[ad_1]

Ah, trip. The time to get away from all of it, sleep in a distinct mattress, eat meals another person makes, and see new websites.

It’s enjoyable. It’s stress-free. It’s budget-busting. Maintain up! Wait a minute on that final one, as a result of it doesn’t should be. You don’t should—and also you shouldn’t—overspend or go into debt to get pleasure from a getaway.

That’s proper—you possibly can money circulation your journey! It simply takes planning forward. We’re right here to assist by sharing easy methods to save for a trip in six simple steps.

1. Resolve when to journey.

We’re going to be actually frank right here. (Frank as in sincere. Not as in Sinatra.)

Should you’re at present crushing your debt with Baby Step 2, this isn’t the time to take a vacation. It’s essential to buckle down and drive debt out of your life. Get livid. Get intense. Get debt-free.

So, the primary “when” it is advisable contemplate is “whenever you’re out of debt.”

When you’re debt-free and making an attempt to determine when to journey, attempt a few of these hacks:

- Look into low season charges to the locations you wish to go.

- Fly on Tuesdays or Wednesdays for cheaper plane tickets.

- Arrange your journey so that you verify in to your lodge on a Sunday (the most affordable day) as an alternative of a Friday (the costliest). That’s proper—staying in the course of the week slightly than the weekend is normally cheaper.

And naturally, there is perhaps an occasion you’re headed to (or break day from college or work) that helps you slim down dates. Simply preserve all this good things in thoughts as you begin planning.

2. Decide a vacation spot.

Whether or not you prefer to spend your trip firmly planted in a lounge chair by the beach or exploring nationwide monuments, there is a vacation ready that’s good for you (and your funds!).

As you’re choosing a vacation spot, keep in mind this journey is for you (and your family and friends, maybe). The aim is to make reminiscences and benefit from the time away, not impress others or fill your social media feed with flashy photographs. Decide a spot you’ll love and may afford.

3. Decide the price of the journey.

As soon as you recognize the when and the the place, begin breaking down the how a lot.

Let’s say your dream vacation is a visit to Washington D.C. It is a tremendous good vacation spot as a result of the place is full of free points of interest. It’s just like the candy land of liberty needs us to know extra about our historical past. Win-win.

Listed here are some frequent trip prices:

- Transportation: airfare, automotive rental, practice tickets

- Lodging: lodge, Airbnb, hostel

- Meals: groceries, eating places, snacks

- Enjoyable: excursions, attraction tickets, souvenirs, suggestions

- Miscellaneous: sudden charges

For instance, let’s say you probably did your analysis and found out you’d want a flight for 2 ($800), practice passes ($60), Airbnb for 4 nights ($600), meals ($500), enjoyable ($100), and miscellaneous ($50). These numbers are simply examples from some gentle on-line looking we did. Don’t base your funds on them!

Complete bills appear to be they’ll be round $2,110 for a pair.

Do the identical form of math with your personal real-life journey to seek out out your grand complete. An excessive amount of too quickly? Should you push your journey to a later date, you’ll have extra time to get this big expense in your budget and save up on your trip.

Additionally contemplate buying round for extra offers or tweaking a few your plans. Purpose for a doable date and affordable prices.

