[ad_1]

Large bills that come round just some occasions a 12 months have a humorous manner of slipping underneath the radar and changing into a giant cash drawback. There’s nothing worse than an unplanned expense placing a dent in your completely prepped price range. (Okay, there are worse issues, however what we imply.)

Right here’s the deal: In the event you aren’t wanting forward, it’s simple to overlook what’s coming. However the excellent news is that budgeting for these month-specific or irregular large bills isn’t laborious. In any respect. Simply use these 5 ideas and also you’ll be prepared once they occur.

1. Revisit your previous.

Earlier than you make a budget, it’s a good suggestion to see what you spent cash on final 12 months. Don’t fear! You received’t want a time machine to sort out this job. Testing your financial institution statements (or clicking again to earlier months in your free EveryDollar budgeting app) will do exactly positive.

Search for any bills that fall outdoors of your month-to-month routine, then write down the quantity and date due. Your listing would possibly look one thing like this:

|

Irregular Expense |

Quantity |

Date(s) Due |

|

Automotive insurance coverage premium |

$850 |

January 1 |

|

Tag renewal charges (2 autos) |

$35 |

March 31, September 30 |

|

HOA dues |

$200 |

January 15, April 15, July 15, October 15 |

|

Household dental cleanings |

$120 |

June 10, December 10 |

|

Annual vet checkup |

$150 |

April 18 |

|

Quarterly pest management |

$75 |

February 5, Could 5, August 5, November 5 |

2. Flash ahead to the longer term.

Now that you just’ve made a listing of all of your irregular bills, it’s time to get them into your price range. That manner they don’t present up uninvited down the highway.

You’ve acquired two methods to deal with this:

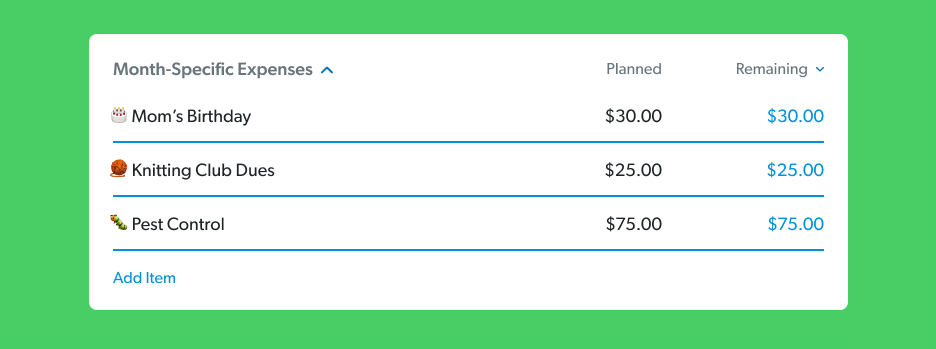

Create a month-specific price range class.

Each month, put all of your particular bills in a month-specific price range class. Give a line to birthdays, insurance coverage, dues, quarterly home expenses and different payments—no matter you have to cowl that month. (That is very easy with EveryDollar. You’ll be able to copy the earlier month over, then make the tweaks you want.)

The subsequent month, you retain the month-specific price range class, however change out the quantity so it matches what’s coming that month.

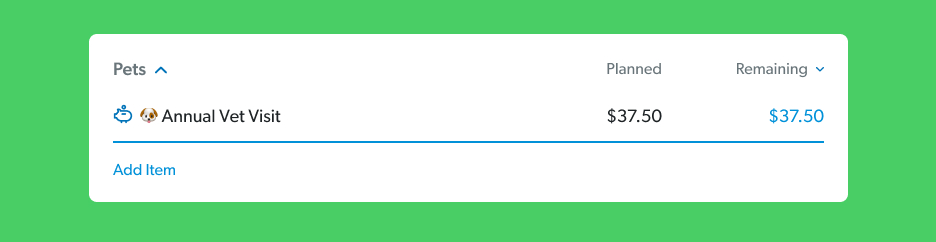

Create sinking funds for large bills.

Another choice is to create a sinking fund for every irregular expense. A sinking fund is a straightforward option to break down the price of large bills into smaller month-sized bites.

For instance, let’s say Scruffy must see the vet each April, and that go to prices $150. Beginning in January, you’ve 4 months to avoid wasting up for the expense. Put away $37.50 a month so that you’ve acquired the money to cover your pup’s bill.

Additionally, you are able to do a mixture of each of those strategies when you like. Possibly you create sinking funds for the actually large irregular bills, and you utilize a month-specific price range class for the cheaper bills. (Strive saying that 5 occasions quick.)

3. Create a miscellaneous line.

Regardless of how laborious you prep that price range, surprises occur. Otherwise you would possibly overlook an expense. That’s okay. It occurs to us all! However how will you cowl it with out dipping into your emergency fund? Simply add a miscellaneous line to your month-to-month price range. It’s that simple!

It doesn’t matter how a lot you put aside. Even $50 a month can do the trick. If an missed expense pops up, that’s $50 you don’t need to subtract from different price range classes. If you find yourself not utilizing it, throw it at your present Baby Step, and also you’ll be $50 nearer to your money goal!

Every savings goal starts with a budget. Create yours today with EveryDollar.

If the shock is kind of the massive expense and prices greater than your miscellaneous line, attempt transferring issues round in different price range classes to make up for it. In the event you can’t, this may very well be an excellent time to use your emergency fund.

4. Give your self grace.

So, does all this new data imply you’ll by no means overlook one other expense once more? Most likely not. We’re all human, and errors include the territory.

Additionally, please understand it normally takes new budgeters about three months to get the hold of this. That’s okay. Give your self grace by means of the method, and don’t surrender. Budgeting is completely value it! It places you within the driver’s seat together with your cash—so that you’re telling each single greenback the place to go, as an alternative of questioning the place it went.

You are able to do this!

5. Make a brand new price range every month.

Keep in mind, budgeting isn’t a one-and-done exercise. You’ve acquired to make a new budget every month. And the very best time to do this? Earlier than the subsequent month even begins.

Why?

Properly, as you may see, it’s tremendous necessary to get forward of issues if you’re budgeting. Once you get your price range prepared early, you’ll do a manner higher job of constructing positive every part’s coated (together with these irregular large bills).

And when every part’s coated, you may transfer ahead as an alternative of feeling continuously caught or shocked by what’s occurring to your cash.

So, make a price range, each month, earlier than the month begins. That’s step one to fixing your cash issues—large and small—and beginning a tremendous cash future! (It’s you. You’re the answer. It’s you!)

Talking of Approach Higher . . .

Budgeting will get that manner if you use our free budgeting app, EveryDollar. Simply saying.

[ad_2]

Source link