[ad_1]

Need to know what’s going to derail your price range faster than virtually something? Sudden bills. Need to know the way to hold that from occurring? Plan forward!

Possibly you’re considering, Okay however how? How can I get forward of one thing I didn’t see coming? Hold studying to see how one can keep in management and on prime of your cash—even relating to surprising bills.

Sudden Bills or Neglected Bills?

First let’s be tremendous clear about what we’re actually coping with right here. As a result of generally “surprising” bills are literally simply “neglected” ones.

Right here’s what we imply by that: When you’ve bought a quarterly pest management invoice, properly, you already know that’s coming 4 instances a 12 months. When the invoice pops up and also you didn’t budget for it that month, that’s not surprising. That’s neglected.

Now, don’t beat your self up over it. Making errors together with your price range is likely one of the methods you study to be a greater budgeter.

Additionally, we’ve bought excellent news. Whether or not the expense is surprising or neglected—you possibly can nonetheless be ready. Yup! And the following tips will present you ways.

1. Have month-to-month price range conferences.

Get your self an accountability accomplice (that’s your partner in case you’re married), and begin having month-to-month price range conferences. This’ll assist in two methods.

First, budgeting could be onerous. Nevertheless it’s simpler once you notice you don’t need to go it alone. An accountability partner doesn’t simply name you out once you’re about to go astray—they stroll with you alongside the best way!

Second, that additional pair of eyes is so useful, particularly once you’re attempting to kind by means of bills that hold falling by means of the cracks—which is a part of what you’ll do in your month-to-month price range conferences.

2. Listing your doable neglected bills.

Open your on-line checking account or EveryDollar budget and search for previous bills that stunned you. Listing them out and jot down the expense, month due and price.

When you’re feeling caught, take a look at the examples beneath that always slip previous us, sorted by price range class.

Groceries: Holidays, celebrations and events can imply greater meals prices.

House: Take into consideration upkeep and maintenance, quarterly payments, months with greater electric bills (cooling in summer time and heating in winter), property taxes, pest management, furnishings substitute, transferring prices and equipment restore.

Vehicles: Be prepared for routine car maintenance and repairs, tires, oil modifications, automobile tags and perhaps toll charges.

Youngsters: They’re all the time rising and needing new garments—plus take into consideration subject journeys, faculty provides and extracurricular actions.

Well being: This would possibly imply copayments for physician’s visits, medication and prescriptions, new glasses or contacts, braces, the start of a brand new child, or maternity go away. When you’ve bought an HSA, don’t overlook to make use of it for any of those prices you possibly can!

Seasonal: Price range in the best month for issues like landscaping, spring break, summer time holidays, vacation journey, Halloween costumes and sweet, and all the things Christmas.

Memberships and subscriptions: When do your annual memberships and subscriptions renew? Do you’ve any membership dues? Price range. For. Them.

Items: Presents ought to be about pleasure—in giving and getting. However let’s be sincere: It’s worrying in case you overlook to price range forward for gifts for weddings, birthdays, holidays, child showers and all the opposite causes you would possibly want a gift.

Okay, right here’s one other necessary callout too: It’s best to by no means ever ever really feel strain to over-give. Ever. This could all the time be about what you possibly can afford and in regards to the particular person receiving your present! You don’t have to spend so much to point out you care quite a bit.

Are you prepared for life’s emergencies? Learn how to get there with Financial Peace University.

Random: Will you could exchange any telephones or computer systems? Does your pup have an annual vet visit? Is your child about to hitch band within the fall and wish a barely used alto saxophone? Must you refill on ear plugs? (They’ll sound much less like a stressed-out goose in a number of months. Don’t fear.)

Actually assume forward and attempt to make your checklist as prepared for every month as it may be!

3. Construct neglected bills into your price range.

When you’ve bought your checklist, it’s time to show the “neglected” bills into price range traces! You’ve bought 3 ways to deal with this—and actually, you must use an influence combo of all three.

Arrange a miscellaneous line in your price range.

When you can price range $50 or extra right into a miscellaneous line, it’ll prevent so many complications. As a result of irrespective of how a lot we plan forward, issues nonetheless get forgotten, or surprises nonetheless pop up—like in case your child makes a brand new greatest good friend and will get invited to their rainbow narwhal-themed party final minute. Simply transfer cash from that miscellaneous line to purchase a present, and also you’re coated. No sweat.

