[ad_1]

Because the monetary independence and early retirement motion (or FIRE motion, for brief) has gained recognition, some myths and misconceptions have sprung up about what it entails. Too many individuals make assumptions about what the FIRE motion is and what it is manufactured from.

Loads of people suppose the FIRE motion is cult-ish. Some suppose that monetary independence and early retirement are just for wealthy white folks. (Or, extra particularly, for white males within the tech business.) Others say that early retirement is barely doable with a excessive revenue. Or you possibly can solely do that should you’re so frugal it hurts. And, in fact, there are folks like Suze Orman who “hate hate hate” the FIRE movement as a result of they consider you want tens of millions in an effort to retire — early or in any other case.

I will be sincere. Every objection and grievance about monetary independence accommodates a grain of reality. However every objection and grievance misses the purpose in some vital methods.

Right now, let us take a look at a few of these myths and misconceptions about monetary independence and early retirement, and discover why these myths and misconceptions are myths and misconceptions.

What IS financial independence?

Earlier than we dive in, listed here are the fundamentals of FIRE for many who are unfamiliar.Monetary independence and early retirement are two phrases for a similar idea: You have saved sufficient cash that — in principle – you should not must work for revenue once more…until you need to. We discuss “monetary independence” as a result of too many individuals need to argue over the definition of retirement.

Roughly talking, you possibly can think about your self financially unbiased (and in a position to retire early) when your investments equal 25x your annual spending. There’s some nuance to this, however that is a tremendous rule of thumb. So, should you spend $50,000 per 12 months, you have achieved F.I. when you could have $1.25 million in your funding accounts. Should you spend $20,000 per 12 months, you want $500,000 invested. Should you spend $200,000 per 12 months, you want $5,000,000.

Monetary independence is achieved by creating a spot between your incomes and spending. This hole — your saving rate — is the key to reaching all monetary targets, particularly early retirement. The bigger your saving price, the earlier you may construct the lifetime of your desires.

That is it. That is all there’s to it. It is simply math — plus onerous work and persistence.

Whereas researching this text, I discovered a October 2018 survey of the FIRE movement produced by TD Ameritrade. The Harris Ballot talked to 1503 Individuals about their cash and about early retirement, then TD Ameritrade interpreted the outcomes. That is the one systematic survey about FIRE that I do know of, and I’ll consult with it all through this text.

Monetary Independence Is not Attainable with Children

The commonest false impression about FIRE is that it is not doable when you have kids. After I clarify the thought to folks I meet, that is typically the very first thing they are saying: “Properly, that works nice should you’re single, nevertheless it simply will not work when you have a household.”

Parenthood is an costly proposition. The USDA estimates that it costs roughly $250,000 to raise a child — and that does not embody faculty. Clearly, which means that when you have kids and need to retire early (or obtain different monetary targets), you’ll need to earn more money. However kids do not make monetary independence not possible.

The truth is, from my expertise, most people on the earth of FIRE have children. It is the norm moderately than the exception. (This 2019 article from Marketwatch profiles a number of households pursuing monetary independence, together with Angela from Tread Lightly, Retire Early.)

Children are solely a barrier to your monetary targets should you permit them to be. And the fact is that many individuals within the FIRE group take nice pleasure of their kids, particularly in educating them about how cash works. (Doug Nordman lately printed a e-book known as Raising Your Money-Savvy Family for Next Generation Financial Independence. That is a mouthful, however the gist is FIRE generally is a household pursuit.)

Monetary Independence Requires Excessive Frugality

In all probability the second-most widespread false impression is that monetary independence requires excessive frugality. “I do not need to reside like a miser,” folks inform me, and so they dismiss the FIRE motion with out absolutely understanding it.

Whereas thrift is definitely a advantage, it’s not a requirement for reaching monetary independence. You probably have a excessive revenue, it is completely doable to retire early even whereas having fun with an expensive life-style throughout your working years. (However an excellent wage is required for this to work.)

In case your revenue is common — or much less — then a point of frugality is required, little doubt. Once more, monetary independence is all about math. There are solely two variables right here: what you earn and what you spend. If you cannot alter one variable to spice up your saving price, then you need to alter the opposite. (Ideally, you’d alter each.)

For the sake of completeness, I ought to level out that there is really a third variable concerned. What you do together with your financial savings can be vital, so your return on investments is one other issue. However these are the three elementary variables of monetary independence: what you earn, what you spend, and the speed of return you earn on the distinction.

