[ad_1]

You simply moved into your stunning new home in a brand-new neighborhood. It’s on the right spot: nestled within the hills with a creek close by. And naturally, you bought a owners insurance coverage coverage ASAP, so that you’re absolutely protected.

However are you? What about that creek? And people hills? You haven’t seen the wet season but . . . In case you’re questioning, Do I want flood insurance coverage? you’re asking the proper questions.

How Do You Know if You’re at Risk for a Flood?

Who’s Required to Have Flood Insurance?

Does Homeowners Insurance Cover Flooding?

What Does Flood Insurance Cover?

What Doesn’t Flood Insurance Cover?

How Much Does Flood Insurance Cost?

How Do You Know if You’re at Danger for a Flood?

There are some apparent areas that instantly pop into our heads once we consider floods, like land proper by the ocean or close to the banks of the Mississippi River. However many different locations may simply see rising waters that threaten close by houses.

Free Flood Preparedness Guidelines

In case you’re able to be ready in case of a flood, here is a free guidelines that can assist you keep on monitor.

A kind of locations is New England. That’s proper, New England—the area identified for vivid, crisp falls, large cities and quaint countryside villages can also be fairly liable to flooding. They’re not the one ones although. The Gulf Coast and Midwest see their justifiable share, together with the mid-Atlantic, South and . . . properly, you get the image. Regardless of the place you reside, you ought to be asking the query, Do I want flood insurance coverage?

In reality, about 20% of flood insurance coverage claims come from areas which are thought-about low to reasonable threat.1

