[ad_1]

I was a collector. I collected buying and selling playing cards. I collected comedian books. I collected pins and stickers and mementos of all types. I had bins of issues I would collected however which basically served no goal.

I can not say I’ve shaken the urge to gather totally, however I’ve a significantly better deal with on it than I used to. A number of years in the past, I sold my comic collection and stopped obsessing over them. Right now, I acquire three issues: patches from the international locations I go to, pins from nationwide parks, and — particularly — outdated books about cash.

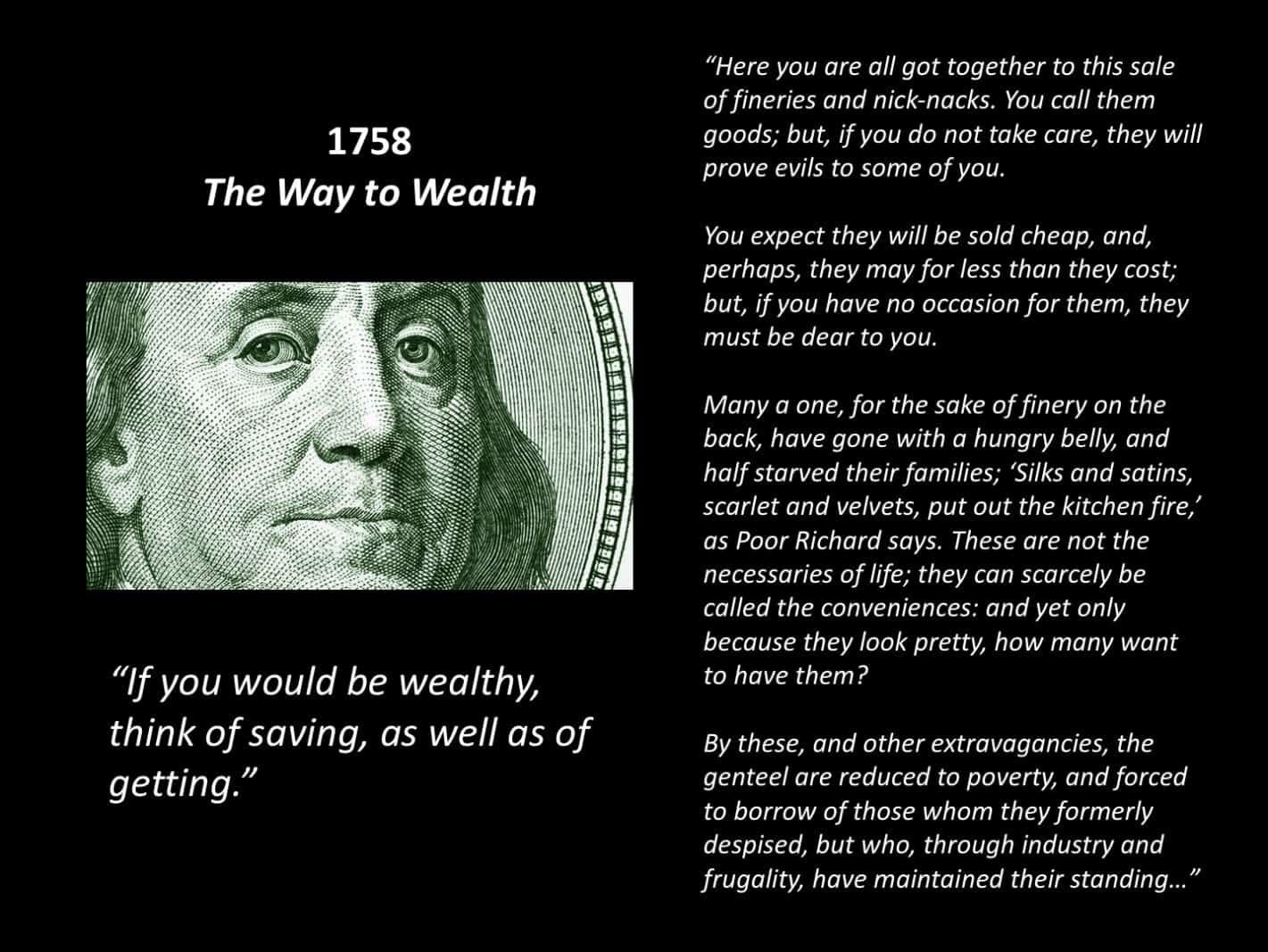

Amassing outdated cash books is enjoyable. For one, it ties to my work. Plus, there’s not an enormous demand for cash manuals, so there’s not a whole lot of competitors to purchase them. (Exception: As a lot as I would love a replica of Ben Franklin’s The Solution to Wealth, so would a whole lot of different individuals. That one is out of my attain.)

