[ad_1]

As the price of residing continues to climb, many Canadians are discovering it more and more tough to maintain up with the minimal funds on their money owed. Assortment calls generally is a near-constant supply of tension. Discovering a option to eradicate your debt means discovering aid from an countless parade of these calls and having the ability to give attention to what’s actually essential.

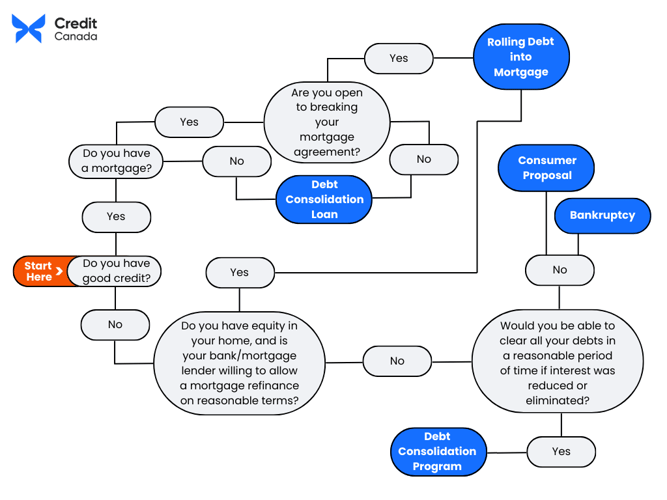

There are numerous methods to seek out debt aid. Two essential methods for getting out of debt are client proposals and debt consolidation. However which debt administration technique is finest for you?

That can assist you make an knowledgeable resolution, let’s examine client proposal vs debt consolidation. What are they? How do they work? Who’s eligible for every? What are their impacts in your credit score?

On this article, we are going to present readability about your choices so you can also make the perfect resolution in your monetary scenario.

What Is Debt Consolidation?

Primarily, debt consolidation is the title for once you mix a number of types of debt right into a single month-to-month fee. There are just a few other ways to go about consolidating debt.

The three major methods of consolidating debt are:

- Debt Consolidation Loans. That is once you get a mortgage from a lender like a financial institution to repay your present money owed after which begin paying off the mortgage as an alternative.

- Rolling Debt into Your Mortgage. That is once you leverage the fairness in a house to pay your debt—rolling it into your mortgage. This usually ends in a decrease rate of interest than a regular mortgage since a mortgage is collateralized (by your private home).

- Debt Consolidation Program (DCP). It is a service offered by a credit score counsellor or non-profit credit score counselling company. The counsellor negotiates together with your collectors in your behalf to cease (or decrease) curiosity in your excellent money owed and roll them right into a single month-to-month fee.

How Does Debt Consolidation Work?

The particular strategy of debt consolidation will fluctuate from one kind of consolidation to the following. Listed here are explanations of how every kind of consolidation course of would usually work:

How Debt Consolidation Packages Work & Who Can Use Them

A debt consolidation program is offered to debtors no matter their credit score rating. Anybody, no matter earnings degree and employment standing, is eligible for a debt consolidation program. In case your money owed (not together with your mortgage) are greater than 20% of your earnings, you could be match for a DCP.

Nonetheless, a DCP can solely be utilized to unsecured money owed like bank cards. Secured debts which have collateral hooked up to them, like mortgages (that are secured with your private home), can not be included in a DCP.

To enter a debt consolidation program, you’ll contact a credit counselling agency (like Credit score Canada). The credit score counsellor would overview your monetary scenario with you and assess if a DCP could be the suitable selection for you.

Professionals:

- Straightforward to satisfy eligibility necessities no matter credit score.

- Places a cease to assortment calls.

- Both stops or lowers rates of interest on debt.

- Leaves the negotiation with collectors to your counsellor.

- Has a transparent finish date.

- Credit score counselling is offered that will help you keep out of debt as soon as this system ends.

Cons:

- Doesn’t cowl secured money owed.

- Collectors can refuse to take part in this system.

- Applies an R7 credit standing to your credit score historical past at some point of this system +2 years.

How Debt Consolidation Loans Work & Who Can Use Them

A debt consolidation mortgage works just about like every other mortgage—you go to your financial institution or one other lender and ask for a mortgage in an quantity that may help you repay your excellent debt. They’ll test your credit score historical past and rating and make a willpower in the event that they need to present a mortgage and what phrases they’ll provide.

