[ad_1]

In case you’re able to get your loved ones’s cash managed as soon as and for all, we’ve obtained excellent news—we all know precisely the place to begin.

Funds.

It’s a easy phrase, however it doesn’t all the time appear easy to place into observe—particularly if you’ve obtained youngsters. You’re busy, your cash’s tight, and cash talks are generally tremendous awkward.

However you possibly can create a household price range, irrespective of your time, revenue or emotional reservations. We’re right here to reply some questions and offer you our greatest ideas and tips to just do that.

What Is a Family Budget?

Why Should You Have a Family Budget?

How to Set Up Your Family Budget in 3 Steps

Tips for Creating a Family Budget That Works (for Everyone)

What Is a Household Funds?

Earlier than we present you how to budget, let’s outline the time period. A price range is only a plan in your cash—every part that is available in (revenue) and goes out (bills).

A household price range is if you make that plan in your complete family. And the most effective household budgets embrace everybody within the household (no less than to a point).

Why Ought to You Have a Household Funds?

Budgeting as a family has many perks. Listed here are three of our favorites: 1) You’ll cease questioning the place your cash went and begin telling it the place to go. 2) You can begin getting everybody on the identical web page about cash. 3) You’ll present that cash isn’t a taboo subject as you open up strains of communication.

Methods to Set Up Your Household Funds in 3 Steps

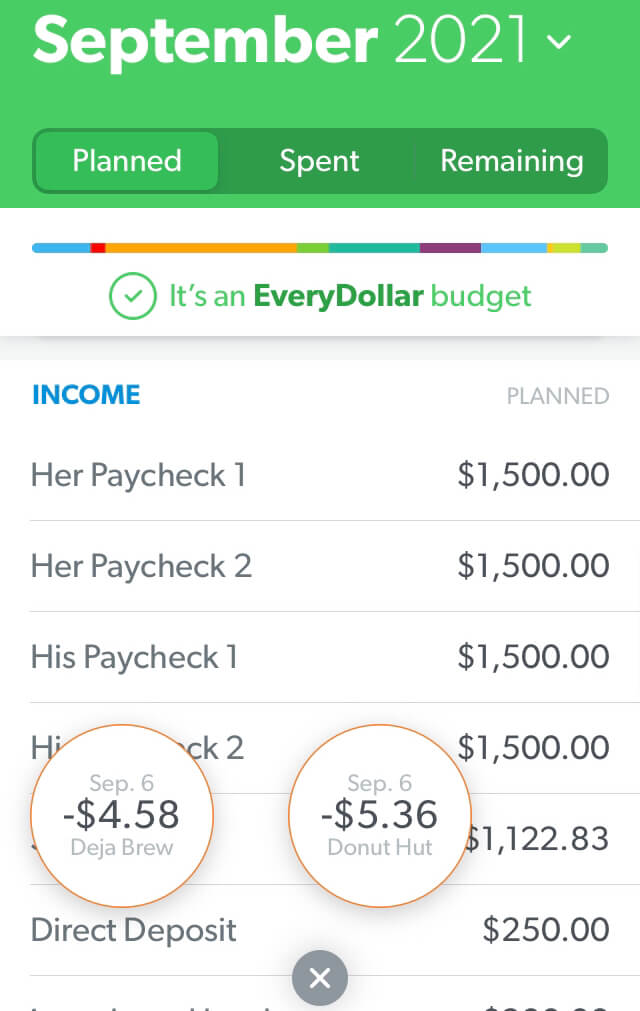

Funds Step 1: Checklist your revenue.

Step one right here is itemizing your revenue—aka any cash you intend to get throughout that month.

Write down every regular paycheck for you and your partner—and don’t neglect any extra cash coming your means via a side hustle, storage sale, freelance work, or something like that.

In case you’ve obtained an irregular income, put the lowest estimate of what you usually make on this spot. (You’ll be able to alter later within the month if you happen to make extra.)

Funds Step 2: Checklist your bills.

Now that you just’ve deliberate for the cash coming in, you possibly can plan for the cash going out. It’s time to record your expenses! (Professional tip: Open up your on-line checking account or take a look at your financial institution assertion that will help you estimate your bills.)