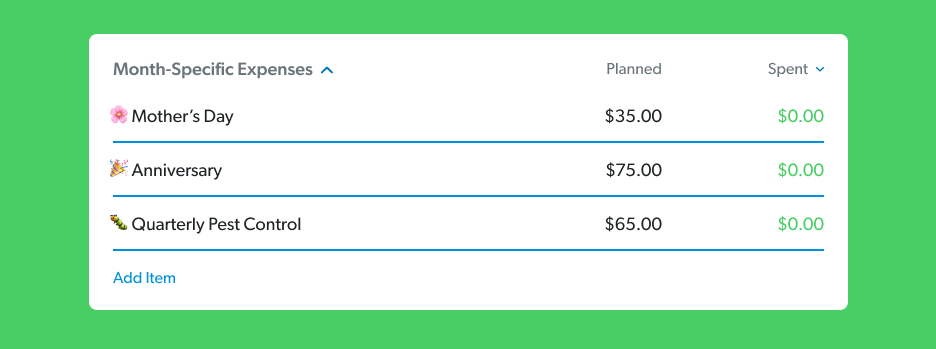

Create a month-specific price range class.

Hold this class in your budget every month. You’ll be able to simply change out the traces that go underneath it as you could.

By the best way, the price range class is type of like a file folder, and the traces are just like the recordsdata that go in it. Or the classes are like your child’s dresser drawers, and the traces are the neatly folded garments inside each. Okay, that final one is wishful considering for many dad and mom, however you get the thought.

This technique is superb for overlaying the smaller (and even medium-sized) bills you listed out earlier. Plan for each month to have couple hundred {dollars} on this class. Adjust your budget traces throughout your month-to-month price range assembly. And in case you don’t find yourself needing that cash one month, throw it at your present Baby Step!

Arrange a sinking fund.

If the expense is an excessive amount of to cowl in a single month, your greatest guess is to arrange a sinking fund. What’s that? Nicely, a sinking fund is a solution to save up an enormous sum of money over time by breaking it into smaller month-to-month bites.

Like Christmas. When you spend round $1,200, meaning you possibly can stick $100 right into a sinking fund each month, beginning in January. You then’ll be cash-ready for the most wonderful time of year!

Or your summer time getaway. When you plan to spend $1,000 in June and begin saving for your vacation in February, you’ll sock $200 away a month till you’ve bought your ft within the sand and a great ebook in hand.

You’ll be able to even use a sinking fund for these much less glamorous neglected bills, like automobile upkeep. If these tires are beginning to put on skinny, get saving for brand spanking new ones! As a result of a tire blowout is an surprising expense, however changing previous tires is one thing you possibly can plan forward for.

Fast callout: Put your sinking fund cash in a protected spot with quick access. A checking account or a financial savings account with check-writing privileges will do the trick.

And in case you use EveryDollar, you possibly can simply create sinking funds for all of your financial savings objectives. It’s a good way to maintain all the things sorted and watch your progress. Each single month!

4. Construct an emergency fund for surprising bills.

Our research reveals solely about half of Individuals (49%) have $1,000 or extra in financial savings. And one-third of Individuals (34%) haven’t any financial savings in any respect. This isn’t okay, folks! Financial stress is a legit downside, and worrying if the subsequent surprising expense will push you over the sting isn’t any solution to dwell.

However there’s hope. You could be budget-ready, even for these actually surprising bills, like an accident or a layoff.

How? With an emergency fund!

An emergency fund is cash put aside for—you guessed it—emergencies. Begin with a starter emergency fund of $1,000. From there, when you’re debt-free, transfer on to a fully funded emergency fund of three–6 months of your present bills.

There’s nothing like the peace of thoughts you’ll acquire from having this cash safely tucked away for once you want it. Belief. Us.

What to Do When an Sudden Expense Hits

To start with, don’t freak out! You’ve deliberate for this:

- You’re having these price range conferences to plan forward.

- Your miscellaneous line is in place for small surprises.

- You’ve bought your month-specific price range class armed and prepared.

- You might have sinking funds arrange for greater bills.

- Your emergency fund is prepped for true surprising bills.

Now, when that surprising expense pops up (as a result of that also occurs), ask your self if it’s time to:

- Use the miscellaneous line,

- Cut spending some other place to cowl the surprising expense, or

- Transfer cash from the emergency fund.

