[ad_1]

Desk of Contents

- Introduction

- How do we define SRI?

- The Challenges of SRI Portfolio Construction

- How is Betterment’s Broad Impact portfolio constructed?

- How is Betterment’s Climate Impact portfolio constructed?

- How is Betterment’s Social Impact portfolio constructed?

- Conclusion

Introduction

Betterment launched its first Socially Accountable Investing (SRI) portfolio in 2017, and has widened the funding choices beneath that umbrella since then. Inside Betterment’s SRI choices, we at present supply a Broad Influence portfolio and two further, extra targeted SRI portfolio choices: a Social Influence SRI portfolio (targeted on social governance mandates) and a Local weather Influence SRI portfolio (targeted on climate-conscious investments). These portfolios characterize a diversified, comparatively low-cost resolution constructed utilizing change traded funds (ETFs), which can be regularly improved upon as prices decline, extra information emerges, and in consequence, the provision of SRI funds broadens.

How can we outline SRI?

Our method to SRI has three basic dimensions that form our portfolio development mandates:

- Lowering publicity to investments concerned in unsustainable actions and environmental, social, or governmental controversies.

- Growing publicity to investments that work to handle options for core environmental and social challenges in measurable methods.

- Allocating to investments that use shareholder engagement instruments, equivalent to shareholder proposals and proxy voting, to incentivize socially accountable company habits.

SRI is the standard title for the broad idea of values-driven investing (many consultants now favor “sustainable investing” because the title for the whole class).

Our SRI method makes use of SRI mandates based mostly on a set of business standards often called “ESG,” which stands for Environmental, Social and Governance. ESG refers particularly to the quantifiable dimensions of an organization’s standing alongside every of its three elements. Betterment’s method expands upon the ESG-investing framework with publicity to investments that use complementary shareholder engagement instruments.

Betterment doesn’t instantly choose corporations to incorporate in, or exclude from, the SRI portfolios. Reasonably, Betterment identifies ETFs which were categorized as ESG or related by third-parties and considers internally developed “SRI mandates” alongside different qualitative and quantitative components to pick ETFs to incorporate in its SRI portfolios.

Utilizing SRI Mandates

One facet of bettering a portfolio’s ESG publicity is lowering publicity to corporations that interact in sure actions that could be thought of undesirable as a result of they don’t align with particular values. These actions might embody promoting tobacco, navy weapons, civilian firearms, in addition to involvement in current and ongoing ESG controversies. Nonetheless, SRI is about extra than simply adjusting your portfolio to reduce corporations with a poor social affect.

For every Betterment SRI portfolio, the portfolio development course of considers a number of internally developed “SRI mandates.” Betterment’s SRI mandates are sustainable investing aims that we embody in our portfolios’ exposures.

|

SRI Mandate |

Description |

Betterment SRI Portfolio Mapping |

|

ESG Mandate |

ETFs monitoring indices that are constructed with regards to some type of ESG optimization, which promotes publicity to Environmental, Social, and Governance pillars. |

Broad, Local weather, Social Influence Portfolios |

|

Fossil Gasoline Divestment Mandate |

ETFs monitoring indices that are constructed with the intention of excluding shares in corporations with main fossil fuels holdings (divestment). |

Local weather Influence Portfolio |

|

Carbon Footprint Mandate |

ETFs monitoring indices that are constructed with the intention of minimizing publicity to carbon emissions throughout the whole economic system (slightly than give attention to screening out publicity to shares primarily within the power sector). |

Local weather Influence Portfolio |

|

Inexperienced Financing Mandates |

ETFs monitoring indices targeted on financing environmentally useful actions instantly. |

Local weather Influence Portfolio |

|

Gender Fairness Mandate |

ETFs monitoring indices that are constructed with the intention of representing the efficiency of corporations that search to advance gender equality. |

Social Influence Portfolio |

|

Racial Fairness Mandate |

ETFs monitoring indices that are constructed with the intention of allocating capital to corporations that search to advance racial equality. |

Social Influence Portfolio |

Shareholder Engagement Mandate

Along with the mandates listed above, Betterment’s SRI portfolios are constructed utilizing a shareholder engagement mandate. One of the vital direct methods a shareholder can affect an organization’s resolution making is thru shareholder proposals and proxy voting. Publicly traded corporations have annual conferences the place they report on the enterprise’s actions to shareholders. As part of these conferences, shareholders can vote on a variety of subjects equivalent to share possession, the composition of the board of administrators, and government stage compensation. Shareholders obtain info on the subjects to be voted on previous to the assembly within the type of a proxy assertion, and may vote on these subjects via a proxy card. A shareholder can even make an express suggestion for the corporate to take a selected plan of action via a shareholder proposal.