One huge bonus from gathering outdated cash books is definitely studying these books. They’re fascinating. And it is attention-grabbing to hint the event of sure concepts on this planet of private finance.

As an illustration, there’s this persistent fantasy of “misplaced financial advantage”. That’s, lots of people immediately need to argue that individuals have been higher at managing their cash prior to now. They weren’t. Debt (and poor cash expertise) has been a persistent drawback since properly earlier than the USA was based. It is not like we, as a society, as soon as had good cash expertise and misplaced them. The way in which individuals handle cash immediately is the way in which they’ve all the time managed cash.

Or there’s the notion of financial independence (and the closely-related subject of early retirement). The usual narrative goes one thing like this:

While you learn outdated cash books, nonetheless, you quickly notice that FIRE is not new. These concepts have been kicking round for some time. Positive, the previous decade has seen the systemization and codification of the ideas, however individuals have been preaching the significance of economic independence for about 150 years. Perhaps longer.

Right now, utilizing my assortment of outdated cash books, let’s check out the place the notion of economic independence originated.

This text is a piece in progress. It is one thing I have been fascinated with for years, however I have not had the assets to really write it till lately. And as I purchase extra outdated books about cash, I am certain my insights will change. This specific model is predicated on a chat I gave final month at Camp FI in Colorado. Actually, a few of the photos I am utilizing listed below are taken from the slides for that discuss.

Within the Starting

Who began the FIRE motion? Who “invented” monetary independence? Who first got here up with the idea? Regardless of my burgeoning library of cash manuals, I haven’t got a definitive reply. Not but anyhow.

That stated, the earliest reference I’ve discovered is Aesop’s fable of the Ants and the Grasshopper from about 560 BCE. (The grasshopper was a cicada within the unique Latin, by the way in which.) Here is an English translation of the unique:

The ants have been spending a nice winter’s day drying grain collected within the summertime. A Grasshopper, perishing with famine, handed by and earnestly begged for slightly meals. The Ants inquired of him, “Why did you not treasure up meals in the course of the summer time?” He replied, “I had not leisure sufficient. I handed the times in singing.” They then stated in derision: “Should you have been silly sufficient to sing all of the summer time, you should dance supperless to mattress within the winter.”

This fable clearly incorporates the germ of the monetary independence concept, even when it does not explicitly discuss F.I. and/or early retirement.

Now, I am sure there are references to this idea in different historical literature. I have not gone searching for them but, nonetheless, so I can not inform you the place to search out them. (If you know, please inform us within the feedback.)

But when we bounce ahead 2250 years, we will see F.I. ideas fairly clearly within the writing of Benjamin Franklin. “Should you can be rich, consider saving, in addition to of getting,” Franklin wrote in 1758’s The Way to Wealth. He famous that as a result of they have been so obsessive about good issues, many rich persons are decreased to poverty and compelled to borrow from individuals they as soon as appeared down upon.

In 1854, Henry David Thoreau revealed Walden. Whereas I’ve some points with this ebook (and with Thoreau), Walden incorporates a transparent basis for the trendy FIRE motion. Actually, once I emailed Vicki Robin to ask what impressed her and Joe Dominguez to show about monetary independence, she particularly cited Thoreau. And it is simple to see why. “The mass of males lead lives of quiet desperation,” he famously wrote. However he additionally wrote this:

The price of a factor is the quantity of what I’ll name life which is required to be exchanged for it, instantly or in the long term.

That quote from Walden sounds as if it may very well be lifted immediately from Your Cash or Your Life‘s dialogue of life vitality, does not it?

In 1864 — in the course of the American civil conflict — Edmund Morris revealed Ten Acres Enough, which documented his household’s moved from the town to the nation as a way to develop ten acres of fruits and berries. His purpose was for his household to be self-sufficient, to acquire what we would name monetary independence.