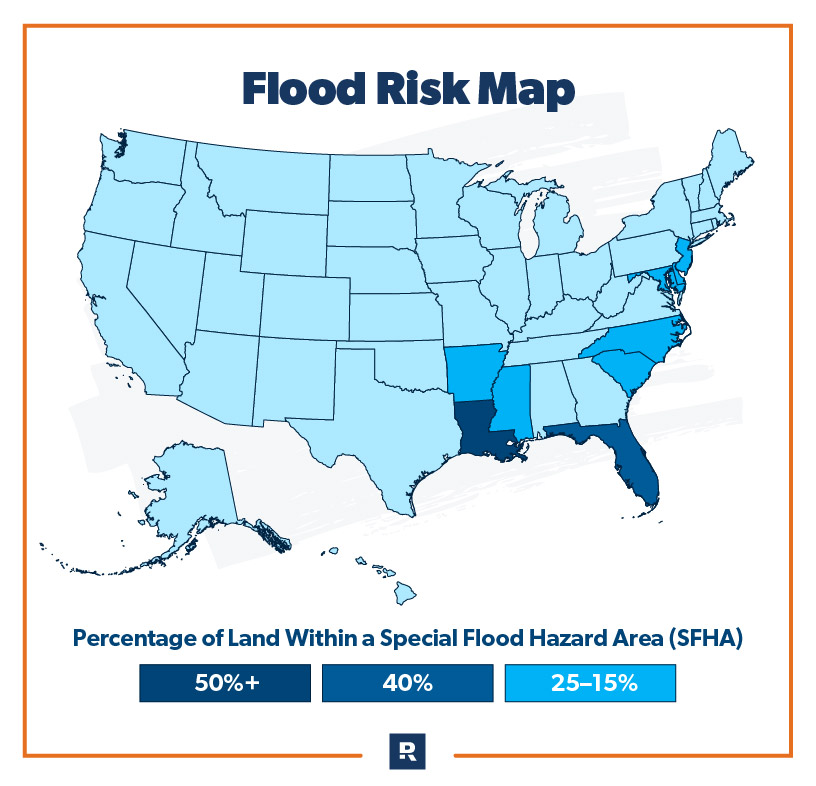

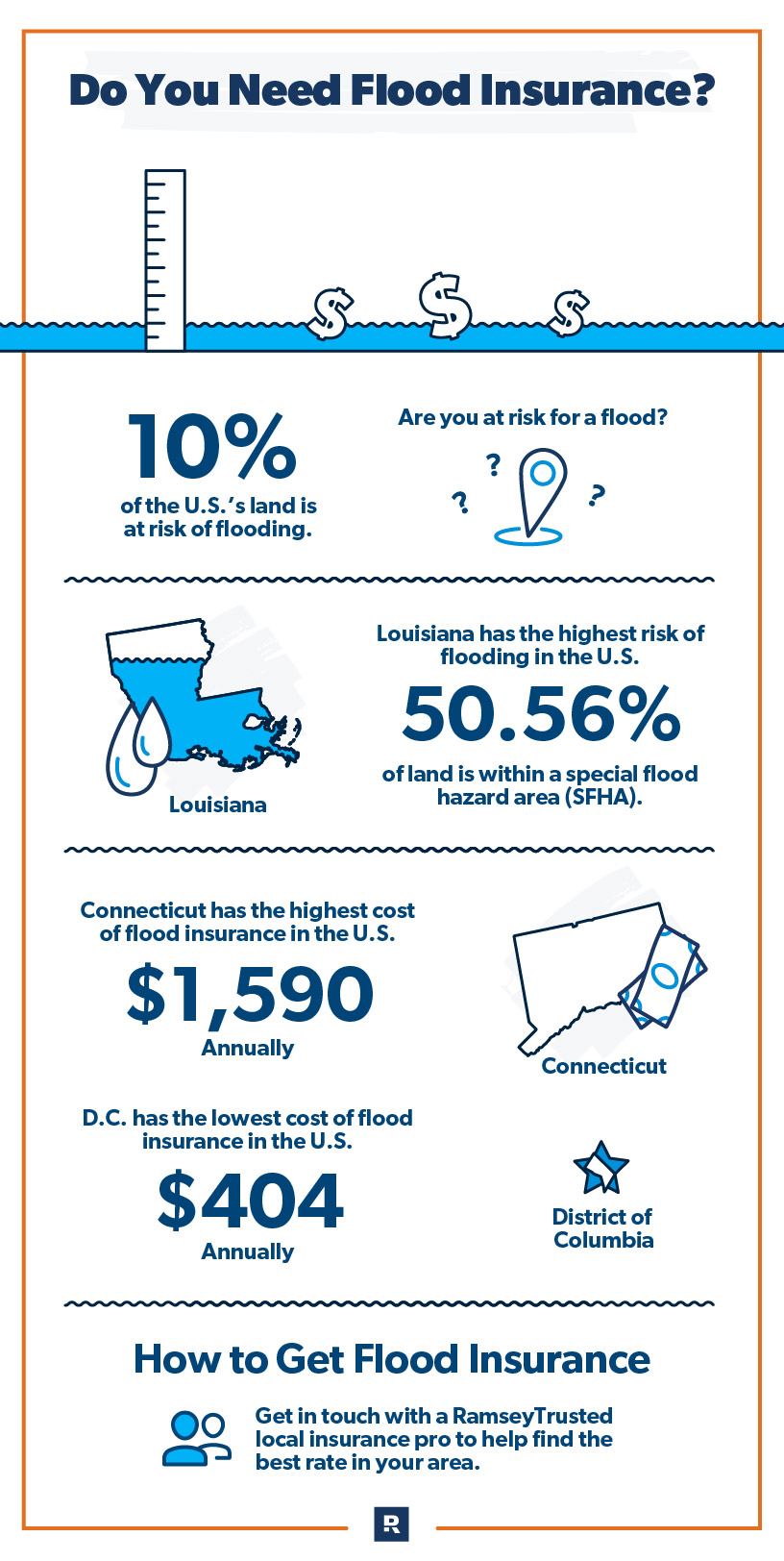

The Federal Emergency Administration Company (FEMA) estimates that 10% of the U.S. is susceptible to flooding.2 That’s quite a bit.

So how have you learnt if you’re in danger for a flood? The best method is to check out a flood map like one among FEMA’s flood insurance coverage price maps (aka FIRMs). FEMA updates their flood maps yearly, giving every group a delegated threat class. In case you dwell in a high-risk zone, the query is not Do I want flood insurance coverage? however How a lot flood insurance coverage do I want?

However even when your house is in a low-risk zone, that’s a very good signal it is best to look into flood insurance too. Low threat doesn’t imply no threat. Flooding can occur nearly wherever.

Plus, flood maps change over time. Components like altering climate patterns, native dam enhancements, and even new neighborhoods may cause the property your home sits on to go from a low-risk flood zone (particular flood hazard space, or SFHA) to a high-risk flood zone (and vice versa) at any time.

So be sure you examine an up-to-date FIRM—and maintain checking sometimes.

To search out out your group’s threat class, you’ll be able to ask your local insurance agent or go to FEMA’s Flood Map Service Center and put in your deal with to view it your self.

Why You Have to Know Your Flood Danger

In case you’re nonetheless questioning, Do I want flood insurance coverage? check out how a lot injury a flood may cause—and how briskly.