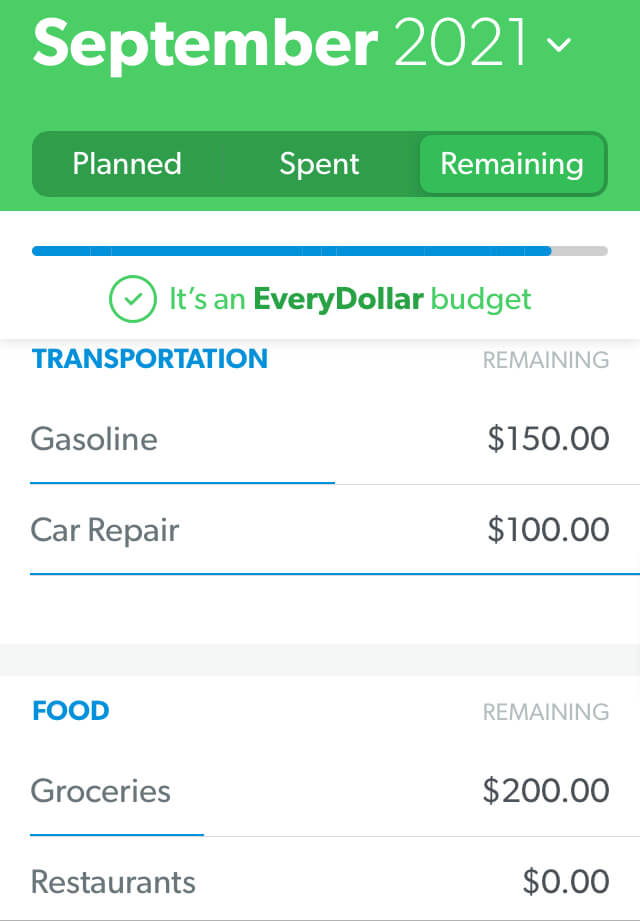

Begin by overlaying your Four Walls—aka meals, utilities, shelter and transportation.

A few of these are referred to as fixed expenses, that means they keep the identical each month (like your mortgage or lease). Others change up, like groceries.

And hey, that grocery price range line is fairly exhausting to guess at first. Simply make a very good estimate, and also you’ll be taught what you really need right here within the month forward.

Subsequent, record all different month-to-month bills. We’re speaking about insurance, debt, financial savings, leisure, dog costs, and any private spending. Begin with fastened bills. Then use your on-line checking account or these financial institution statements to estimate deliberate quantities for every part else primarily based in your spending up to now months.

Funds Step 3: Subtract your revenue out of your bills.

Whenever you subtract your revenue out of your bills, it ought to equal zero. That doesn’t imply your checking account is at zero: It means each little bit of your revenue has a job. (That is referred to as a zero-based budget.)

When you’ve got cash left over after you’ve subtracted all of your bills, make sure to put it within the price range too! In any other case, you’ll find yourself mindlessly spending it on coffees and people one-click offers of the day. Actually. Put something “additional” towards your present cash purpose, like saving or paying off debt.

Start budgeting with EveryDollar today!

What if you find yourself with a destructive quantity? You is likely to be considering, Yikes! Nevertheless it’s actually okay! You simply want to chop bills till your revenue minus your bills equals zero. Trace: Begin with these restaurant and leisure strains. (Sure, we went there.) As a result of hey—you possibly can’t spend greater than you make. You bought this!

Keep in mind, you’re employed exhausting in your cash. It ought to work exhausting for you. Each. Single. Greenback.

Suggestions for Making a Household Funds That Works (for Everybody)

1. Choose a budgeting technique.

It is advisable to decide a budgeting technique. Whether or not it’s a spreadsheet, pencil and paper, or an app . . . decide a technique to log your revenue, bills and spending. Each. Single. Month.

No matter technique you decide wants to fulfill just a few necessities. It ought to be:

- Simple for each spouses to entry

- Easy to create new month-to-month budgets

- Handy to trace spending all through the month

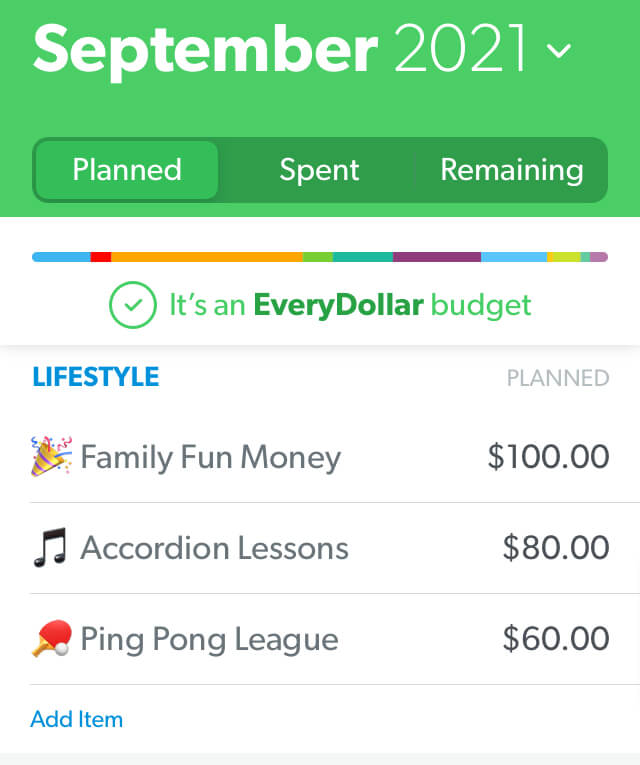

Might we propose our favourite budgeting software, EveryDollar? It meets all these necessities . . . after which some.

