[ad_1]

It doesn’t matter what you wish to do along with your cash, it begins with a funds. As a result of a budget is a plan to your cash—you inform it the place to go, so that you cease questioning the place the heck it went.

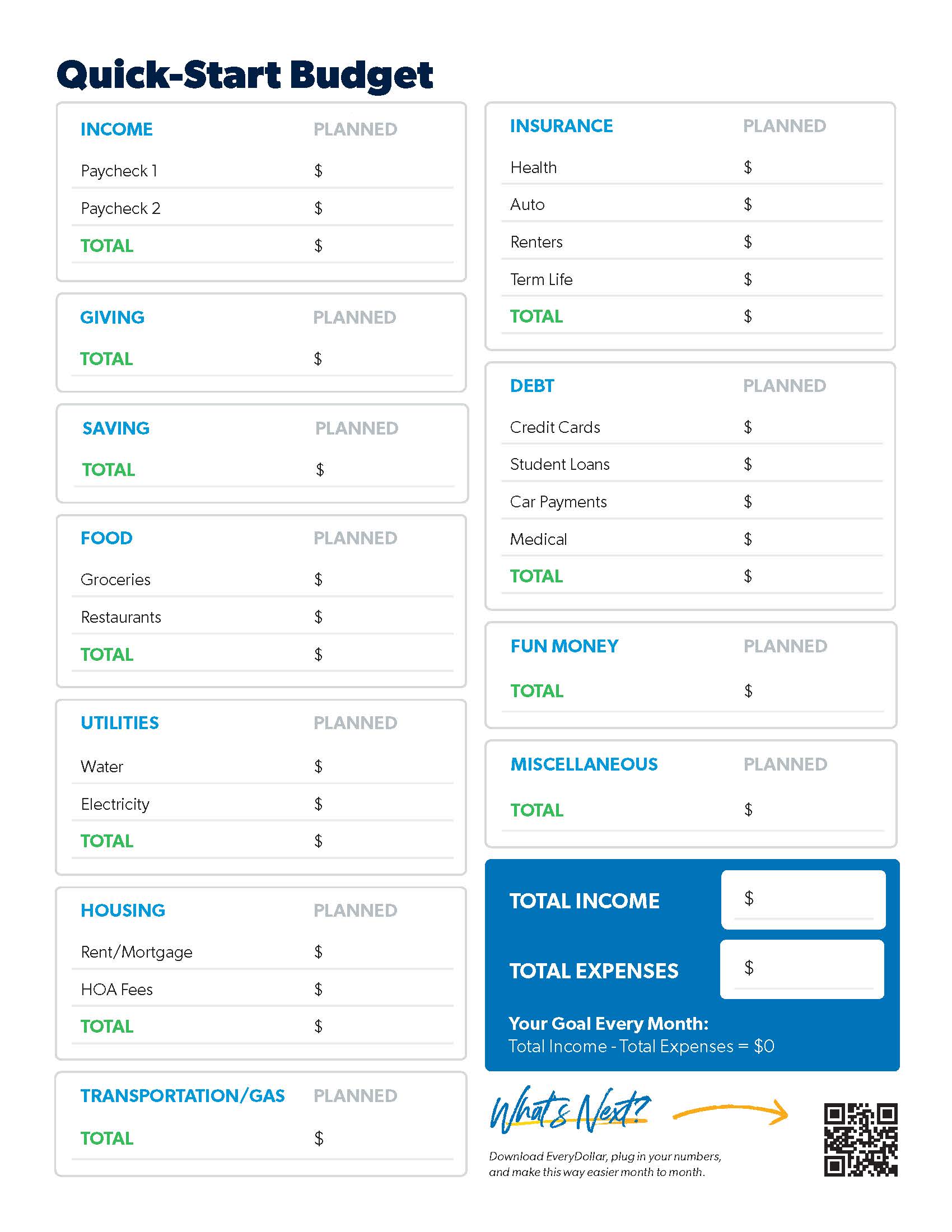

However when you’ve by no means budgeted earlier than, or it’s been some time, leaping in might be difficult. You realize what will help? A funds template!

There’s nothing like having clear instructions to comply with and step-by-step blanks to fill in to provide the confidence you might want to get occurring this budgeting journey. You prepared? (Sure, you might be.)