- The injury from just one inch of water can value a house owner greater than $25,000.3

- Flash floods sometimes carry water between 10 and 20 toes excessive.4

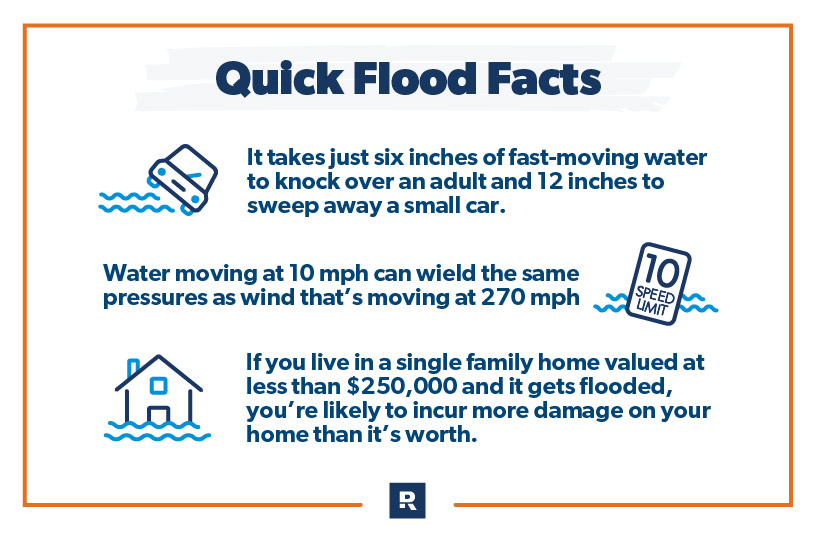

- It takes simply six inches of fast-moving water to knock over an grownup and 12 inches to brush away a small automobile.5

- Water transferring at 25 mph can wield the identical pressures as wind that’s transferring at 790 mph—quicker than the velocity of sound.6

- In case you dwell in a 100-year flood plain, your property has a 1% probability of flooding yearly. Within the final a number of years, Houston alone has seen a minimum of three 500-year floods.7

- In case you dwell in a flood plain or a high-risk space, you’re required to have flood insurance coverage if your property has a federally backed mortgage.

The injury from only one inch of water can value a house owner greater than $20,000.

Who’s Required to Have Flood Insurance coverage?

Whereas it may be a good suggestion for most individuals to have flood insurance coverage, there are some who’re required by regulation to have it. For instance, when you have a house or enterprise with a government-backed mortgage and it’s positioned in a high-risk space, you want flood insurance coverage.

Like we talked about earlier, yow will discover out whether or not you’re in a flood zone by taking a look at FEMA’s maps. In case you do dwell in a high-risk zone, examine together with your lender to search out out if it’s important to carry a flood coverage—generally, they’ll require you to even when the federal government doesn’t.

Does Owners Insurance coverage Cowl Flooding?

Solely 27% of homeowners have flood insurance coverage based on a survey by the Insurance coverage Info Institute. However the precise quantity may very well be a lot decrease.8 Many individuals mistakenly imagine they’ve flood insurance as a result of they suppose their owners insurance coverage covers it. But it surely doesn’t.

Whether or not you could have flood protection or not with an ordinary homeowners policy depends upon what sort of flooding you’re speaking about. In case you’re hoping it covers a spontaneous pond within the laundry room from a burst washer hose, you’re in luck. However for those who’re holding out for protection on a hurricane, monsoon and even rainwater from a bad thunderstorm getting inside, you want to think again.

In case you solely have an ordinary owners insurance coverage coverage, you’ll be able to just about guess you’re not covered for flooding from any type of storm or event outdoors your home that brings water in. To get flood protection, it’s important to purchase it individually or pay further to have it included in your coverage as a rider.

What Does Flood Insurance coverage Cowl?

There are two sorts of flood insurance coverage you should buy, and each covers one thing totally different. In case you’re at any threat of flooding, it is best to most likely have each.

Protect your home and your budget with the right coverage!

You may get constructing protection and contents protection, and most of the people purchase theirs by the federal government’s Nationwide Flood Insurance coverage Program (NFIP), though you may get them by a non-public provider as properly. Prefer it sounds, these insurance policies cowl your home construction and what’s inside your constructing.

Let’s check out what they cowl:

Constructing Protection

- Insured constructing and basis

- Electrical and plumbing techniques

- Furnaces and water heaters

- Fridges, cooking stoves and built-in home equipment

- Completely put in carpeting

- Completely put in cupboards, paneling and bookcases

- Window blinds

- Basis partitions, anchorage techniques and staircases

- Indifferent garages

- Gasoline tanks, properly water tanks and pumps, and photo voltaic power tools

- Particles removing

Contents Protection

- Private belongings, like clothes, furnishings and digital tools

- Curtains

- Washer and dryer

- Moveable and window air conditioners

- Microwave oven

- Meals freezers (and the meals inside)

- Carpets not included in constructing protection (aka carpet put in over wooden flooring)

- Invaluable gadgets akin to authentic paintings and furs (as much as $2,500)

Take into accout, what brought about the flooding is vital in determining if these items are actually lined. Identical to injury attributable to a storm flood isn’t lined below an ordinary owners coverage, injury attributable to some forms of flooding isn’t lined by some flood insurance policies. (Yeah, there are many guidelines.)