Morris’ strategy was typical of the day. He wrote:

No prudent man, accepting such a belief, and guaranteeing its integrity, would make investments the fund in shares. Our nation is full of pecuniary wrecks from causes like this…

Like lots of his contemporaries, Morris thought shares have been a poor funding. He advocated investing in actual property. (And be aware his use of the phrase “pecuniary” as an alternative of “monetary”. We’ll come again to that in a second.)

Enjoyable trivia! In Ten Acres Sufficient, Morris does not name the Civil Battle a “civil conflict”. He calls it “the slaveholders’ insurrection”. He additionally makes liberal use of the phrase “treason”. There is not any bullshit concerning the supply of the conflict being “states’ rights” as we hear these days.

Coining a Time period

In 1872, H.L. Reade revealed a ebook referred to as Money and How to Make It. That is an wonderful ebook — one in all my favorites out of all of the volumes I’ve picked up over the previous few years. It tackles all types of numerous subjects, and is sort of progressive for its day.

A lot of the ebook is, because the title suggests, about how to earn more money. To that finish, Reade presents chapters on earn cash with geese and with geese and with cattle. He talks about making cheese. He talks about changing into a physician or a lawyer. However he additionally features a chapter on “Lady’s Half in Making Cash” and one on “The Brotherhood of Man”. Cool stuff for 1872!

However the cause this ebook is essential is that it is the first occasion that I have been capable of finding the place an writer really writes about monetary independence. Here is a quote from the ebook’s introduction:

Now we have purposely united with plain sensible discuss, sufficient of historical past and story to alleviate the amount from any textual content ebook tendency, and believing, as we sincerely do, that no man or girl can learn it with out receiving a worth far higher than its value, we commend it to the calm consideration of each one that, like the author, starting comparatively poor, is anxious to succeed in what all males ought to want and labor for, PECUNIARY INDEPENDENCE.

There you could have it. The primary reference (that I have been capable of finding to date) to the concept of economic independence.

