[ad_1]

Homeownership is a life-changing occasion. So is having a considerable amount of debt. Whether or not you personal a house or are planning to purchase one, figuring out your choices for managing your debt is essential.

Should you’re struggling to make month-to-month funds in your debt, you might be investigating completely different debt aid choices to eliminate that debt so you possibly can have sufficient leeway to make mortgage funds. Submitting for chapter makes it extremely tough to qualify for a mortgage. So, as a substitute of chapter, you may be contemplating debt consolidation.

Right here’s the essential query: does debt consolidation have an effect on your home-buying skill? Under, we’ll evaluation how debt consolidation works, the way it can have an effect on shopping for a house, and a few methods for balancing your debt administration together with your mortgage.

Understanding Debt Consolidation

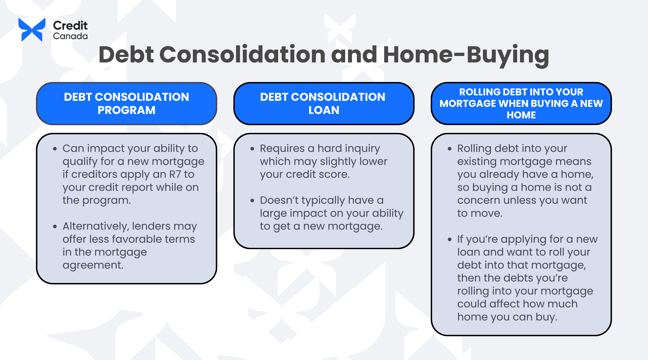

Debt consolidation is a blanket time period for a wide range of methods that mix a number of types of debt right into a single month-to-month fee. There are three main methods to think about: debt consolidation applications, debt consolidation loans, and rolling debt into your mortgage.

Every of those methods can affect your credit score rating and skill to purchase a house or preserve your present mortgage.

About Debt Consolidation Packages

A debt consolidation program (DCP) is if you work with a licensed credit score counsellor to barter together with your collectors to cut back (and even remove) the curiosity in your debt. Then, you make a single month-to-month fee to your credit score counselling company, which then redistributes funds to your collectors.

It must be famous {that a} DCP can solely cowl unsecured money owed. Secured money owed with some type of collateral, corresponding to a automotive mortgage, can’t be included in this system.

Whereas on a DCP, your collectors might apply an R7 rating to your credit report at some stage in this system plus two years after the program is complete. Additionally, you’ll be required to give up any unsecured credit cards as part of this system.

About Debt Consolidation Loans

A debt consolidation loan is if you apply for a private mortgage to get the cash it is advisable to repay your present money owed. You then begin repaying the mortgage as a substitute of the high-interest bank cards, excellent payments, and different money owed that you simply’ve paid off.

The advantages of a debt consolidation mortgage embrace an total decrease rate of interest in your debt and, in case you make funds on time, serving to you enhance your credit score rating.

Nonetheless, it is advisable to get authorised for the mortgage. This may be tough you probably have a low credit score rating. Should you don’t have a great credit score rating, you would possibly get supplied loans with larger rates of interest than the debt you already maintain. Alternatively, some loans would possibly require you to safe them with collateral that the lender can declare in case you fall behind in your compensation schedule.

About Rolling Debt right into a Mortgage

If you have already got a house, a 3rd choice is to roll your debt into your mortgage. Generally referred to as a “debt consolidation mortgage,” it is a debt consolidation technique that leverages your home equity (the distinction between how a lot your property is value and the way a lot you owe on it) to repay your money owed. Nonetheless, this isn’t only for present householders—potential patrons can even apply for a mortgage bigger than they should buy the house and use the additional cash to repay their high-interest bank card debt and different payments.

One of many largest benefits of consolidating debt into your mortgage is decreasing the curiosity in your debt much more than with an unsecured mortgage. Why is that this? Mortgages are likely to have decrease rates of interest than unsecured loans as a result of the mortgage is secured with collateral, and the unsecured mortgage will not be.

Nonetheless, to consolidate your debt into your mortgage, it is advisable to have sufficient fairness in your house to cowl the debt and pay charges for breaking your present mortgage settlement. Should you’re rolling your debt right into a brand-new mortgage, then the largest impediment could also be qualifying for a mortgage that covers each the price of your new residence and your excellent debt.

Moreover, this type of debt consolidation means delaying paying off your property in full as you add to the mortgage’s principal steadiness (i.e., the amount of cash owed that isn’t curiosity) or if the rate of interest and phrases of the mortgage are modified.

Debt to Earnings Ratio and Shopping for a House

Once you’re making use of for a mortgage, the mortgage firm will wish to study your debt-to-income ratio or DTI. Sometimes, a lender will want a borrower to have a back-end DTI of 35% or less. Nonetheless, some lenders might have stricter DTI pointers or settle for debtors with the next DTI.

That is one motive why debt consolidation could be important for getting a house. By consolidating money owed in a means that lowers your rate of interest (or finishing a DCP and eliminating your money owed), you possibly can cut back your DTI and make qualifying for a mortgage simpler.

What Is Debt to Earnings Ratio and How Is It Calculated?

The debt-to-income ratio permits lenders to match how a lot of a borrower’s month-to-month earnings is being put in direction of month-to-month debt funds.

For instance, in case you made $10,000 a month and needed to spend $3,000 on debt funds, your DTI could be 30%.