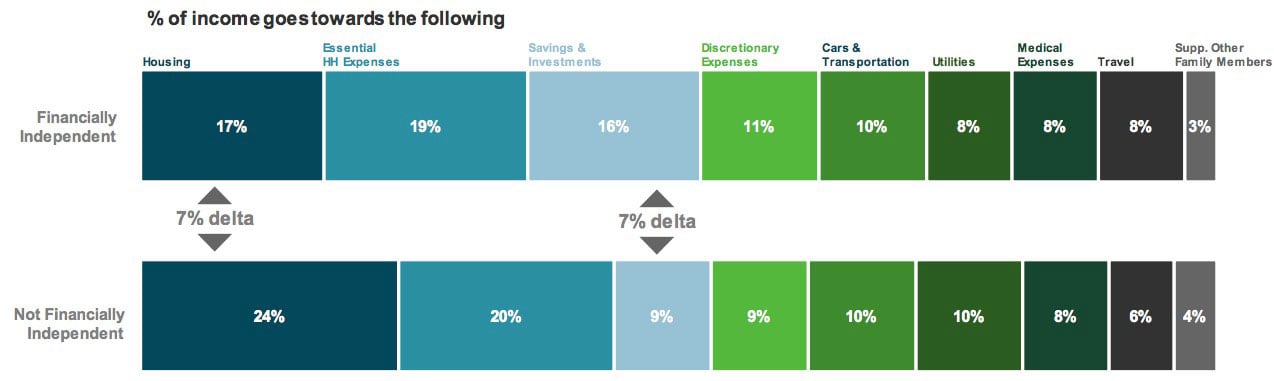

Imagine it or not, the afore-mentioned FIRE survey discovered simply one key distinction between these are and people who aren’t on the trail to monetary independence: F.I. people spend about 7% much less of their revenue on housing — and put about 7% extra of their revenue into saving and investments. (These numbers are extra placing should you body them otherwise. FIRE people allocate 30% much less of their price range to housing however put aside 78% extra of their price range for investing.)

So, what is the supply of the misperception that monetary independence requires hard-core thrift? I feel it most likely stems from the truth that two of the earliest proponents of the fashionable FIRE motion have been Jacob from Early Retirement Extreme and Pete from Mr. Money Mustache, each of whom advocate excessive frugality as a path to wealth. They don’t seem to be flawed. However they are not the one ones who’re proper.

Monetary Independence Requires a Excessive Earnings

The flip facet of the “excessive frugality” fable is the assumption that monetary independence requires a six-figure wage.

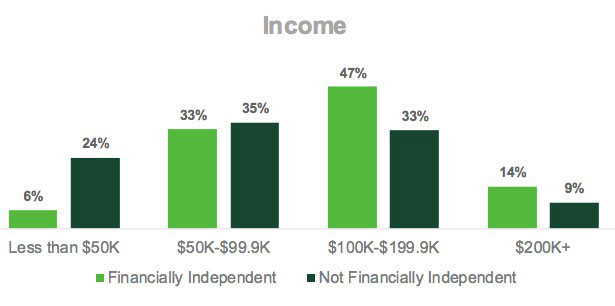

Now, this fable is grounded in actuality. Most people within the FIRE motion do have excessive incomes. They’re medical doctors or software program engineers or entrepreneurs. Or they work a number of jobs in order that they’ll earn extra. The TD Ameritrade survey makes this clear. Whereas it is doable to pursue F.I. with a low revenue, it is a lot simpler to take action with extra money.

There is a motive for this. You attain FIRE by rising the hole between your incomes and spending. Thus, a excessive revenue completely accelerates the method.

That stated, there are many individuals who attain monetary independence with out making tens of millions of {dollars}. That is solely doable, although, should you maintain your bills low. Keep in mind, that is all about math. You need to enhance the distinction between your revenue and bills. In case your revenue is low and you may’t (or will not) enhance it, then your solely possibility is to chop bills.

Additionally, I hope it is apparent to you that if each of those beliefs exist — FIRE is barely doable by way of excessive frugality and FIRE is barely doable with a excessive revenue — then neither is probably going correct. As a result of that is the reality.

