Q3 of 2023, there have been 24,043 shopper proposals and 6,428 bankruptcies filed in Canada by shoppers, for a complete of 30,471 insolvency filings. A consumer proposal is an association between debtors and collectors to change their reimbursement phrases and is a typical various to chapter that has a lesser influence on a shopper’s credit score rating.

How Submitting for Chapter Works

The method begins with you reaching out to a Licensed Insolvency Trustee. They’ll evaluation your utility and determine whether or not to simply accept your file. Should you can’t discover an LIT to simply accept your file or can’t afford the LIT’s companies, you might be able to get assist via the Office of the Superintendent of Bankruptcy’s (OSB’s) Chapter Help Program—assuming you meet standards resembling having already reached out to 2 LITs, not being concerned in business actions, not being required to make surplus earnings funds*, and never being at present in jail.

*Observe: Surplus earnings is earnings above the quantity wanted to keep up an inexpensive lifestyle. In case your LIT determines that you just make surplus earnings in extra of $200, you’ll be required to make further funds to the LIT to repay your collectors.

Whenever you discover an LIT, they may work with you to file the required kinds and submit paperwork to the OSB. After you have been declared bankrupt:

- You’ll cease making funds on to any unsecured collectors.

- Your collectors will probably be notified concerning the chapter submitting.

- This will likely contain a gathering along with your collectors to allow them to acquire extra info and appoint inspectors or give course to the LIT.

- Any garnishments in opposition to your wage will stop.

- Lawsuits by collectors ought to cease.

- The LIT will begin promoting your belongings (excluding sure exempt belongings) to boost cash to repay your collectors.

- You might be examined by a consultant of the OSB to ask about your conduct, the explanations for the chapter, and your property.

- You’ll be required to attend monetary counselling classes.

- The LIT will calculate your surplus earnings and could require you to make surplus income payments for distribution to your collectors.

About Chapter Discharges

On the conclusion of the chapter, you’ll obtain a chapter discharge. A chapter discharge is the discharge out of your money owed that you just had on the time you filed for chapter (some exceptions apply). Discharges may be automated if:

- The discharge is unopposed by the LIT, any collectors, or the OSB.

- The debtor has attended the obligatory monetary counselling classes.

- It’s the first or second chapter.

For a first-time filer who doesn’t have to make surplus earnings funds, an automated discharge from chapter happens after 9 months. First-time filers who do have to make surplus earnings funds may be discharged after 21 months.

On a second chapter, the time to automated discharge will increase to 24 months for individuals who don’t have to make surplus earnings funds and 36 months for individuals who do.

Should you don’t qualify for an automated discharge, you will have to undergo a discharge listening to with the courtroom. The LIT will prepare for this listening to and put together a report for the courtroom. Observe that the courtroom could select to refuse your chapter discharge. If this occurs, contact your LIT and they’ll inform you of the explanation for the refusal and what your choices from there could also be.

Evaluating Debt Consolidation and Chapter

Debt consolidation and chapter are very completely different processes which have completely different impacts in your monetary answer, however each may be viable paths to debt aid for individuals who discover that their month-to-month funds for debt are outpacing their potential to afford them.