FEMA defines flooding as “an extra of water on land that’s usually dry, affecting two or extra acres of land or two or extra properties.”9 So in case your sewer backs up into your home (if this has occurred to you, we’re very sorry) due to flooding outdoors, you’re lined. But when the backup wasn’t brought about straight by flooding, you’ll need to depend on any sewer backup rider you (hopefully) added.

What Doesn’t Flood Insurance coverage Cowl?

Like with all forms of insurance coverage, there are some issues flood insurance coverage doesn’t cowl—like just about something in a basement.

Listed here are among the widespread issues not lined by flood insurance coverage:

- Water injury or moisture leading to mold development (and extra injury) that the home-owner may have prevented

- ALE (further residing bills), like the price to pay for a resort room and meals whereas your property is being repaired.

- Most automobiles, like automobiles, boats, and so forth.

- Stuff saved in a basement or finishings (like carpeting, drywall, and so forth.)

- Something outdoors the constructing that’s insured (suppose landscaping, swimming pools, patios, fencing, septic techniques, and so forth.)

- Misplaced revenue or different monetary losses from having to shut your online business or not having the ability to use your insured property (suppose farms or rental properties)

- Harm from water flowing below the bottom

- Any further expense that comes from having to adjust to new legal guidelines, rules or code as you rebuild or restore from flood injury

Insurance policies will be totally different, although, so be sure you examine yours for a full record.

How A lot Does Flood Insurance coverage Price?

On common, a flood insurance coverage coverage from NFIP prices round $900 a 12 months.10 How a lot flood insurance coverage will value you depends upon how excessive your threat of flooding is.

Apart from location in a flood zone, there are numerous different elements that impression your flood insurance coverage price.

These embody:

- How far your property is from the water’s edge (aka ocean, lake or river)

- Whether or not you’re shopping for constructing or contents protection (or each)

- How large of a deductible you select and the boundaries in your protection

- The place your construction is positioned in your property (Is it downhill or in a bowl?)

- How your constructing is designed (Is it on stilts?)

- How previous your home is

- The place your largest (aka most costly) stuff is saved (Are your utilities on the second ground or on stilts?)

In the long run, how a lot it’ll cost to cowl your explicit home will rely upon the place you fall on all of those factors.

That being mentioned, states nonetheless differ quite a bit in how a lot flood insurance coverage prices inside their borders. Seven out of the highest 10 most costly states are in New England.

Flood Insurance coverage Prices by State

Like we talked about, the place you reside undoubtedly impacts your threat for flooding and the way a lot you’ll pay. Listed here are the ten states the place residents pay essentially the most:

|

High 10 States The place Residents Pay the Most for Flood Insurance coverage |

|

|

State |

Annual Charge |

|

Connecticut |

$1,590 |

|

Hawaii |

$1,437 |

|

Massachusetts |

$1,269 |

|

New Hampshire |

$1,216 |

|

Vermont |

$1,197 |

|

New York |

$1,184 |

|

West Virginia |

$1,133 |

|

New Jersey |

$1,081 |

|

Pennsylvania |

$1,075 |

|

Rhode Island |

$1,062 |

Information From FEMA11

There are many states the place flood insurance coverage isn’t as excessive as, properly, the floodwaters. These are the states the place you’ll possible pay the least for flood insurance coverage:

|

High 10 States The place Residents Pay the Least for Flood Insurance coverage |

|

|

State |

Annual Charge |

|

District of Columbia |

$404 |

|

Alaska |

$454 |

|

Maryland |

$608 |

|

Utah |

$645 |

|

Nevada |

$715 |

|

Virginia |

$743 |

|

Texas |

$776 |

|

Georgia |

$791 |

|

North Carolina |

$791 |

|

North Dakota |

$798 |

Information From FEMA12

Take into accout although, these numbers are what individuals are really, presently paying. Some owners have backed charges (aka the federal government is paying a part of their premium). It is because just a few years in the past, the way in which charges had been calculated modified drastically and a few individuals all of the sudden ended up with a lot greater premiums. The federal government stepped in and backed their charges so that they didn’t get priced out of the market.

The precise risk-based prices are sometimes a lot greater. For these paying backed charges, annually their price will increase a bit of till they attain the risk-based price. In case you purchase a coverage now, you’ll be paying the risk-based price.

Find out how to Get Flood Insurance coverage

If determining whether or not you want flood insurance coverage and the way a lot you want looks like an enormous job, don’t fear—you don’t need to do it alone! An independent insurance agent is tremendous useful on the subject of checking out your insurance coverage and discovering the perfect price.

Don’t wait to search out out if flood insurance coverage is best for you. Get in contact with a RamseyTrusted local insurance pro. These impartial brokers have the center of a instructor and can aid you perceive your protection choices and dangers, plus they’ll be sure you get the perfect deal besides.

Contact an area impartial insurance coverage agent as we speak!

[ad_2]

Source link