Some debtors would possibly specify a distinction between “front-end” DTI (which solely covers housing bills) and “back-end” DTI (which incorporates all debt obligations).

Debt Consolidation and House Shopping for

So, does debt consolidation have an effect on shopping for a house? The reply relies on the kind of debt consolidation you employ as a result of every type of consolidation has a special affect in your credit score.

Debt Consolidation Packages and Shopping for a House

A debt consolidation program can affect your skill to qualify for a brand new mortgage. It’s because collectors might apply an R7 score to your credit score report whereas on this system (some collectors might apply completely different scores, however R7 is the most typical). When this occurs, lenders might even see the merchandise in your credit score historical past and resolve to not work with you for the reason that score signifies an account the place you could have made an alternate association to repay your collectors.

Alternatively, they might supply much less beneficial phrases within the mortgage settlement. This consists of issues like charging the next rate of interest or decreasing how a lot you possibly can borrow. This could make it tougher to purchase the house that you really want.

Debt Consolidation Loans and Shopping for a House

A debt consolidation mortgage doesn’t usually have a big affect in your skill to get a brand new mortgage. Whereas the arduous inquiry in your credit score report can have a unfavourable affect in your rating, credit inquiries only account for 10% of your credit score. That is much less impactful than gadgets like your fee historical past, which accounts for 35% of your rating, and credit score utilization ratio, which accounts for 30% of your credit score rating.

In truth, by making constant month-to-month funds on the consolidation mortgage on time, you possibly can construct a optimistic credit score historical past and enhance your credit score rating—making it simpler to qualify for a mortgage over time.

Rolling Debt into Your Mortgage When Shopping for a New House

Should you’re rolling debt into your present mortgage, you have already got a house, so shopping for a house might be not a priority except you wish to transfer. Nonetheless, in case you’re making use of for a brand new mortgage and wish to roll your debt into that mortgage, then the money owed you’re rolling into your mortgage might have an effect on how a lot residence you should buy.

It’s a great debt administration technique to spend even much less on your property than the mortgage worth you qualify for. It’s because taking a smaller mortgage than what you’re authorised for can assist you repay your mortgage even sooner and enable you put apart extra money for the longer term because you’re not paying as a lot curiosity on the mortgage.

Methods for Balancing Debt Consolidation and House Buy Objectives

So, how will you steadiness the necessity to handle your debt together with your purpose of buying a brand new residence (or paying off your mortgage)? Some methods for minimizing the affect of debt consolidation in your purpose of shopping for a house embrace:

Leveraging a Debt Consolidation Mortgage

Take into account making use of for a debt consolidation mortgage as a primary choice for clearing your excellent debt. Whereas the arduous inquiry has a small affect in your credit score rating, the regular compensation of your mortgage can assist you construct a optimistic historical past and enhance your credit score rating.

Don’t Purchase Extra House Than You Can Afford

How a lot are you able to afford to spend in your mortgage each month? Earlier than getting down to get a mortgage for a brand new residence, take a while to create a monthly budget so you possibly can observe your earnings and bills.

How a lot are you spending on requirements like meals or lease? How a lot cash do you at the moment spend on lease? Are you able to put aside sufficient cash to cowl your month-to-month minimums on debt funds? What bills might you in the reduction of on, if crucial?

Utilizing a budget planner and expense tracker tool can assist you clearly set up how a lot you possibly can afford in your month-to-month fee.

Take into account Paying Off Excessive-Curiosity Money owed Earlier than Shopping for a House

Should you can not safe a debt consolidation mortgage or roll your money owed into your new mortgage, take into account focusing in your money owed with the very best rates of interest earlier than making use of for a mortgage.

By making bigger, common funds in opposition to your highest curiosity money owed whereas sustaining the minimal funds on different money owed, you do two issues that can assist you enhance your credit score rating:

- You create a optimistic historical past of creating on-time funds; and

- You enhance your credit score utilization ratio.

These are each main elements that have an effect on your credit score rating.

Make an inventory of your money owed, the full quantity you owe, and the rates of interest for every type of debt you maintain so you possibly can identify the most important debts to repay first.

Set Apart Additional Cash for Your Down Fee

Should you’ve cleared your high-interest money owed (like bank cards) and nonetheless can’t discover a residence that’s reasonably priced for you, take into account setting apart extra money in your down fee. Saving up cash to make a bigger down fee means you have to a smaller mortgage mortgage when making a purchase order—making it simpler to purchase your dream residence.

Moreover, it will possibly serve as an emergency fund when you watch for the prime rate (the rate of interest that banks cost their greatest clients) to enhance. This can assist you cowl emergency bills with out going into extra debt.

What’s the Greatest Possibility for You? Attain Out to a Licensed Credit score Counsellor for Recommendation!

The affect of debt consolidation in your skill to purchase a house can range relying on the consolidation methodology that works greatest for you. When you’ve got good credit score, you must attempt to get a debt consolidation mortgage or roll your money owed into your mortgage, as these strategies have a small affect in your credit score rating.

Within the case of a debt consolidation mortgage, securing the mortgage after which constantly making funds on it will possibly enable you enhance your credit score rating to get a greater mortgage.

A debt consolidation program is an efficient various for many who don’t have nice credit score and wish a possibility to clear their unsecured money owed to allow them to begin constructing a optimistic credit score historical past. Should you be part of a DCP, take into account ready for not less than two years after this system ends earlier than making use of for a mortgage.

[ad_2]

Source link