[ad_1]

Life occurs. However you may be money prepared with an emergency fund.

If you crack a tooth on a popcorn kernel, really feel the AC exit in the midst of summer season, and even lose your job—you gained’t fear about the right way to cowl the payments. You may relaxation simple at evening figuring out you’ll be okay in these life occurs moments.

If this type of monetary safety seems like a fairy story that’s too good to be true, you’ve received to imagine me: It. Is. Potential!

Let’s break down every thing emergency fund—from what it’s to the place to stash it—so you can begin residing within the peace that financial savings will deliver.

What Is an Emergency Fund?

An emergency fund is cash you put aside for all times’s sudden bills, like automobile repairs, hospital visits and even job loss. This cash provides you the ability at hand over money to cowl the large and small surprises that come your means.

Why Do I Want an Emergency Fund?

I can consider so many the explanation why you want an emergency fund. Listed here are just a few:

- You’ll be ready. If you make a budget every month, you’re prepping for all of the anticipated bills that will come. When you’ve gotten an emergency fund, you are prepping for all of the sudden bills that would possibly come.

- You’ll get monetary savings. Don’t use a bank card as your emergency fund. Ever. Emergencies are costly sufficient with out you paying curiosity on them for months and months. Having money in hand means emergencies are paid in full and you’ll transfer on.

- You’ll really feel peace. I discussed feeling peace earlier, however I wish to deliver this residence. Ramsey Options did a research study that confirmed 54% of People fear every day about their monetary scenario. And 34% of them haven’t any financial savings in any respect. That’s sufficient to maintain anybody up at evening. However you don’t must dwell like that! Money within the financial institution brings peace of thoughts.

Your grandmother most likely referred to as her emergency fund a wet day fund, and with good cause! It’s going to rain. And typically, it’ll flood. With an emergency fund, you’ll be prepared. Curiosity (and fear) free.

How A lot Ought to I Save for My Emergency Fund?

Let’s speak about how a lot to save lots of for an emergency fund. That reply is dependent upon just a few issues.

Starter emergency fund: You probably have shopper debt, you want a starter emergency fund of $1,000. This might not seem like a lot, nevertheless it’s only a momentary buffer when you repay that debt.

Totally funded emergency fund: As soon as that debt’s gone, you want a completely funded emergency fund of three–6 months of bills. (This follows the 7 Baby Steps, the confirmed plan for getting out of debt and constructing wealth that my fellow Ramsey Personalities and I actually break down in Financial Peace University.)