ETF shareholders themselves don’t vote within the proxy voting strategy of underlying corporations, however slightly the ETF fund issuer participates within the proxy voting course of on behalf of their shareholders. As traders sign rising curiosity in ESG engagement, extra ETF fund issuers have emerged that play a extra lively function participating with underlying corporations via proxy voting to advocate for extra socially accountable company practices. These issuers use engagement-based methods, equivalent to shareholder proposals and director nominees, to interact with corporations to result in ESG change and permit traders within the ETF to precise a socially accountable choice. For that reason, Betterment features a Shareholder Engagement Mandate in its SRI portfolios.

|

Mandate |

Description |

Betterment SRI Portfolio Mapping |

|

Shareholder Engagement Mandate |

ETFs which intention to meet a number of of the above mandates, not by way of allocation choices, however slightly via the shareholder engagement course of, equivalent to proxy voting. |

Broad, Local weather, Social Influence Portfolios |

The Challenges of SRI Portfolio Building

For Betterment, three limitations have a big affect on our total method to constructing an SRI portfolio:

1. Many present SRI choices out there have critical shortcomings.

Many SRI choices at the moment sacrifice adequate diversification acceptable for traders who search market returns, and/or don’t present traders an avenue to make use of collective motion to result in ESG change.

Betterment’s SRI portfolios don’t sacrifice international diversification. In keeping with our core precept of worldwide diversification and to make sure each home and worldwide bond publicity, we’re nonetheless allocating to some funds with out an ESG mandate, till passable options can be found inside these asset lessons. Moreover, all three of Betterment’s SRI portfolios embody a partial allocation to an engagement-based socially accountable ETF utilizing shareholder advocacy as a way to result in ESG-change in company habits. Engagement-based socially accountable ETFs have expressive worth in that they permit traders to sign their curiosity in ESG points to corporations and the market extra broadly, even when explicit shareholder campaigns are unsuccessful.

2. Integrating values into an ETF portfolio might not all the time meet each investor’s expectations.

For traders who prioritize an absolute exclusion of particular kinds of corporations above all else, sure approaches to ESG will inevitably fall in need of expectations. For instance, lots of the largest ESG funds targeted on US Massive Cap shares embody some power corporations that interact in oil and pure gasoline exploration, like Hess. Whereas Hess may not meet the factors of the “E” pillar of ESG, it might nonetheless meet the factors when it comes to the “S” and the “G.”

Understanding that traders might choose to focus particularly on a sure pillar of ESG, Betterment has made three SRI portfolios out there. The Broad Influence portfolio seeks to stability every of the three dimensions of ESG with out diluting completely different dimensions of social duty. With our Social Influence portfolio, we sharpen the give attention to social fairness with partial allocations to gender and racial variety targeted funds. With our Local weather Influence portfolio, we sharpen the give attention to controlling carbon emissions and fostering inexperienced options.

3. Most out there SRI-oriented ETFs current liquidity limitations.

Whereas SRI-oriented ETFs have comparatively low expense ratios in comparison with SRI mutual funds, our evaluation revealed inadequate liquidity in lots of ETFs at present available on the market. With out adequate liquidity, each execution turns into dearer, making a drag on returns. Median every day greenback quantity is a technique of estimating liquidity. Increased quantity on a given asset means you can shortly purchase (or promote) extra of that asset out there with out driving the worth up (or down). The diploma to which you’ll be able to drive the worth up or down along with your shopping for or promoting should be handled as a value that may drag down in your returns.

We anticipate that elevated asset flows throughout the business into such SRI-oriented ETFs will proceed to drive down expense ratios and improve liquidity over the long-run. To that finish, Betterment reassesses the funds out there for inclusion in these portfolios usually. In balancing value and worth for the portfolios, the choices are restricted to funds of sure asset lessons equivalent to US shares, Developed Market shares, Rising Market shares, US Funding Grade Company Bonds, and US Excessive High quality bonds.

How is Betterment’s Broad Influence portfolio constructed?