With EveryDollar, you possibly can price range in your desktop or within the app. Which means each spouses can log in to the identical price range on their separate telephones, checking in to see how a lot is left in a selected price range line or monitoring their spending on the go. This creates accountability—which is essential in a profitable household price range.

Oh, and making new month-to-month budgets takes only a couple minutes. An EveryDollar price range is a time and communication saver.

2. Speak about the place you’re proper now.

You’ll be able to determine simply how a lot you need to share together with your youngsters primarily based on their age and your consolation degree. Possibly you don’t need to spell out how a lot cash you make or the precise quantity of each invoice. However do have an trustworthy household dialog about how issues are with funds in your family. Proper now.

After that, you possibly can speak about the place you’re going and how one can get there—as a group. Maintain these strains of communication open and make speaking about cash really feel regular. It is likely to be a bit uncomfortable at first, however you’ll get the cling of it!

3. Focus on the distinction in desires and desires.

For any household price range to succeed, it’s essential to clarify to youngsters (and possibly remind your self?) the difference between wants and needs—and the way necessary it’s to fulfill wants first. This implies you’re budgeting for these 4 Partitions (which we talked about earlier) earlier than household memberships to the native wax museum.

4. Talk together with your youngsters to prioritize spending that connects to them.

You in all probability don’t find the money for within the price range in your youngsters to be concerned in every part they’re enthusiastic about. And that’s okay.

With regards to extracurriculars, golf equipment, sports activities, classes and the like—discuss to your youngsters about how these all value cash. One factor per child per season is a lot for their time and your price range. Work collectively to determine what that one factor ought to be.

And if you put all of it within the price range, make sure to embrace a household enjoyable price range line (if you happen to’ve obtained cash to cowl it).

5. Create cash targets collectively.

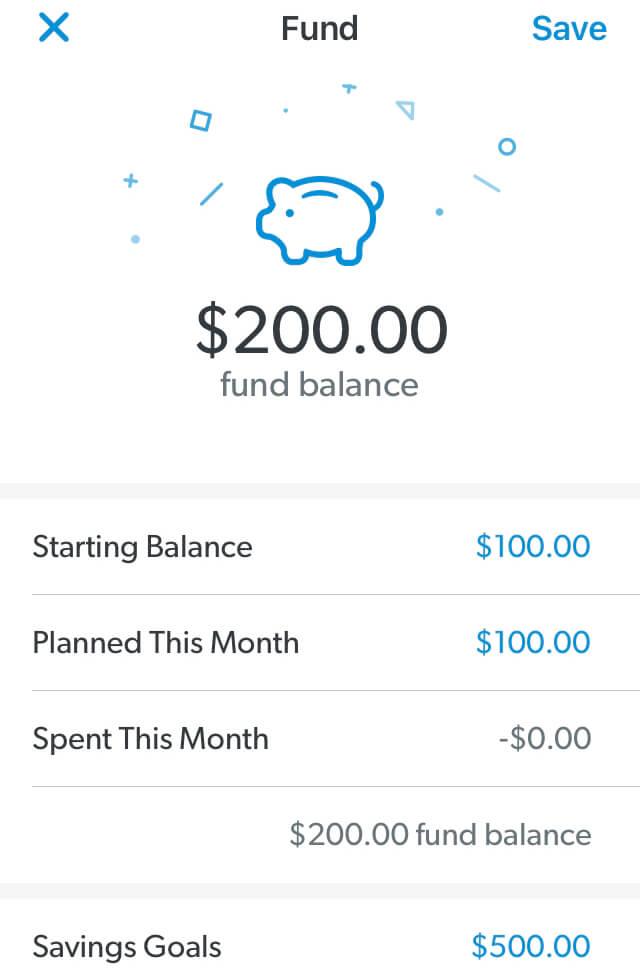

Begin making money goals collectively. These targets can connect with paying off debt or saving cash (as in saving up for emergencies, an enormous buy, or a enjoyable household expertise).

Discuss via how everybody might be concerned in making these targets come true. Methods to try this are coming in sizzling with this subsequent tip.

6. Monitor your purpose progress.

Let’s say you’re saving up for a household trip. Set a financial savings goal for this cash purpose—and observe your progress as a household.

In case you’re utilizing EveryDollar, you possibly can arrange a sinking fund in your purpose and watch it replenish alongside the best way.

Wish to get to the purpose sooner? Have a household planning assembly to brainstorm methods to make it occur. Determine to tighten or cut spending by going with out some extras for a pair months. Take on side jobs (some you possibly can even do from residence). Even the children can do a bake sale or mow some lawns to assist the household targets occur sooner.