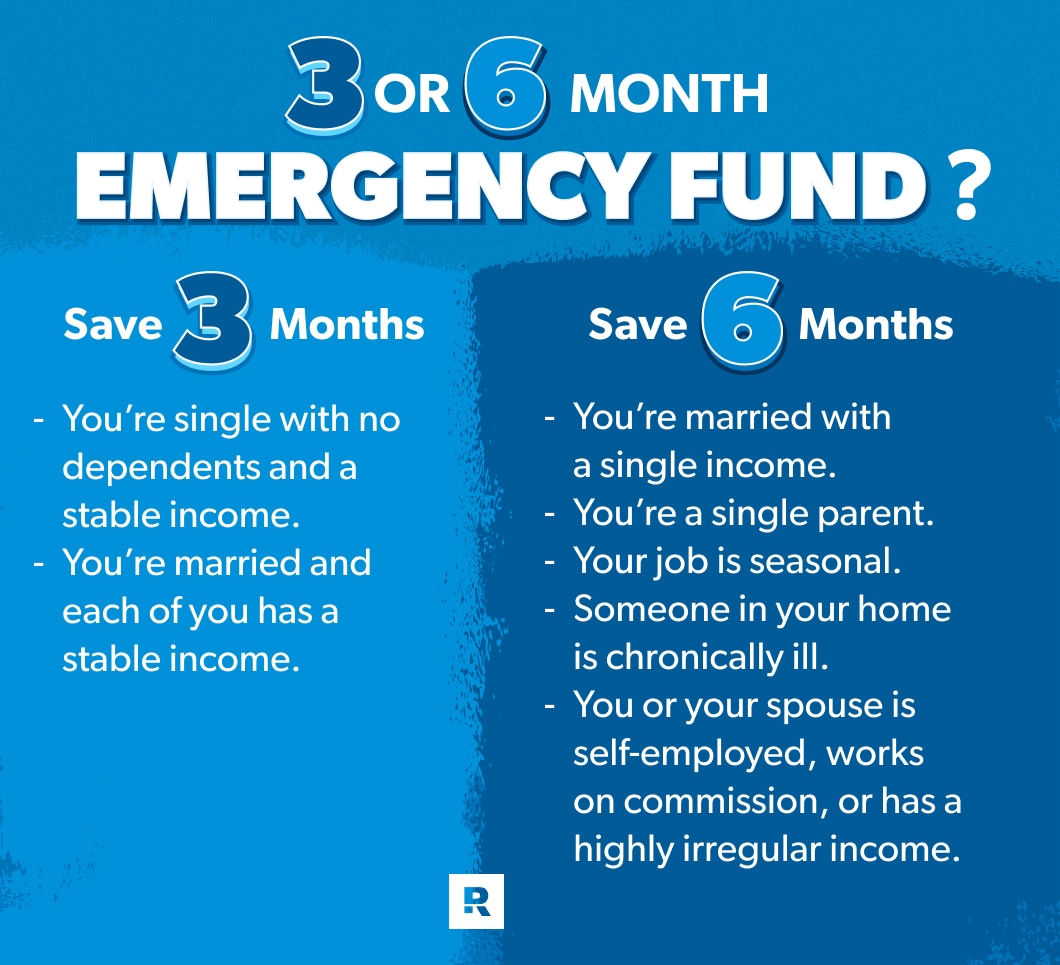

Okay, however how are you aware should you ought to save up three months or six months of bills? It’s not as sophisticated as you would possibly suppose. Simply observe the information on this chart!

However how a lot do you have to save? Begin by looking at your checking account to see what you normally spend every month. Then multiply that quantity by three or six to get an concept of how a lot it is best to save to your emergency fund. (For instance, the average monthly expenses in America vary from about $4,000 for singles and as much as almost $8,600 for a household of 4.1)

Are you prepared for life’s emergencies? Learn how to get there with Financial Peace University.

Now, these numbers are primarily based on every thing within the price range—together with streaming providers, consuming out, haircuts, and many others. But when (worst-case state of affairs) you lose your job and have to dwell off your emergency fund for a pair months, you’ll wish to get on a bare-bones price range that simply covers the essentials. It’s not the time to pay for fancy extras.

With that in thoughts, be sure to’ve received sufficient in your emergency fund to pay your payments, put meals on the desk, and refill the fuel tank. And should you want a much bigger cushion for added peace of thoughts, that’s okay too!

The place Ought to I Maintain My Emergency Fund?

Now that you recognize the why and how a lot, you may be questioning in regards to the the place. As in the place do you retain all this cash?

Ensure that your emergency fund is liquid, that means you may get to it simply and rapidly. Strive considered one of these choices:

- A easy savings account related to your checking account

- A money market account that comes with a debit card or check-writing privileges

- An online bank that pays the next rate of interest and the place you may nonetheless switch cash rapidly and on to your checking account

- Not a shoebox in your sock drawer or buried within the yard

- Not in an funding account the place it may lose worth within the brief time period (your emergency fund is insurance coverage—not an funding)

The bottom line is safety and accessibility. You need to have the ability to pay that physician or mechanic rapidly with zero trouble and complications. However you don’t need the cash really easy to get to that you simply’re dipping into it for each little cause. Which brings me to my subsequent level.

When Ought to I Use My Emergency Fund?

So, a sudden expense pops up, and it feels like an emergency—however how do you know if it’s actually time to faucet into your emergency fund?