4. Begin budgeting on your trip.

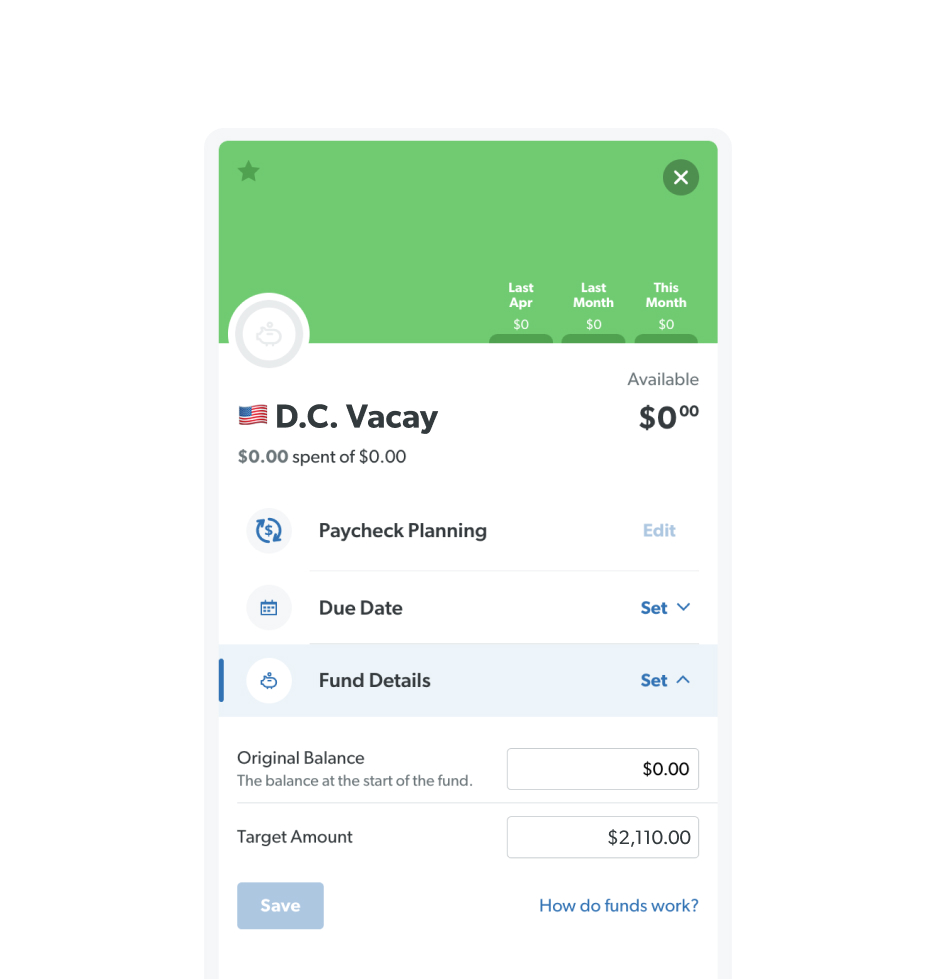

It’s time to get right down to enterprise. The enterprise of budgeting. That is the literal saving-for-your-vacation step. And it’s method simpler for those who arrange a fund in your EveryDollar budgeting app.

Right here’s how:

- First, discover your Financial savings funds class.

- Then click on Add Merchandise and label your fund—we known as ours D.C. Vacay. And we even added in a patriotic American flag emoji.

- Faucet to open your new funds line.

- You’ll see a piggy financial institution subsequent to the phrase Fund. Click on this and the subsequent button that claims Make This a Fund.

- Scroll down and put the whole you want for this large expense because the goal quantity.

5. Work to make your trip financial savings fund develop.

You’ve obtained a plan. Now let’s make it occur! Develop that fund larger and stronger than Bruce Banner when he will get indignant. However in contrast to the Hulk, you’re completely accountable for your inexperienced.

Every savings goal starts with a budget. Create yours today with EveryDollar.

What number of months do you have got till your journey? Divide the whole quantity you want by the months till you journey. That is how a lot you need to funds to save lots of every month (aka the quantity you set as your Deliberate quantity within the fund for every month).

And the place does that extra cash come from? Listed here are some concepts for bulking up your trip financial savings:

- Drop to at least one streaming service. Decide only one budget-friendly streaming service—this can show you how to save for the journey and liberate money in your funds each month.

- Go on a spending freeze. Strive a no-spend challenge. Pay for necessities solely for every week (or actually ramp it up with an entire month).

- Lower out additional bills. No extra live performance tickets, spur-of-the-moment day journeys, or fancy eating places. Bear in mind: That is momentary!

- Discover a side hustle. Make some additional money you possibly can throw instantly towards your trip financial savings.

- Work time beyond regulation hours. Put in additional hours at work. Your boss will love you, and your trip fund will too!

- Promote your additional stuff. Go online to promote all these garments you don’t put on anymore or clear out your complete home and host a garage sale.

- Save on groceries by meal planning. Resolve up entrance what you’ll eat for every meal all through the week, and watch your trip fund soar.

As you add cash to your trip fund all through the month, all you must do is sort it into the Deliberate part! Each time you add cash to the Deliberate part of your sinking fund, it instantly provides that quantity to your fund.

6. Monitor your spending on the precise journey.

Hear—budgets aren’t simply numbers you set down on paper and by no means take into consideration once more. If you’d like your cash plans to occur, you’ve obtained to work together along with your funds.

Meaning it is advisable monitor all of the spending that occurs on your trip—earlier than and in the course of the journey!

Earlier than you head out for all of the enjoyable, arrange funds strains for every of the principle classes of your journey.

You’ll see in our instance beneath that we made separate funds strains for flights to get there, trains passes for round city, lodging and meals. Plus there’s a small funds line for enjoyable (since these free museums and memorials may be the principle points of interest) and that miscellaneous line for any surprises.

![]()

Thank goodness EveryDollar has a cell model, so you possibly can sustain with all of it on the go. This implies you possibly can hop into that app to observe these steps for easy methods to save for a trip and log your spending all through the journey to be sure you don’t overspend.

Simply keep in mind: What you don’t do—in any respect, ever—is put any of this on a credit card. And don’t be tempted to take out a bank card for factors or miles. In the long run, it’s not price it. You don’t wish to nonetheless be paying off the journey months after it’s over.

Make it a debt-free vacation by saving money and paying money. Carry residence reminiscences, not debt!

Finances for Trip

Arrange your fund in EveryDollar at the moment so you possibly can quickly get pleasure from all the relief of your trip.

[ad_2]

Source link