[ad_1]

I get it—long-term care isn’t a simple topic to cope with. Nobody needs to consider themselves or their family members being unable to dwell on their very own.

However hear me out: Regardless that long-term care is an uncomfortable subject, it’s an excellent essential one. That’s as a result of some form of long-term care—like residing in a nursing residence, assisted residing facility, or needing in-home care—is probably going in your future, so you should take into consideration the way you’re going to pay for it.

My guess is you in all probability have already got some questions, like, Is long-term care insurance coverage actually essential? and How have you learnt for those who really need it? You may also be questioning whether or not Medicare will cowl the prices of long-term care.

So, let’s have a look at who wants long-term care insurance coverage and the way a lot you’ll be able to count on to pay for it. That manner, you’ll be able to put collectively a strong plan to your future.

What Is Lengthy-Time period Care Insurance coverage?

Long-term care insurance covers the fee for a nursing residence, assisted residing facility, or in-home care while you become older and begin coping with well being points. Lengthy-term care is outlined as any care that’s longer than three months.

Lengthy-term care insurance coverage additionally covers issues like grownup day care providers, residence modifications, and care coordination (or administration). For many individuals, it permits them to guard their retirement financial savings whereas additionally residing of their residence longer. It’s additionally one of many eight types of insurance you want.

Who Wants Lengthy-Time period Care Insurance coverage?

If you happen to’re presently wholesome, you is perhaps questioning, Do I want long-term care insurance coverage? Sure! You aren’t required by any legal guidelines to buy long-term care insurance coverage, however you continue to want a coverage as a result of odds are you’ll find yourself needing long-term care—and it’s not low cost.

The numbers say 7 out of 10 Individuals over 65 will want long-term care, and an estimated 20% of Individuals will want it for longer than 5 years.1 And the standard price of simply one month in a nursing residence in the USA is $8,910!2

That’s insane, you guys. Until you’ve constructed sufficient wealth to be self-insured and pay for that price your self, long-term care insurance coverage is the easiest way to be sure to don’t find yourself operating out of cash towards the top of your life. Common health insurance received’t cowl these prices, however long-term care insurance coverage will.

Now, you is perhaps questioning whether or not there are any authorities applications that may assist. Nicely, for starters, Medicare will not cowl long-term care prices. And whereas Medicaid—the federal government program designed for individuals who really don’t have any cash—will cowl some long-term care bills, it ought to by no means be your first selection since you’ll should spend all of your property earlier than you obtain assist.

So, for those who wouldn’t really feel comfy writing a test for $9,000 each month for a number of years, you’ll need long-term care insurance coverage.