First off, are you able to merely adjust your budget this month to cowl the expense? Skipping some extras for just a few weeks to keep away from dipping into financial savings is completely price it. As a result of bear in mind, when you spend from the emergency fund, you need to rebuild the emergency fund!

If shifting issues round on this month’s price range gained’t reduce it, merely ask your self these three questions:

- Is it sudden?

- Is it essential?

- Is it pressing?

For those who can reply sure to all three of these, you’ve received an actual emergency—and an actual want to make use of your emergency fund.

Easy methods to Construct an Emergency Fund

For those who don’t have an emergency fund but (otherwise you’re realizing proper now that yours isn’t sufficiently big), it’s time to start out saving. Right here’s how:

Set a complete financial savings objective.

Okay, what are you trying to save: that $1,000 starter emergency fund or the three–6 month totally funded emergency fund? Earlier than you may attain that quantity, you’ve received to set it!

For those who’re engaged on that totally funded emergency fund, the important thing to setting your quantity is to take a look at the chart from earlier, do your personal math, and choose a financial savings objective that makes you’re feeling assured. If which means saving a bit extra to have additional financial security, go for it.

After all, should you’re married, ensure that it’s a quantity you each agree on. You’ll be working collectively to put it aside up, and that’ll be a lot simpler should you’re on the identical web page.

Make a price range.

As soon as you recognize the complete quantity you’re aiming for, you can begin breaking down the right way to get there. And which means you’ll want a price range.

Keep in mind, a price range is how you intend out the place your cash will go. So if you wish to put cash into financial savings, you need to plan for it—aka put it within the price range.

For those who’re making an attempt to save $1,000, get intense and knock this out in a month.

For those who’re working in your totally funded emergency fund, create a financial savings price range line and work on this objective one month at a time.

And should you need assistance making this occur, take a look at our budgeting instrument, EveryDollar. It’s the instrument my household makes use of each single month, and you will get began in the present day—free of charge!

Lower your bills.

Irrespective of how a lot you’re making an attempt to save lots of, should you don’t have more money in your price range already, one thing’s received to provide.

Begin by lowering your bills, both by spending much less or cutting some costs out fully. Want some inspiration? Strive one (or all) of those:

- Purchase generic brands to save lots of on meals and family bills.

- Meal plan to save lots of on groceries.

- Be taught cheap lunch ideas, and skip the noon restaurant runs.

- Be a part of a grocery rewards program—not a bank card—to save lots of on fuel.

- Bathe faster (not much less usually, please) to decrease your water invoice.

- Lower your TV streaming providers down to at least one (or none!).

- Have a no-spend month the place you purchase necessities solely.

Improve your earnings.

One other technique to ramp up your financial savings every month is by increasing your income. Listed here are just a few methods to do this:

- Work time beyond regulation.

- Seize a side hustle, like delivering meals or tutoring on-line.

- Decide up some freelance shoppers.

- Promote stuff for a fast enhance in earnings.

I ran a ballot with The Ramsey Show viewers to see which of these is their go-to technique. Guess what gained? Working time beyond regulation!

However hey, whichever you choose, bear in mind to get that additional earnings within the price range. You don’t wish to accidently spend it elsewhere. You’ve received targets to hit and an emergency fund to construct.

Automate your financial savings.

One final tip on constructing your emergency fund: You realize that month-to-month quantity you determined to stay into financial savings? Go forward and set it to switch into your financial savings mechanically out of your paycheck. That means, you gained’t even take into consideration sending it on a detour out of your checking account to live performance tickets, retailer gross sales or no matter different temptation would possibly come your means every month.

That cash has a job: going into financial savings. So assist your self by sending it straight there!

Begin Saving Your Emergency Fund At the moment

You’ve received the information it’s worthwhile to begin saving—so work out your financial savings objective, download EveryDollar to get that objective within the price range, and put within the work to construct up your emergency fund.

That peace of thoughts I preserve speaking about isn’t a fairy story. It’s actual. And also you’re actually going to dwell it. Take these first steps and begin saving in the present day!

[ad_2]

Source link