Together with the children right here exhibits them how funds work—and the way what they do impacts the household in a number of methods. Life classes throughout.

7. Have month-to-month price range conferences.

Month-to-month price range conferences are top-of-the-line methods to maintain these open strains of communication about cash going all year long. Right here’s what it is best to take into consideration earlier than and through these conferences.

Every month comes with the standard stuff you spend money on—in addition to month-specific bills. Plan family budget meetings to speak about these altering bills for positive. Additionally, go over the place you struggled final month, have fun your budgeting victories, and test in in your targets.

Be sure that the conferences don’t run too lengthy. You don’t need budgets to seem boring—as a result of they aren’t! And it’s all the time in your finest curiosity to have snacks. All the time.

P.S. Obtain the EveryDollar Couples Budget Meeting Guide to assist!

8. Make paying off debt a precedence.

$15.85 trillion. That’s the whole family debt in America as of the beginning of 2022.1 No. Joke.

Debt is consistently knocking on our entrance doorways like a sneaky salesman with tempting “rewards” and the promise of immediate gratification. However actually, all debt does is maintain your revenue hostage to pay in your previous.

Nicely, it’s time to slam the door in debt’s mendacity face. No extra being part of that $15.85 trillion statistic.

One of the best ways to get out of debt is to get everybody in the home on board—make paying off debt a precedence. Discuss it up. Get hyped. Create a playlist and have a dance social gathering each time you make greater than a minimal fee. Study concerning the debt snowball method, and use it to take again your revenue. All. Of. It.

You’ve obtained to stay motivated through budgeting and paying off your debt. You’ve obtained to seek out methods to celebrate the victories (large and small). And also you’ve obtained to do it collectively—as a group!

9. Monitor your spending all through the month.

We talked about how tracking your spending all through the month creates communication and accountability together with your partner. However guess what. It additionally makes you accountable to your self.

Yup. Typically you’re the precise one that wants to take a look at that restaurant price range line and see it’s simply too low to hit up the Fry Guys meals truck for lunch together with your coworkers.

However monitoring spending shouldn’t get the status of being a killjoy. Sure, it’s being accountable. However people who find themselves accountable with their cash are individuals who take management of their cash—as a substitute of the opposite means round. People who find themselves accountable with their cash don’t marvel the place all of it went on the finish of the month. It’s completely value it!

In case you don’t need your cash proudly owning your loved ones and holding you again out of your targets, then watch your spending. Monitor your bills.

Additionally, look how simple it’s to trace transactions with the premium version of EveryDollar. You’ll be able to join your price range to your financial institution so transactions stream proper in. Grabbed a candy deal with at Donut Hut? Drag and drop the acquisition to the correct price range line. It’s the most effective life for busy budgeters.

10. Alter your price range when wanted.

Braces, bow ties and budgets. What do these three B-words have in widespread? All of them want adjusting.

Sure, you’re supposed to regulate your budget throughout the month. As you’re monitoring these transactions and a price range line is getting near maxing out, you could have two choices. One: Simply say no. Two: Transfer issues round.

The primary possibility is all the time your reply for the extras in life. When your private spending line is gone, it’s gone. When the restaurant price range line is spent, it’s spent.

However let’s say your electricity bill was larger than you deliberate. You’ll be able to’t name the electrical firm to elucidate your price range line and ask them to take again a number of the lights you left on final month. Nope. You pay the invoice. And you discover that cash by adjusting a unique price range line.

A price range isn’t a sluggish cooker. You’ll be able to’t set it and neglect it. You’ve obtained to get in there and make changes so your price range works for you and your loved ones.

11. Have the children work on fee.

Plenty of us obtained an allowance rising up. However having your youngsters work for a fee as a substitute of handing them cash for nothing teaches them how the world of labor runs. They do chores—they receives a commission. They save their cash—they pay for issues.

Begin youngsters out on commission-based incomes in order that they be taught the worth of cash, exhausting work, and the way these two issues are straight related.

12. Don’t be afraid to speak about cash.

If this all appears awkward at first, that’s regular. Seems solely 28% of oldsters are speaking to their youngsters about cash.2 That’s not ok!

Push previous the awkwardness that is likely to be holding you again. Budgeting collectively and instructing your youngsters how one can make and spend cash properly—these are two of the most effective monetary foundations you possibly can create in your youngsters to assist them win with cash later in life.

You already know what they are saying: The household that budgets collectively, grows collectively. (Okay, possibly we’re the one ones who say that. Nevertheless it’s true.)

Hey, we’ve mentioned it earlier than, and we’ll say it once more. We love budgets. We made EveryDollar as a result of we wish you to like budgets too—or no less than notice they aren’t exhausting or unhealthy or a ton of labor.

Get began with EveryDollar immediately, as a household. And produce snacks.

[ad_2]

Source link