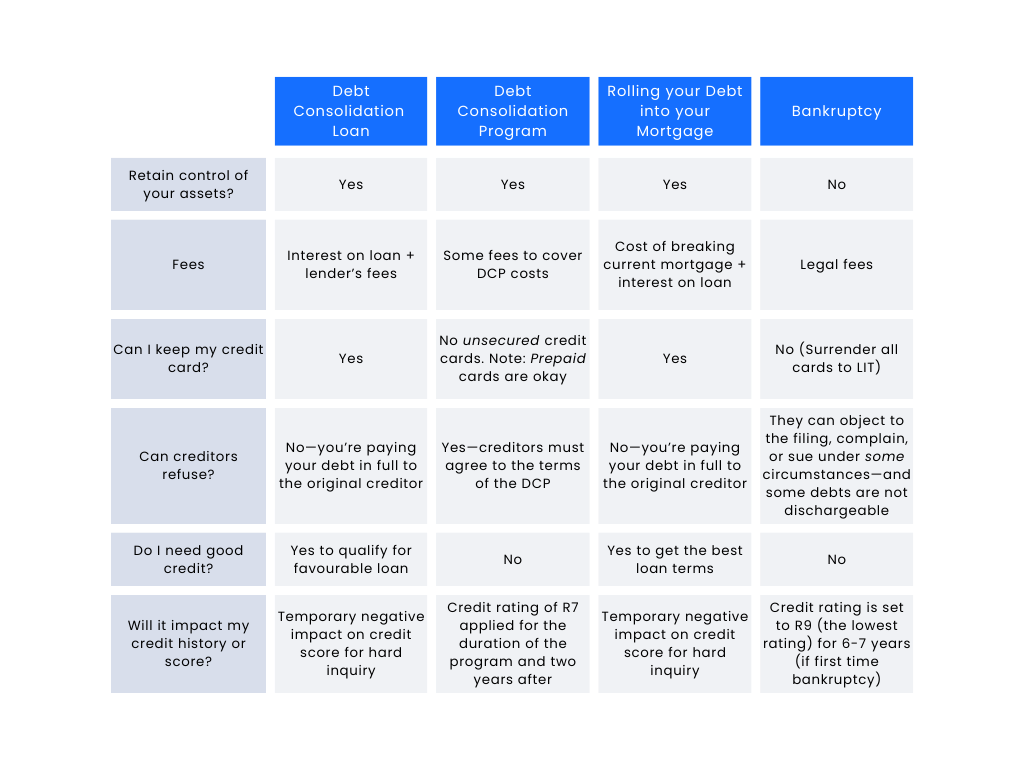

However which one is best for you? Let’s weigh the professionals and cons of debt consolidation vs chapter:

All of those choices have the advantages of stopping nuisance assortment calls and, when accomplished efficiently, leaving you debt-free.

Of those processes, chapter has the biggest influence in your credit score because the chapter submitting will stay in your credit score historical past for six to seven years for a first-time submitting and 14 years for every subsequent submitting. Additionally, the discharge from chapter just isn’t assured, so ask the LIT or your monetary advisor for recommendation earlier than starting the method.

In the meantime, a debt consolidation program has a lesser influence in your credit score historical past and rating than chapter. Additionally, the R7 ranking fades out of your historical past extra shortly than the R9 ranking utilized by chapter.

Debt consolidation loans or rolling debt into your mortgage has the smallest influence in your credit score rating in the long run as these actions have an effect on your utilization ratio and produce a tough inquiry, but additionally assist you to construct your credit score historical past afterward.

Debt Consolidation vs Chapter: When to Select What

So, which is finest for you? Debt consolidation or chapter? The reply is: it is dependent upon your monetary state of affairs.

A debt consolidation mortgage could be finest if:

- You’ve got good credit score.

- You’ve got high-interest debt the place the mortgage would scale back your rate of interest.

- You don’t wish to break your present mortgage settlement.

Rolling your debt into your mortgage could be a good suggestion if:

- It will assist you to cut back your general rate of interest.

- The present common mortgage rate of interest is decrease than your mortgage’s rate of interest.

- You’ve got sufficient fairness in your house to cowl your debt.

- You may afford the charges for breaking your mortgage.

A debt consolidation program may be best if:

- Your credit score rating is just too low to qualify for a beneficial mortgage.

- You don’t have fairness in your house to leverage for debt reimbursement.

- You do not need to lose management of your belongings.

- You need assist constructing debt administration habits to maintain you out of debt sooner or later.

Submitting for chapter could also be the most suitable choice if:

- Your money owed are really past your potential to repay.

- Nearly all of your money owed are dischargeable.

- You’ve got restricted belongings obtainable.

- You’ve got misplaced your major supply of earnings.

Steerage from Credit score Counsellors

Selecting between debt consolidation and chapter shouldn’t be taken frivolously. Should you’re analyzing these choices, it’s necessary to hunt assist and recommendation from somebody with skilled information.

That is the place a Certified Credit Counsellor can assist. A credit score counsellor can assist you evaluation your monetary state of affairs and study your debt aid choices to decide on the very best path ahead on your long-term monetary well being. They can assist you sort the myths from the facts in terms of debt administration and reimbursement so you may make a extra knowledgeable determination.

Shifting Ahead: Lengthy-Time period Monetary Well being

Whenever you’re completed along with your chapter submitting or used debt consolidation, what’s subsequent? The highway to restoration generally is a lengthy one, however following some good money habits can assist you enhance your monetary state of affairs shifting ahead and construct your credit score rating again up over time.

It gained’t be straightforward. It gained’t be quick. However, with constant effort, you are able to do it. Some primary suggestions embrace:

- Monitoring Your Revenue and Bills. Utilizing a software like a budget planner and expense tracker, maintain observe of how a lot cash you’re incomes and what you’re spending it on. This fashion, you may establish objects in your price range that you may in the reduction of on to keep away from getting again into debt.

- Limiting Your Use of Credit score Playing cards. Should you use a bank card following your debt consolidation or chapter, spend no extra on it than you may comfortably repay in a single month. Should you expertise issue with controlling spending, think about reducing up your playing cards to keep away from temptation.

- Management Prices for Objects You Commonly Buy. Are there some home goods that you just buy often? Examine on-line for particular gross sales or coupons that can assist you save on these frequent purchases. Additionally, attempt to fill up on non-perishable objects throughout gross sales whereas avoiding buying too many perishable objects in order that they do not go to waste.

- Attain Out to a Credit score Counsellor. You don’t need to go it alone. Search assist by reaching out to a Licensed Credit score Counsellor who can coach you thru debt administration methods and methods to construct your month-to-month price range to keep away from racking up debt.

[ad_2]

Source link