Steps for Utilizing Your Funds Template

A funds template (or funds worksheet) is an effective way to get all the things on paper, proper there in entrance of your eyes. We’ve received three steps to set up that budget and two extra to maintain it going—each month.

Earlier than you dive in, print out your Quick-Start Budget template and open up your on-line checking account!

Additionally, heads up: We’re about to say the Baby Steps a few instances. That is the confirmed plan to get forward along with your cash—from saving extra to paying off debt to constructing actual wealth.

1. Checklist your revenue.

Do you see the Deliberate column on the prime of your Fast-Begin Funds template? That’s the place you checklist out all the cash that’s coming on this month. Listed here are some fast callouts in the case of this primary step:

- Be sure to write in common paychecks and something further, like that side hustle money. (Go you!)

- In case you’re married, checklist out all of the revenue for each of you. (It’s fairly romantic, actually.)

- In case you’ve received an irregular income, check out what you’ve made the previous couple of months and checklist the lowest quantity as this month’s deliberate revenue funds line. You may modify later within the month when you make extra. (We’ve received a particular irregular income budget template when you want it.)

Now, add all of it up and write in your complete. Now you know the way a lot cash you need to work with this month.

2. Checklist your bills.

Now that you simply’ve deliberate for what’s coming in, you might want to plan for what’s going out: your giving, saving (relying on what Child Step you’re on), and spending.

Relating to all of the month-to-month spending you might want to plan for, you’ll see the funds worksheet goes on this order:

- Four Walls—meals, utilities, housing and transportation

- Different necessities—like insurance coverage and debt

- Extras—like enjoyable cash and that useful miscellaneous line

(You’ve in all probability observed your on-line checking account is coming in actual helpful proper now.)

As you’re employed by your month-to-month funds template:

- Skip any traces you don’t want.

- Write in something you don’t see a spot for.

- Add the deliberate quantities inside every field.

All proper. What’s subsequent?

3. Subtract bills out of your revenue.

Once you do the maths in your funds planner sheet, your revenue minus your bills ought to equal zero. We name this the zero-based budget.

No, this doesn’t imply you let your checking account attain zero. Depart a bit buffer in there of about $100–300.

What it does imply is that you simply’re giving all of your cash a job—paying the payments and shifting you ahead in your money goals. Since you work arduous to your cash, folks. And it ought to work arduous for you. Each. Single. Greenback.

What when you don’t hit zero?

- Acquired cash left over? Um, rejoice. That is nice! Then put these {dollars} towards your present Child Step.

- Acquired a unfavorable quantity? Pause. Don’t freak out. It’ll be okay. You simply want to cut spending (or increase your income!) till you get to zero.

So, guess what. That’s it for creating the funds. These subsequent two ideas will assist you to stick to it and make it really give you the results you want.

4. Observe your transactions (all month lengthy).

How do you keep on prime of your spending? Track. Your. Transactions. Which means you’re monitoring all the things that occurs to your cash all month lengthy! That is the way you keep watch over your progress and preserve from overspending.

5. Make a brand new funds (earlier than the month begins).

Your funds gained’t change an excessive amount of from month to month—however no two months are precisely the identical. So, create a brand new funds each single month. Don’t overlook month-specific expenses (like holidays or seasonal purchases). And do that earlier than the month begins so you may get forward of what’s coming your means.

To the Funds Template . . . and Past!

Okay, you in all probability observed these final two steps aren’t in your month-to-month funds template. As a result of the template is a superb begin. It truly is! It helps you stage up from funds dreamer to funds planner.

Start budgeting with EveryDollar today!

However when you get these first three steps on paper, it’s truthfully means simpler to maintain up with all of it whenever you’ve received an easy-to-use budgeting app like our private BBFF (budgeting greatest pal perpetually), EveryDollar. Obtain the app (totally free!), plug in all these numbers you organized in your funds template, and take your funds with you. In all places. It’s so significantly better than penciling in each transaction and doing the maths your self or rewriting a funds each month. Belief us.

Listed here are three extra useful assets earlier than you go:

Hey, we’re happy with you for budgeting. It’s severely step one to go from the place you might be along with your cash to the place you wish to be. And also you’re going nice locations, one EveryDollar budget at a time!

[ad_2]

Source link