The massive caveat for a consolidation mortgage is that should you don’t have nice credit score, you could battle to get a mortgage with beneficial phrases. Nonetheless, should you do have an excellent credit score, then this can be a perfect option to consolidate your debt and scale back your general rate of interest. A consolidation mortgage additionally helps you construct a optimistic credit score historical past should you can persistently make funds on it.

Lastly, in contrast to a DCP, a consolidation mortgage can be utilized for aid from any type of debt.

Professionals:

- Can be utilized to repay any type of debt.

- Might scale back your general rate of interest.

- Will help construct a optimistic credit score historical past.

Cons:

- Should endure a mortgage qualification course of.

- Your credit score rating might have an effect on mortgage phrases.

- Doesn’t resolve underlying spending habits that result in debt.

How Rolling Debt Into Your Mortgage Works

When you’ve got a house with some fairness (that means that you simply owe much less on the house than its present market worth), you could possibly roll your debt into your mortgage. Nonetheless, to do that, you’ll have to interrupt your present mortgage settlement and enter a brand new one.

Breaking your mortgage settlement means paying a penalty to your lender for breaking the settlement. Additionally, there’s no assure that your new mortgage phrases might be higher than your previous mortgage—if the common rate of interest of the market goes up, you could end up with a mortgage that has a better rate of interest than you probably did earlier than. Nonetheless, the reverse can also be true. If rates of interest are decrease than once you signed your preliminary mortgage, then you could end up with a greater rate of interest than earlier than. Whereas which may appear close to inconceivable primarily based on latest mortgage rate trends, a mortgage dealer will have the ability to overview your choices with you.

Rolling your debt into your mortgage is perhaps a sensible choice you probably have plenty of fairness in your house, mortgage rates of interest have gone down because you signed your mortgage, otherwise you’re coming into a mortgage for the primary time and have some high-interest debt you’d prefer to roll into the mortgage.

Professionals:

- Can be utilized to repay any type of debt.

- Might lead to decrease general curiosity in your debt.

Cons:

- Extends how lengthy your mortgage will final.

- You will want to pay charges for breaking your present mortgage.

- Your mortgage’s rate of interest might improve or lower relying available on the market.

- Doesn’t resolve underlying spending habits that result in debt.

- Depends on having sufficient fairness within the dwelling to cowl your different money owed.

Additional Point out: Residence Fairness Line of Credit score (HELOC)

A house fairness line of credit score is a revolving line of credit score that’s considerably just like a bank card, however has a variable rate of interest. It may be helpful for changing a high-interest bank card, however runs the danger of utilizing up all your dwelling’s fairness should you don’t exercise good money habits.

What Is a Shopper Proposal?

A consumer proposal is an association debtors could make with their collectors by means of a Licensed Insolvency Trustee (LIT) like Harris & Partners. It’s a type of insolvency that’s thought of much less extreme than bankruptcy. This may occasionally clarify why extra folks apply for client proposals than bankruptcies every year—in response to information from the Office of the Superintendent of Bankruptcy (OSB), in Q3 of 2023, there have been 24,043 client proposals and 6,428 bankruptcies filed in Canada by customers, for a complete of 30,471 insolvency filings. Which means that client proposals accounted for 78.9% of all insolvency filings in Q3 2023.

Underneath a client proposal, the debtor pays off a portion of what they owe to their collectors. The catch is that your collectors need to comply with the phrases of the proposal. If accepted, assortment efforts from collectors that comply with the proposal will instantly cease, and you’ll start making funds to the LIT for them to distribute to your collectors.

The longest a client proposal association will final is five years—although you’ll be able to choose to pay it off early should you’re capable of. As soon as it’s paid off, you’ll be within the clear for all the money owed that have been included within the proposal.

Nonetheless, should you fall behind by greater than three months, your proposal might be deemed annulled under paragraph 66.31(1)(a) of the Bankruptcy and Insolvency Act (BIA). If that occurs, you might have the ability to have the proposal revived by interesting to the court docket (referred to as the “judicial route”) or by interesting to the administrator of the proposal (referred to as the “administrative route”). If revived, any missed funds will must be made up earlier than the tip of the proposal. If not revived, your collectors might resume assortment actions.