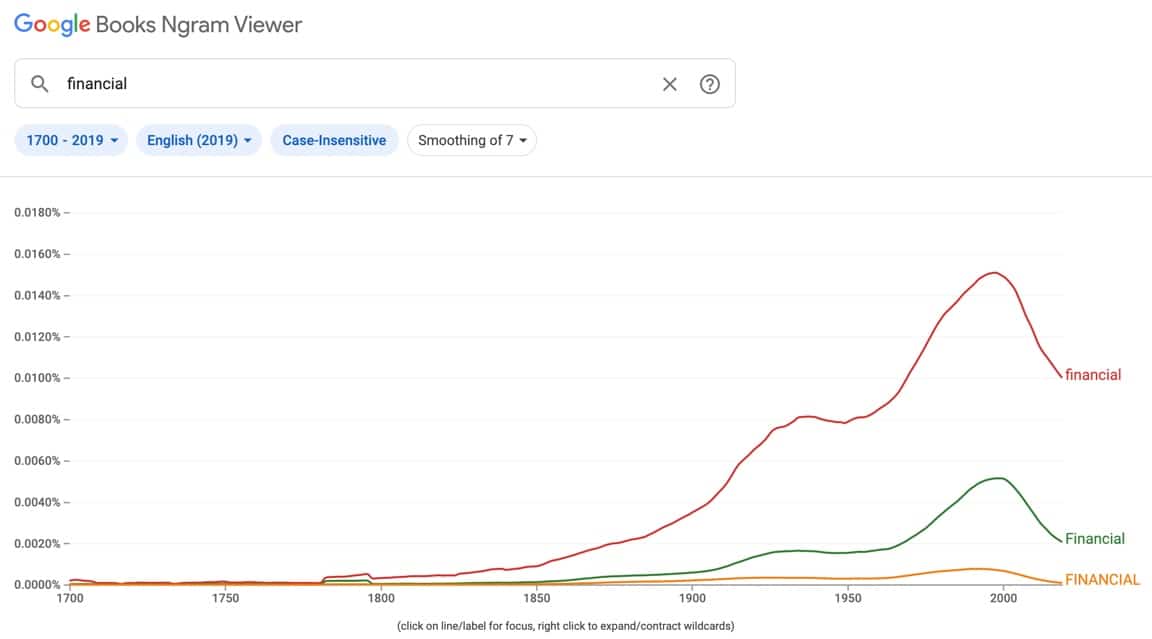

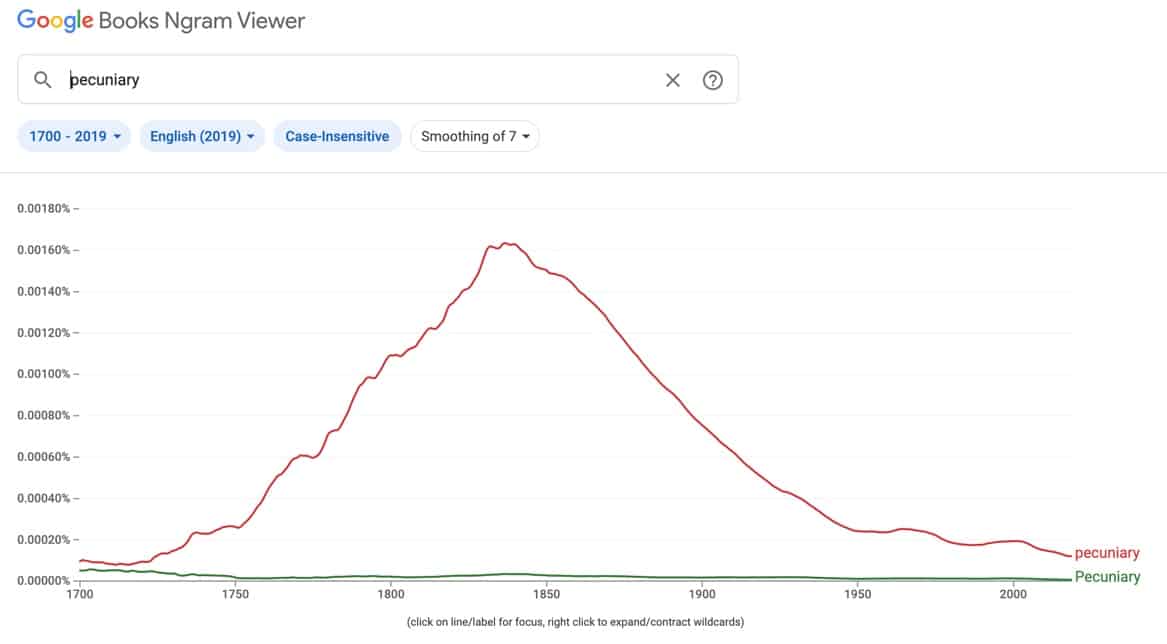

However wait. What’s up with Reade calling it “pecuniary independence”. That is unusual, is not it? Nicely, not likely. Seems that the phrase “monetary” wasn’t but in frequent use in 1872. The phrase had been round a number of hundred years, but it surely wasn’t till the late 1700s that “monetary” started to tackle the definition it has immediately: “regarding cash”. Earlier than that, individuals used the phrase “pecuniary” as an alternative.

Listed below are a few graphs that present how the utilization of “monetary” and “pecuniary” have modified over time.

It wasn’t till the late 1800s that “monetary” supplanted “pecuniary” because the time period of selection. In 1872, Reade did not write about “monetary independence” as a result of “pecuniary indepence” was the extra frequent time period!

Nerdy stuff, eh?

One other essential early F.I. ebook was revealed at about this similar time. In 1875, Scottish writer and social reformer Samuel Smiles revealed Thrift, which was meant to conclude a trilogy of private improvement books. (Smiles revealed Self-Help in 1859 and Character in 1871.)

Within the preface to Thrift, Smiles writes:

Each man is sure to do what he can to raise his social state, and to safe his independence. For this goal he should spare from his means as a way to be unbiased in his situation. Business permits males to earn their residing; it must also allow them to be taught to stay. Independence can solely be established by the train of forethought, prudence, frugality, and self-denial. To be simply in addition to beneficiant, males should deny themselves. The essence of generosity is self-sacrifice.

And Smiles begins the ebook by re-stating the fable of the Ants and the Grasshopper. For my cash — and I have not learn your entire ebook but as a result of I simply acquired within the mail yesterday — this might very properly be the primary ebook about monetary independence…even when it by no means makes use of that time period exactly.