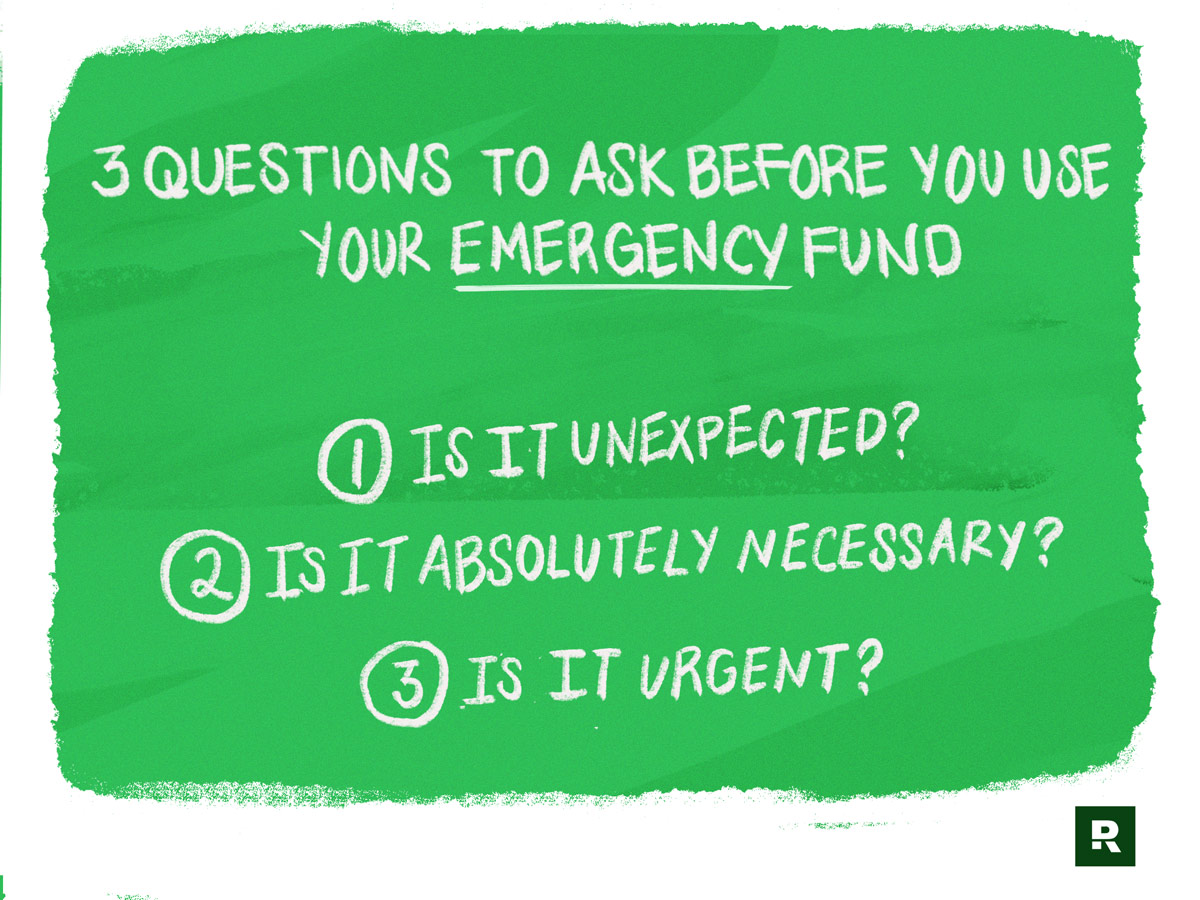

Earlier than you contact that emergency fund—attempt these first two choices. And ask your self these questions:

- Is it surprising? (Neglected doesn’t depend right here.)

- Is it completely mandatory?

- Is it pressing?

For instance: Needing to restore the furnace in the midst of winter is surprising, pressing and completely mandatory, however eager to redo an ugly-but-functional toilet is just not. Begin a sinking fund for the toilet and use your emergency fund for the furnace.

This All Helps You Put together for Sudden Bills

Actual fast, if don’t already use EveryDollar, you must test it out! This app will allow you to deal with your month-to-month price range and arrange these sinking funds for giant bills. You’ll be able to attempt it at no cost. Like . . . immediately.

That’s it! That’s the way you cease feeling like you’re running out of money due to fixed shock payments. That’s the way you keep ready.

From getting actual with your self about neglected bills to organising particular financial savings for surprising bills—now you understand how to plan for the unplanned!

Price range for All Bills

Create a plan for all of your cash. EveryDollar makes it easy.

[ad_2]

Source link