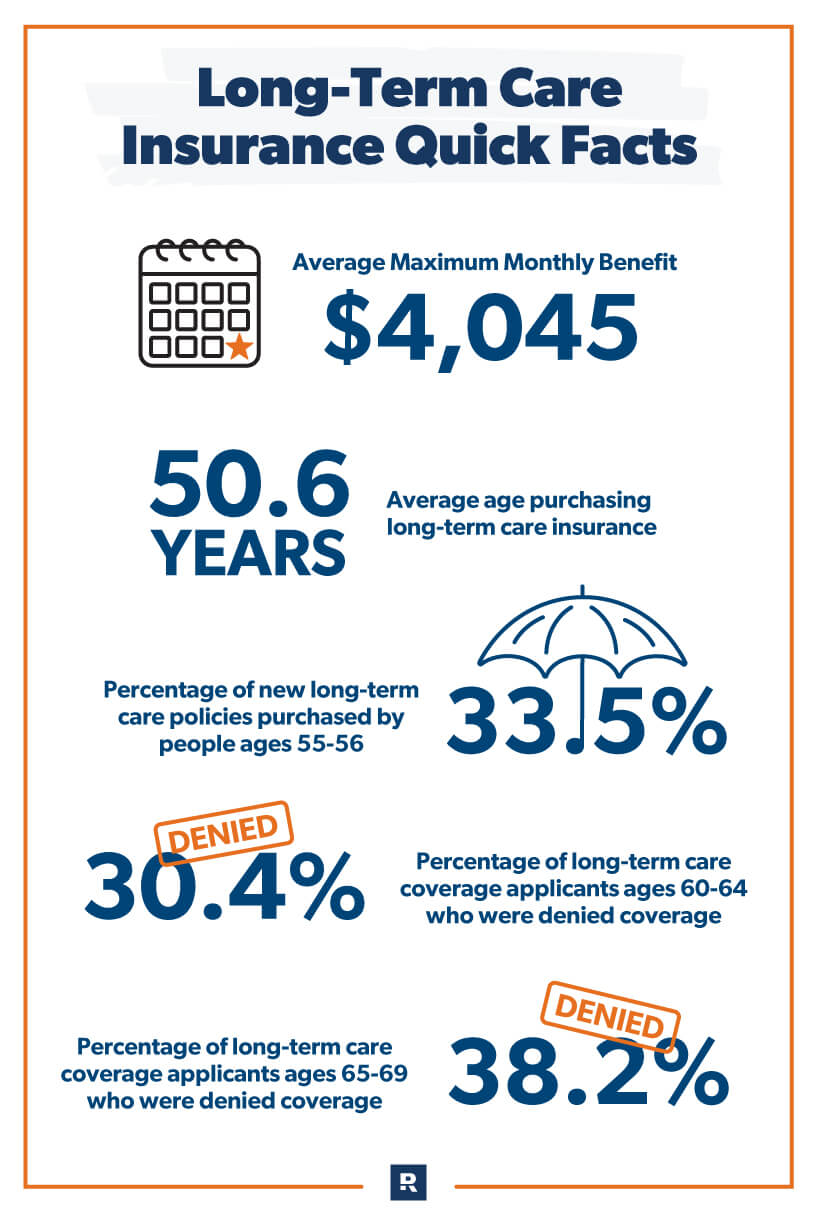

Milliman Lengthy Time period Care Insurance coverage Survey3

Is Lengthy-Time period Care Insurance coverage Value Shopping for?

Sure, long-term care insurance coverage is definitely worth it. Regardless that it may be costly, most insurance policies work out to be a cut price in the long term, contemplating what you get in return. The truth is, most Individuals merely will be unable to afford the tremendous excessive prices of long-term care. Or they’ll should dip into their financial savings or retirement funds to pay for it, which is a horrible plan!

Lengthy-term care insurance coverage additionally lets you dwell in your house longer as a result of it pays for issues like in-home care and residential modifications (like including a wheelchair ramp).

One other profit is that your loved ones and associates received’t be burdened with each side of your care. You possibly can spend extra high quality time with them with out relying in your grown children or associates to return over day by day to assist.

Long-term care is an important decision. Connect with a trusted pro to make sure you have the right coverage.

With long-term care insurance coverage, you’ll enter your golden years with a plan, and your high quality of life will probably be higher than for those who have been always making an attempt to chop prices. Your long-term care insurance coverage premiums could seem costly now, however they’ll be value it later while you begin getting these long-term care payments within the mail.

How A lot Does Lengthy-Time period Care Insurance coverage Value?

Relying on elements like your age, gender, well being and household well being historical past, the cost of long-term care insurance might be reasonably priced. For others, it may be dearer. The fee additionally varies relying on the place you reside and how much coverage you decide.

The typical 60-year-old man can pay $1,200 per 12 months for a coverage that covers $165,000 in care. The typical 60-year-old lady can pay $1,960 for a similar protection.4 (As a result of ladies are likely to outlive males, insurance coverage firms require them to fork over more cash to make up for the added threat.) The typical 60-year-old couple can pay $2,550 a 12 months for a mixed coverage.5 The {couples} low cost ranges from 15–30%, relying on the place you reside.6

It’s additionally essential to know that long-term care insurers can enhance your charges after you join, so don’t be shocked in case your charges climb. However right here’s a silver lining: Lengthy-term care insurance coverage premiums are tax-deductible as much as sure limits, so you could possibly avoid wasting cash there.

When Ought to I Get Lengthy-Time period Care Insurance coverage?

I like to recommend getting long-term care insurance coverage while you flip 60. Consider it as a birthday current! (Okay, that doesn’t should be the solely current you get, but it surely’s an essential one.)

About 92% of long-term care claims are filed by folks older than age 70, with most new claims beginning after age 80.7 That’s why it doesn’t make sense to buy a long-term care insurance coverage coverage any sooner than age 60. You don’t need to dish out cash for an additional decade while you don’t must.

However needless to say insurance coverage isn’t one-size-fits-all. You want to do what’s best for you and your loved ones. If you happen to or your partner has a household historical past of sickness at a younger age, or both of you might be presently coping with massive well being points, you may must get long-term care insurance coverage earlier. The peace of thoughts you’ll have is value greater than any money you’ll save on premiums. However don’t do it since you’re afraid of what may occur. If it’s not more likely to occur, wait till you’re 60.

You could have heard you’ll pay much less and lock in a decrease premium for those who purchase your coverage at age 50, however don’t neglect that insurers can change your premium after you purchase your coverage.

Will Your Well being Have an effect on Your Capacity to Purchase a Coverage or Declare Advantages Later On?

Whereas shopping for a long-term care coverage is nearly all the time an important concept, not everybody qualifies to purchase it. Sadly, sure well being points make insuring some folks too costly for carriers.