A client proposal submitting is reported to the key credit score bureaus (Equifax and TransUnion), as is the completion of the proposal. Whereas a client proposal is in your credit score historical past, it applies an R7 ranking to your credit score. Equifax removes client proposals out of your report three years after completion. In the meantime, the timing for TransUnion to take away a proposal might fluctuate—it will likely be both three years following the completion of the proposal or six years after the proposal is signed (whichever is sooner).

Throughout a client proposal, your bank cards with an excellent steadiness might be cancelled, however playing cards you maintain that haven’t any steadiness on the time of submitting could also be stored. You may additionally have the ability to preserve secured bank cards throughout the proposal interval.

Are There Charges for Submitting a Shopper Proposal?

Sure. There are charges for submitting a client proposal. These charges are regulated below the BIA and are included within the periodic or lump sum funds you make to the LIT. The preliminary session with the LIT could also be free and they need to have the ability to talk about details about charges for companies at the moment.

Shopper Proposal Professionals and Cons

Professionals:

- Much less impactful in your credit score than submitting for chapter (R7 ranking for proposal period +3 years vs R9 ranking for chapter period +6-14 years).

- You keep management of most of your property, in contrast to a chapter.

- When accomplished, your money owed on the proposal might be cleared.

- Might eradicate curiosity on debt.

- You’ll be able to pay the proposal off early.

- Potential authorized actions to gather money owed will finish as soon as the proposal begins.

Cons:

- Requires collectors to comply with the phrases of the proposal.

- Should quit any unsecured bank cards with balances on them when the proposal begins.

- If you happen to fall behind on funds, collectors can restart assortment efforts.

Evaluating Shopper Proposals and Debt Consolidation

So, which is finest for you: a client proposal or debt consolidation? The reality is that it’d rely in your monetary scenario. We suggest that you simply seek the advice of with a monetary advisor, credit score counsellor, or a Licensed Insolvency Trustee first earlier than deciding on any of those choices. Right here’s a desk to check these choices:

.png?width=1024&height=768&name=Blog%20Post%20Table%20%26%20Flowchart%20(1).png) Of those choices, a debt consolidation mortgage or rolling debt into your mortgage will possible have a smaller, shorter-term impression in your credit score rating than a debt consolidation plan or a client proposal. In truth, each of those choices can add optimistic objects to your credit score historical past over time.

Of those choices, a debt consolidation mortgage or rolling debt into your mortgage will possible have a smaller, shorter-term impression in your credit score rating than a debt consolidation plan or a client proposal. In truth, each of those choices can add optimistic objects to your credit score historical past over time.

Each debt consolidation plans and client proposals apply an R7 credit standing to your credit score historical past at some point of this system or proposal, plus a while after completion. Within the case of DCPs, it’s at some point of this system plus two years, whereas a proposal applies the R7 ranking at some point of the proposal plus three years.

Making an Knowledgeable Resolution About Debt Consolidation vs Shopper Proposal

So, which is finest for you and your wants? Debt consolidation or a client proposal? The reply is dependent upon your monetary scenario.

A debt consolidation mortgage is perhaps finest if:

- You will have good credit score.

- You will have high-interest debt the place the mortgage would scale back your rate of interest.

- You don’t need to break your present mortgage settlement.

Rolling your debt into your mortgage is perhaps a good suggestion if:

- It could enable you to scale back your general rate of interest.

- The present common mortgage rate of interest is decrease than your mortgage’s rate of interest.

- You will have sufficient fairness in your house to cowl your debt.

- You’ll be able to afford the charges for breaking your mortgage.

A debt consolidation program might be perfect if:

- Your credit score rating is just too low to qualify for a beneficial mortgage.

- You wouldn’t have fairness in your house to leverage for debt reimbursement.

- You need assist constructing debt administration habits to maintain you out of debt sooner or later.

A client proposal is perhaps finest if:

- You will have a low credit score rating.

- You can not qualify for a consolidation mortgage or roll debt right into a mortgage.

- You can not be a part of a debt consolidation program.

- You need to work together with your collectors to clear your debt.

- You need to finish wage garnishment.

[ad_2]

Source link