In actuality, monetary independence is greatest achieved by discovering steadiness, by doing no matter doable to each enhance earnings whereas reducing bills. In the end, your purpose is to extend the hole between the 2, to extend your saving price. The way you select to do that relies upon by yourself strengths, targets, and circumstances

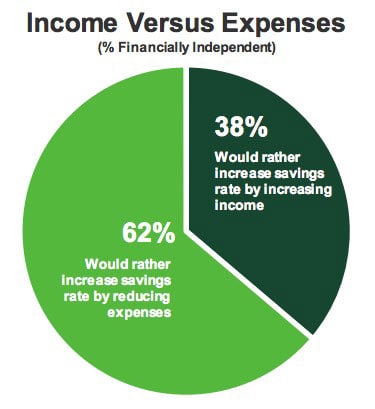

Let’s take a look at some precise information! In line with the TD Ameritrade survey about financial independence, FIRE people take each approaches: rising revenue and lowering bills. However one is a transparent favourite.

Of these surveyed, almost twice as many individuals choose to extend their saving price by reducing bills moderately than rising revenue. From my expertise, that is largely as a consequence of the truth that it is simpler to chop prices than to spice up incomes energy. Should you have been motivated, you would slash your non-housing bills drastically in solely a few weeks. But it surely takes time and planning to extend your revenue.

Monetary Independence Is a Get-Wealthy-Fast Cult

My mind has grown numb from the individuals who name the FIRE motion a cult. It is not a cult. There is not any chief. There is not any rulebook. There is not even collective settlement on lots of the core ideas. (Significantly, you need to see the arguments in the financial independence subreddit.)

The FIRE motion is a unfastened assortment of like-minded people who’re all pursuing related goals: They need to save sufficient that they’ll give up their day jobs and pursue extra significant lives.

Now, it is true that FIRE people can exhibit cult-like qualities.

- They’re enthusiastic concerning the topic, to allow them to be evangelical and need to share with the folks they meet.

- They use a whole lot of jargon, which is unlucky.

- They have a tendency to steer unconventional lives, eschewing a whole lot of what most individuals think about “regular”. (I downsized from a elaborate 1800-square-foot penthouse apartment, as an example, to a unusual 1100-square foot “nation cottage”.)

- They have a tendency to hang around with one another, each on-line and within the Actual World.

It is additionally true that the FIRE motion is certainly about getting wealthy rapidly. (Or quick-ish, anyhow.) However this is not a nasty factor.

Sometimes once we discuss get-rich-quick schemes, we imply shady enterprises which might be one way or the other meant to trick folks and/or construct wealth by reducing corners. These schemes are scams. They provide guarantees that can’t presumably be fulfilled.

Monetary independence is not a rip-off. It is math. There’s nothing shady about it. It is merely the method of placing present instruments to make use of in a highly-efficient method as a way to make the numbers work in your favor.

Most people save 5% to 10% of their revenue. Aggressive monetary advisors urge their shoppers to avoid wasting 20%. Folks within the FIRE motion have saving charges of fifty% — or greater. There’s nothing scammy about saving extra of your personal cash.

Monetary Independence Is Solely Attainable Via Privilege and Luck

In the course of the previous 12 months, a brand new fable has reared its ugly head. And it is a fable that will get me riled up.

Some have begun to argue that financial independence and early retirement are only options for folks blessed by privilege or luck. (Higher but, each.) The purpose of those items — whether or not specific or implied — is that preaching the ability of non-public accountability is misguided, that we should always as an alternative concentrate on the Large Image in an effort to enhance financial alternative for folks.

I agree that privilege and luck do make it simpler for some people to realize their monetary targets than others. I, as a white man, have loved advantages that different demographics haven’t. And systemic poverty is an actual downside. Essentially, there are obstacles that make it extraordinarily tough for sure folks to succeed. I feel it is nice that there are folks on the market who need to prioritize a battle for public coverage that results in elevated wealth for extra folks.

Having stated that, I additionally worth private accountability. I am not going to mince phrases right here: Those that deny the ability of self-determination are filled with bullshit. No, company is not going to be equally efficient for each particular person. Some who take motion will take pleasure in higher outcomes. Some persons are ranging from significantly better positions than others. And dangerous issues will occur. They occur to everybody.

However I consider — strongly — that particular person motion is all the time the best manner for any given particular person to raised her circumstances. The truth is, “action beats inaction” is among the elementary tenets of my financial philosophy.