So, what’s the very first reference to the time period “monetary independence”? I haven’t got a definitive reply but, however I do know its earliest look in my assortment of outdated cash books.

In 1919, Victor de Villiers revealed Financial Independence at Fifty, a set of loosely-related articles that initially appeared in “The Journal of Wall Avenue”. Whereas the ebook itself does not dwell on monetary independence, the writer contains this definition at first:

What’s monetary independence? Freedom from dependence on others for steerage, authorities, or monetary assist. The spirit of self-reliance, or of freedom from subordination to others.

He additionally features a chart displaying “the six ages of funding” which is strikingly just like my very own listing of the six stages of financial independence!

Monetary Independence by way of the Years

From these humble origins, the idea of “monetary independence” grew extra advanced and extra strong. The trail to monetary independence turned codified.

One of many first books to set out a system to assist others grow to be F.I. was the immensely widespread The Richest Man in Babylon, which is sort of presumably the best-selling cash handbook of all time.

The Richest Man in Babylon started as a sequence of pamphlets distributed by way of banks and insurance coverage corporations in the course of the early Nineteen Twenties. In 1926, writer George Clason collected this materials into ebook kind for the primary time. Through the years, Richest Man underwent a number of revisions till it reached the shape we all know immediately.

As you are in all probability conscious, Clason advised the next seven commandments for constructing wealth.

- Begin thy purse to fattening. (Save 10% of all you earn.)

- Management thy expenditures. (Avoid lifestyle inflation; curb wishes.)

- Make thy gold multiply. (Use compounding to develop wealth.)

- Guard thy treasures from loss. (Keep away from get-rich-quick schemes.)

- Make of thy dwelling a worthwhile funding. (Purchase your property.)

- Insure a future earnings. (Plan for retirement.)

- Enhance thy capacity to earn. (Educate your self.)

However there have been loads of lesser-known books revealed in the course of the twentieth century that provided glorious monetary recommendation and espoused the ideas of economic independence.

In 1936, for example, as a part of a sequence of books referred to as “The Franklin System”, Lansing Smith wrote Gaining Monetary Safety. This ebook (which is healthier than 90% of the cash books being printed immediately!) is perhaps the earliest ebook to advertise monetary independence as an idea by identify and with a system. Here is an excerpt (emphasis mine):

If you would like monetary independence, you should notice its nice and lasting worth as a fascinating attainment. You will need to maintain everlastingly on the process of creating it come true. Lastly, you should let nothing shake or weaken your willpower to realize your goal.

There’s one issue you need to perceive completely on the outset: The quantity of 1’s annual earnings has far much less to do with final monetary independence than most individuals assume. There are in all probability 1000’s of individuals with incomes many occasions the dimensions of yours who’re however deeply in debt and wholly unable to fulfill their obligations. Then again, many 1000’s have far much less earnings than you could have and but they’re managing to realize monetary safety or at the moment are sustaining and, certainly, rising it.

Comparable books adopted. In 1946, within the wake of the second world conflict, John Durand revealed How one can Construct Monetary Independence for a New Age. And in the course of the Nineteen Fifties, a number of books appeared with the time period “monetary independence” of their title. (Universally, nonetheless, these later books did not really talk about monetary independence. As a substitute, they have been manuals for investing within the inventory market.)

The Nineteen Sixties and Seventies noticed different books about monetary independence seem, lots of which promoted a philosophy that appears comparatively workable by immediately’s requirements. Then, in 1988, Paul Terhorst revealed what I contemplate the primary fashionable FIRE ebook: Cashing In on the American Dream [my review].

Terhorst was 33 years outdated and a accomplice at a serious accounting agency. However he started to surprise if he actually wished to be a part of the rat race. Did not he come up with the money for already? It took him two years of enjoying with numbers, however ultimately he realized that he might give up working if he wished. At age 35, he retired. And he is been retired ever since.

Early Retirement

You may discover that to date I’ve solely mentioned the origin of the idea of “monetary independence”. What about early retirement? The fashionable FIRE motion combines these two notions beneath one roof. Why do not older books achieve this?

The reply to that is difficult as a result of the history of retirement is difficult.