Betterment’s Broad Influence portfolio invests belongings in socially accountable ETFs to acquire publicity to each the ESG and Shareholder Engagement mandates, as highlighted within the desk above. It focuses on ETFs that take into account all three ESG pillars, and consists of an allocation to an engagement-based SRI ETF. Broad ESG investing options are at present essentially the most liquid, highlighting their reputation amongst traders. To be able to keep geographic and asset class diversification and to satisfy our necessities for decrease value and better liquidity in all SRI portfolios, we proceed to allocate to some funds that don’t mirror SRI mandates, significantly in bond asset lessons.

How is Betterment’s Local weather Influence portfolio constructed?

Betterment gives a Local weather Influence portfolio for traders that need to put money into an SRI technique extra targeted on the environmental pillar of “ESG” slightly than specializing in all ESG dimensions equally. Betterment’s Local weather Influence portfolio invests belongings in socially accountable ETFs and is constructed utilizing the next mandates that search to attain divestment and engagement: ESG, carbon footprint discount, fossil gas divestment, shareholder engagement, and inexperienced financing. The Local weather Influence portfolio was designed to provide traders publicity to climate-conscious investments, with out sacrificing correct diversification and balanced value. Fund choice for this portfolio follows the identical tips established for the Broad Influence portfolio, as we search to include broad based mostly climate-focused ETFs with adequate liquidity relative to their measurement within the portfolio.

How can the Local weather Influence portfolio assist to positively have an effect on local weather change?

The Local weather Influence portfolio is allotted to iShares MSCI ACWI Low Carbon Goal ETF (CRBN), an ETF which seeks to trace the worldwide inventory market, however with a bias in direction of corporations with a decrease carbon footprint. By investing in CRBN, traders are actively supporting corporations with a decrease carbon footprint, as a result of CRBN overweights these shares relative to their high-carbon emitting friends. A method we will measure the carbon affect a fund has is by its weighted common carbon depth, which measures the weighted common of tons of CO2 emissions per million {dollars} in gross sales, based mostly on the fund’s underlying holdings. Based mostly on weighted common carbon depth information from MSCI, Betterment’s 100% inventory Local weather Influence portfolio has carbon emissions per unit gross sales which can be almost 50% decrease than Betterment’s 100% inventory Core portfolio as of February 8, 2024.

Moreover, a portion of the Local weather Influence portfolio is allotted to fossil gas reserve funds. Reasonably than rating and weighting funds based mostly on a sure local weather metric like CRBN, fossil gas reserve free funds as an alternative exclude corporations that personal fossil gas reserves, outlined as crude oil, pure gasoline, and thermal coal. By investing in fossil gas reserve free funds, traders are actively divesting from corporations with a few of the most damaging affect on local weather change, together with oil producers, refineries, and coal miners equivalent to Chevron, ExxonMobile, BP, and Peabody Vitality.

One other method that the Local weather Influence portfolio promotes a constructive environmental affect is by investing in bonds that fund inexperienced initiatives. The Local weather Influence portfolio invests in iShares World Inexperienced Bond ETF (BGRN), which tracks the worldwide market of investment-grade bonds linked to environmentally useful initiatives, as decided by MSCI. These bonds are referred to as “inexperienced bonds.” The inexperienced bonds held by BGRN fund initiatives in a variety of environmental classes defined by MSCI together with various power, power effectivity, air pollution prevention and management, sustainable water, inexperienced constructing, and local weather adaptation.

How is Betterment’s Social Influence portfolio constructed?

Betterment gives a Social Influence portfolio for traders that need to put money into a technique extra targeted on the social pillar of ESG investing (the S in ESG). Betterment’s Social Influence portfolio invests belongings in socially accountable ETFs and is constructed utilizing the next mandates: ESG, gender fairness, racial fairness, and shareholder engagement. The Social Influence portfolio was designed to provide traders publicity to investments which promote social fairness, with out sacrificing correct diversification and balanced value. Fund choice for this portfolio follows the identical tips established for the Broad Influence portfolio mentioned above, as we search to include broad based mostly ETFs that concentrate on social fairness with adequate liquidity relative to their measurement within the portfolio.

How does the Social Influence portfolio assist promote social fairness?