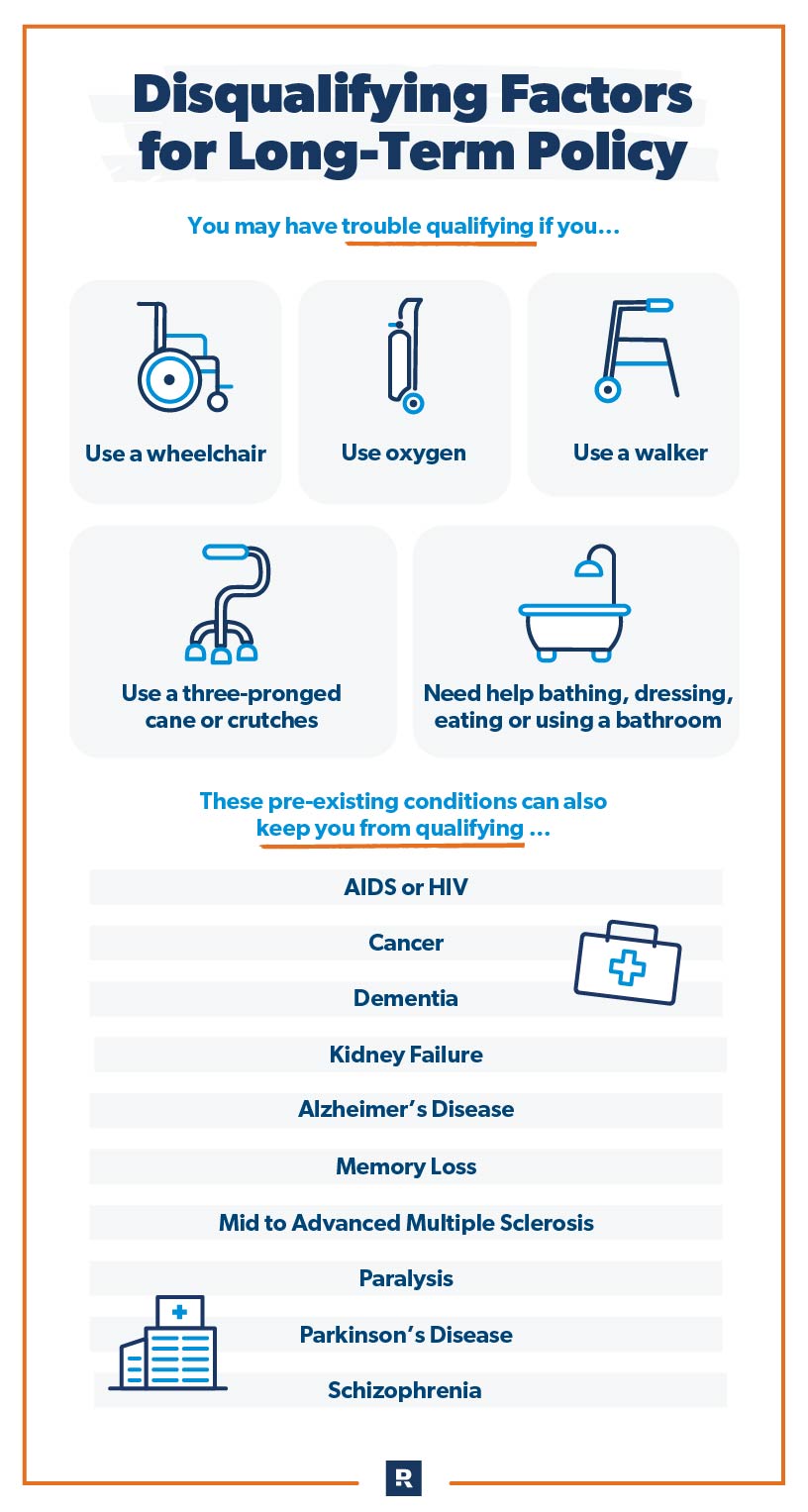

You’ll have bother qualifying for those who already:

- Use a three-pronged cane or crutches

- Use oxygen

- Use a walker

- Use a wheelchair

- Need assistance bathing, dressing, consuming or utilizing the lavatory

What if You Have a Preexisting Situation?

A preexisting situation can even hold you from with the ability to get a long-term care coverage. Here’s a listing of main well being situations that disqualify folks:

- AIDS or HIV

- Alzheimer’s illness

- Most cancers

- Dementia

- Kidney failure

- Reminiscence loss

- Mid to superior a number of sclerosis

- Paralysis

- Parkinson’s illness

- Schizophrenia

What if You Have a Preexisting Situation?

A preexisting situation can even hold you from with the ability to get a long-term care coverage. Here’s a listing of main well being situations that disqualify folks:

- AIDS or HIV

- Alzheimer’s illness

- Most cancers

- Dementia

- Kidney failure

- Reminiscence loss

- Later to superior a number of sclerosis

- Paralysis

- Parkinson’s illness

- Schizophrenia

The Finest Approach to Get Lengthy-Time period Care Insurance coverage

The finest long-term care insurance coverage coverage is the one that matches your finances and covers your future wants.

Be sure the coverage you select can pay you sufficient to maintain your retirement financial savings intact. If you happen to’re on a decent finances, you’ll be able to attempt decreasing your premium by selecting an extended elimination interval (the time you need to wait between while you begin receiving long-term care and when your insurance coverage begins paying the payments)—however provided that you’ll be able to afford to pay for 3 months of care out-of-pocket.

The easiest way to be sure to get the best coverage, although, is to speak with an unbiased insurance coverage agent. They’ll reply all of your questions, store round with a number of completely different long-term care firms, and get you quotes that may prevent hundreds of {dollars} and a great deal of pointless worries.

[ad_2]

Source link