You see, retirement as we all know it has solely existed for about 150 years. In actuality, the definition of “retirement” has been in fixed flux for many of that point. Within the latter a part of the nineteenth century (and the early a part of the twentieth century), retirement wasn’t thought of fascinating. It was referred to as “obligatory retirement”, and it was one thing that individuals railed towards.

https://www.youtube.com/watch?v=39D20T3xa4M

100 years in the past, retirement was an enormous social situation, a lot the identical manner that immigration or gun rights are immediately. Many individuals opposed retirement. It wasn’t till the Social Safety Act of 1935 that attitudes started to vary. In time — by the Nineteen Fifties, actually — our fashionable view of retirement as a interval of relaxation after of lifetime of labor started to crystalize.

As soon as this occurred, then a notion of “early retirement” turned attainable. And we will see society discover the concept by way of books and journal articles.

The books are typically tutorial and of little curiosity to us. The magazine articles, however, are attention-grabbing — particularly since they painting early retirement as a possibility to pursue different paid work. (This flies within the face of an angle distinguished in some quarters immediately, an angle that claims “you may’t be retired in the event you proceed to work”. That concept was bullshit sixty years in the past and it is bullshit immediately.)

Closing Ideas

So, if monetary independence is not a brand new idea, why hasn’t it caught on? If individuals have been preaching the facility of economic freedom since 1872 (or earlier than), why do not extra individuals learn about it? I feel there are a variety of causes.

Samuel Smiles — and individuals who adhere to his Victorian concepts — would argue that the explanation F.I. hasn’t grow to be extra widespread is that persons are weak. As progressive as he was in his day, Smiles believed that poor individuals have been poor as a result of they made poor selections. There are various individuals who would make the identical argument immediately. And whereas I actually consider that poor selections can be a barrier to wealth, I feel they seem to be a barrier for the center and higher lessons, not the decrease class. I consider that poverty is often a result of systemic issues.

Be aware: Let me be clear, although, that regardless the supply of poverty, I consider strongly that it’s as much as the person to raise her monetary place. It does not matter the explanations you are poor. If you would like to flee poverty, it is as much as you to make the alternatives required to take action. Then, after you have freed your self, you may flip your consideration to systemic points, to serving to different individuals stand up as properly.

Maybe the largest change from 1872 to immediately is know-how.

When Cash and How one can Make It was revealed, its attain was restricted. To start with, it was costly. The ebook value $20 again then, which might be roughly equal to $400 in 2020. (You virtually needed to be financially unbiased to purchase the ebook!) Should you might afford to purchase it, then what? Who might you share the data with? Should you loaned the ebook to your sister or your neighbor, perhaps you’d have a number of individuals to speak about these concepts with, however principally you have been by yourself.

Right now, however, this info is ubiquitous. If you wish to study monetary independence and early retirement, there’s virtually an excessive amount of materials on the market for you. And it is simple to search out like-minded of us to speak with! There are Fb teams, subreddits, blogs, podcasts, YouTube channels, and in-person meet-ups galore. Know-how makes it simple to attach with different people who find themselves fascinated by monetary independence and early retirement.

However I feel the true cause that F.I. concepts did not catch on in 1872 (or 1919 or 1936 or 1957 or 1988) is straightforward: Most individuals simply do not care. Some of us do not consider the ideas work. (They do.) Others do not consider the concepts apply to them and their scenario. (They do.) And loads of individuals merely aren’t prepared to attend. The pursuit of economic indepence requires buying and selling short-term consolation for long-term safety. People aren’t hard-wired to assume long run.

As a result of we’re a myopic species, it is robust for us to plan 5 or ten or twenty years sooner or later. That was true 150 years in the past. It is true immediately.

I am not saying that the FIRE motion goes to fade away and be forgotten. I do not assume it’s going to, really. However I do assume that its attraction is proscribed. Most individuals are unwilling to make the alternatives and adjustments essential to retire early. They’re okay with the usual path…although which means they will be working till they’re 65. Or 70. Or older.

I think that 150 years from now, some child can be digging by way of a digital archive and uncover the handfuls of FIRE blogs from 2020. And he’ll marvel at how the concepts he thought have been unique to him and his colleagues in 2170 have really been round for many years. So, he’ll whip up a hologram for HoloTube and share what he is discovered concerning the historical past of economic independence and early retirement.

As a result of — to cite George Santayana — “those that can’t keep in mind the previous are condemned to repeat it”.

[ad_2]

Source link