The Social Influence portfolio shares lots of the identical holdings as Betterment’s Broad Influence portfolio. The Social Influence portfolio moreover appears to be like to additional promote the “social” pillar of ESG investing, by allocating to 2 ETFs that particularly give attention to variety and inclusion — Influence Shares NAACP Minority Empowerment ETF (NACP) and SPDR SSGA Gender Variety Index ETF (SHE).

NACP is a US inventory ETF provided by Influence Shares that tracks the Morningstar Minority Empowerment Index. The Nationwide Affiliation for the Development of Coloured Individuals (NAACP) has developed a strategy for scoring corporations based mostly on a variety of minority empowerment standards. These scores are used to create the Morningstar Minority Empowerment Index, an index which seeks to maximise the minority empowerment rating whereas sustaining market-like threat and powerful diversification. The tip result’s an index which gives higher publicity to US corporations with sturdy variety insurance policies that empower staff no matter race or nationality. By investing in NACP, traders are allocating extra of their cash to corporations with a observe report of social fairness as outlined by the NAACP.

SHE is a US Inventory ETF that enables traders to put money into extra female-led corporations in comparison with the broader market. To be able to obtain this goal, corporations are ranked inside every sector in keeping with their ratio of ladies in senior management positions. Solely corporations that rank extremely inside every sector are eligible for inclusion within the fund. By investing in SHE, traders are allocating extra of their cash to corporations which have demonstrated higher gender variety inside senior management than different companies of their sector.

For extra details about these social affect ETFs, together with any related dangers, please see our disclosures.

Ought to we anticipate any distinction in an SRI portfolio’s efficiency?

One would possibly anticipate {that a} socially accountable portfolio might result in decrease returns in the long run in comparison with one other, related portfolio. The notion behind this reasoning is that by some means there’s a premium to be paid for investing based mostly in your social beliefs and values.

A white paper written in partnership between Rockefeller Asset Management and NYU Stern Center for Sustainable Business studied 1,000+ analysis papers revealed from 2015-2020 analyzing the connection between ESG investing and efficiency. The first takeaway from this analysis was that they discovered “constructive correlations between ESG efficiency and operational efficiencies, inventory efficiency, and decrease value of capital.” When ESG components had been thought of within the research, there gave the impression to be improved efficiency potential over longer time durations and potential to additionally present draw back safety during times of disaster. It’s essential to notice that efficiency within the SRI portfolios may be impacted by a number of variables, and isn’t assured to align with the outcomes of this research.

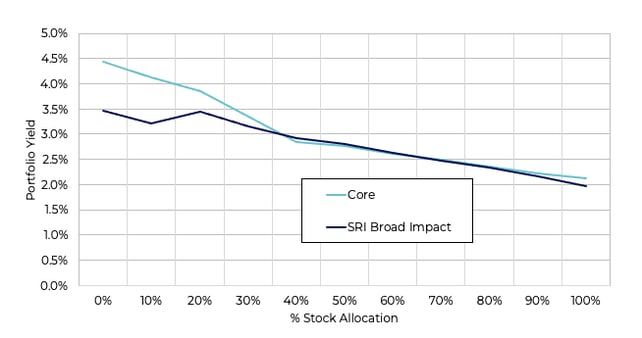

Dividend Yields May Be Decrease

Utilizing the SRI Broad Influence portfolio for reference, dividend yields over a one 12 months interval ending February 8, 2024 point out that SRI earnings returns at sure threat ranges have been decrease than these of Core portfolio. Oil and gasoline corporations like BP, Chevron, and Exxon, for instance, currently have relatively high dividend yields and excluding them from a given portfolio could cause its earnings return to be decrease. In fact, future dividend yields are unsure variables and previous information might not present correct forecasts. Nonetheless, decrease dividend yields generally is a consider driving whole returns for SRI portfolios to be decrease than these of Core portfolios.

Comparability of Dividend Yields

Supply: Bloomberg, Calculations by Betterment for one 12 months interval ending February 8, 2024. Dividend yields for every portfolio are calculated utilizing the dividend yields of the first ETFs used for taxable allocations of Betterment’s portfolios as of February 2024.

Conclusion

Regardless of the assorted limitations that each one SRI implementations face at the moment, Betterment will proceed to help its prospects in additional aligning their values to their investments. Betterment might add further socially accountable funds to the SRI portfolios and substitute different ETFs as extra socially accountable merchandise turn out to be out there.

[ad_2]

Source link