It is so irritating to to listen to folks argue that non-public motion does not work. They’re flawed. And what they’re doing (with out realizing it, I feel) is giving folks permission to do nothing about their circumstances as an alternative of resolving to take accountability.

Here is the factor that basically bugs me although. It is a false dichotomy. It is not either-or. These goals aren’t mutually unique. You’ll be able to pursue each systemic change and private accountability on the identical time. That is how I’ve tried to reside my life, and that is what number of others within the FIRE motion reside theirs. I consider that those that argue solely for coverage change are simply as misguided as those that argue solely for private accountability.

Privilege and luck play a hand within the FIRE motion, sure. However from my expertise chatting with a whole bunch of early retirees over the previous decade, extra people discover monetary independence by way of deliberate efforts to avoid wasting extra and spend lower than by way of the whims of destiny.

Some will dismiss my response right here just because I am a white man. Thankfully, the message of self-determination is outstanding in all demographic teams. As a result of it is vital. As an illustration, try The Wealth Choice: Success Secrets of Black Millionaires from Dennis Kimbro or A Latina’s Guide to Money by Eva Macias. Identical message, totally different supply automobiles.

Monetary Independence Means By no means Working Once more

It is a persistent fable that when someone retires early, she’ll by no means work once more. Folks suppose that when you obtain monetary independence, you transition to an indolent lifetime of luxurious: seashores, martinis, pedicures, private assistants. This merely is not so.

In almost each case I do know, people who obtain FIRE preserve their present life-style. The truth is, that is normally the objective. Folks on the trail to monetary independence typically make a deliberate determination to avoid wasting sufficient to fund their present lifestyle. That is the specific purpose. Solely a handful of individuals need to reside massive after early retirement.

Plus, many of individuals do select to work in early retirement, simply as many select to work after conventional retirement. The so-called Web Retirement Police need to argue that “should you work, you are not retired”, however that is bullshit. This has by no means been the definition of retirement.

Work provides folks function. It affords which means. It lets them do good work that improves their group — and the world. And positive, work offers extra revenue. There’s nothing flawed with that. If something, incomes extra in retirement is a brilliant risk-mitigation measure. However principally, the roles we take after reaching monetary independence assist us to fend off ennui.

I all the time use myself for example when tackling this topic. I’ve sufficient saved that I haven’t got to work once more if I do not need to. And, in truth, I took a while off for a few years to do nothing. However you recognize what? A lifetime of leisure is not all it is cracked as much as be. It seems that writing about money makes me happy. It brings me achievement and offers me a motive to rise up each morning!

I am reminded of the tip of one in all my favourite TV reveals, The Good Place. (Spoiler alert!) Our most important characters attain the quasi-heaven of the afterlife, the place each want is fulfilled and life is ideal. However they’re stunned to search out that the prevailing inhabitants of The Good Place is something however pleased. The residents are numb. They’re bored. Why? As a result of having all of it doesn’t suggest something with out context.

Monetary Independence Is All About Greed

One other fable that bugs me is the assumption that the FIRE motion is all about greed, that we’re a bunch of Scrooge McDucks trying to hoard our wealth for egocentric functions.

Certain, there are people who find themselves on this just for themselves. They’re like Han Solo in Star Wars, who has no real interest in defeating the Galactic Empire. “Look, I ain’t on this on your revolution,” he says. “I am not in it for you, Princess. I anticipate to be properly paid. I am in it for the cash.”

If that is your purpose, tremendous. I am okay with that. Who am I to evaluate different folks’s motivations? However I feel it is a mistake to ascribe this motive to everybody within the FIRE motion. (And even to most individuals within the FIRE motion!) Those that study monetary independence and keep it up typically have greater goals.

Famously, Mr. Money Mustache, one in all FIRE’s most outstanding voices, makes no secret that his web site is barely secondarily about cash. His objective is to get folks to reside lighter on the world. He needs to assist the setting by lowering consumption. He needs folks to be wealthy, pleased, and to avoid wasting the world.

Or there’s Vicki Robin, one of many fashionable FIRE motion’s earliest voices. After I wrote to ask about her preliminary inspiration, Vicki responded:

“I needed the world to be a greater place. Extra lovely. Extra aligned with my highest sense of interrelatedness of life. I used to be additionally influenced by Thoreau and Emerson. I studied utopian communities as early as highschool…Cash itself was by no means of curiosity.”

Vicki’s imaginative and prescient is clearly evident in Your Money or Your Life, her 1992 e-book that impressed many people within the FIRE motion to pursue this path.

And what about about Tanja Hester from Our Next Life? Tanja is all about utilizing her place in early retirement as a power for good.

As you possibly can most likely inform, I’ve thought lots about this, and I’ve had many discussions concerning the matter. The truth is, I’ve begun creating a chat on this topic, which I offered for the primary time in October 2019. And it is a large motive that I lately ordered a replica of What We Owe to Each Other by T.M. Scanlon. (The opposite motive? “ELEANOR — FIND CHIDI”.)

For extra on this topic, try my article on what happens after you achieve financial independence.

Monetary Independence is a Fad

Lastly, there are lots of people who consider the FIRE motion is a fad, and that its recognition will fade with time.

Some would put me on this camp. I have been very vocal that I do consider FIRE’s present recognition is a product of the previous decade’s roaring financial system. Occasions are good, so private wealth has grown. Folks really feel wealthy. They’re excited about matters like early retirement. However once I began Get Wealthy Slowly, issues have been bleaker. Frugality and thrift and getting out of debt have been the favored matters.

The previous 11-12 years have produced a rare set of circumstances which have allowed many individuals to construct wealth rapidly — if they’d the power (and information) to spend money on both actual property or the inventory market. Consequently, there is a bunch of people that discover they’re in a position to retire early if they need, and that is led to larger curiosity within the FIRE beliefs.

In a single speak lately, I claimed that we have reached “peak FIRE”. And I stand by that. However whereas I feel we’re at (or close to) peak recognition for this topic, I do not suppose monetary independence is a fad. The truth is, I do know it is not.

Should you analysis the history of financial independence, you possibly can see that this concept has been round for a protracted, very long time. In 1758, Benjamin Franklin was espousing lots of the core ideas we all know and love immediately. But it surely wasn’t simply Franklin. All through the nineteenth century (and into the twentieth), many books promoted “pecuniary independence” as a path to monetary achievement.

What we have seen these days — over the previous eight years or so — is a speedy refinement of those ideas, a codification of the steps required to construct wealth quickly. It is kind of how the the varied components that make up the idea of evolution had been round for hundreds of years, nevertheless it wasn’t till Darwin printed On the Origin of Species that your entire course of was neatly packaged in a single place.

The Backside Line

Most of those myths about monetary independence and early retirement stem from the identical downside: assuming that the FIRE motion is homogenous, that there is some unifying motive or methodology. There’s not. Monetary independence is not merely one factor. Early retirement is totally different for everybody.

From my expertise, the solely factor that unites FIRE people is math. This pursuit is barely doable by creating a private revenue, a spot between what you earn and spend. That is it. That is the one commonality.

Earlier than I shut, I would like to deal with one closing fable. There are those that uncover the thought of monetary independence later in life. They do not determine they need to retire early till their forties — or fifties. Too many occasions, folks abandon the thought as a result of they suppose they only cannot make it occur.

However in accordance with the survey I have been citing this complete article, the common FIRE adherent begins his journey to monetary independence at age 37 and plans to retire in twenty years. Just one-third of FIRE people begin earlier than age 30. (In July, I met Becky Heptig who writes the weblog Started at 50, which is all about this topic.)

There is not any query that beginning early helps. It makes an enormous distinction. However you recognize what’s higher than beginning yesterday? Beginning immediately. Do not fret having waited so lengthy. Start where you are.

Should you’re intrigued by monetary independence and early retirement however do not know the place to start out, try The Money Boss Manifesto, my free information to reaching monetary freedom. There are not any gross sales pitches on this factor. It is not an try and upsell you. (I do not suppose I even ask you to join my mailing record!) The Cash Boss Manifesto is a legit free introduction to the framework of monetary independence and early retirement.

If this topic pursuits you and also you need to be taught extra, you need to learn it.

To wrap issues up, I would wish to level out that my buddy Diania Merriam lately hosted a webinar about FIRE misconceptions, assumptions, and criticisms. Diania is the founding father of the EconoMe conference, and I have been serving to her in a volunteer capability these days. She’s superior. I have not watched the video from the webinar, however I think it is stable. If this matter is up your alley, you need to completely watch the video beneath.

[ad_2]

Source link