[ad_1]

More often than not while you purchase insurance coverage, it’s to guard your self. However occasionally you must purchase insurance coverage to guard one thing bizarre—like a financial institution. Wait . . . what?

Sure. When you ever want a mortgage to purchase a house, you’ll be required to buy lender’s title insurance coverage. The phrase lender’s offers you a touch about who’s being insured. It’s a coverage to guard your lender from any issues with the title to your property.

If that is sounding a little bit difficult, don’t fear. It’s not a giant deal. Actually, lender’s title insurance coverage is an reasonably priced protection you solely pay for as soon as, and hopefully by no means take into consideration once more.

Let’s outline it, work out the way it works, and get the main points about what it actually covers.

What Is Lender’s Title Insurance coverage?

When you have a mortgage, lender’s title insurance protects your lender from issues which may floor with your own home’s title sometime—stuff like long-lost heirs, errors in public data, or any sort of authorized declare that would put the financial institution’s funding in danger.

When you didn’t know, the title of a home is the whole historical past of who has owned the property you wish to purchase. Often, the switch of possession is clean and clear—both an inheritor will get it when the proprietor dies, or the proprietor offers it away, or they promote it to a brand new purchaser. In these circumstances, all events agree concerning the new possession and the data are public.

However there can be oversights, mix-ups and miscommunications! And that’s when title insurance coverage is important. Banks want this safety for the reason that mortgage is their lien (the authorized proper to somebody’s property till they settle their debt). With out it, some grasping cousin or a newly found will might jeopardize their funding—to not point out your own home!

Lender’s title insurance coverage is often paid for by the client taking out the mortgage, and it’s just about assured to be part of the mortgage utility. (Trace: You’re going to need each lender’s and proprietor’s title insurance coverage, and we’ll cowl proprietor’s in a while.) It’s very low-cost—often just some hundred {dollars}.

How Does Lender’s Title Insurance coverage Work?

When you’ve ever bought a house, you in all probability bear in mind going to a title firm to signal all of the paperwork. (Simply speaking about it makes our wrists ache!) A title firm’s job is correct there within the identify—they’re a 3rd get together that helps each you and your lender get all of the historical past and information concerning the title on the property you’re shopping for.

Your lender makes use of a title firm to do two foremost issues:

- Search to make certain the vendor is the true and undisputed proprietor with the authorized proper to promote the property with a clear title

- Problem a lender’s title insurance coverage coverage

The face worth of a lender’s title coverage will match the quantity of the mortgage itself. As you pay the mortgage down, the worth of the coverage will go down at the very same fee. Sometime, the coverage will expire (however because you’ll have paid off your own home by then, you in all probability gained’t even discover.) Cheers!

The lender’s facet of title insurance coverage kicks in anytime there’s a problem to your standing because the true proprietor of a property. Title firms strive to get the total historical past of any property they deal with in an actual property transaction—however no person’s good. Even essentially the most thorough analysis can miss a title defect. (That’s a authorized problem with the title the place the true proprietor might be disputed.)

When that sort of problem comes up, your own home is on the road. Hopefully any disputes concerning the standing of your completely happy dwelling end up in your favor! However simply in case some ex-spouse or hidden easement pops as much as cancel your title, your lender will make a declare on the lender’s insurance coverage to procure. If it seems you’re truly not the proprietor, the home you borrowed for is not yours or the financial institution’s—they usually’ll must recoup the cash they’re dropping within the deal.

Like we mentioned above, the premium on a lender’s title coverage is one thing you solely pay as soon as. Often, it’s a part of the closing on your own home.

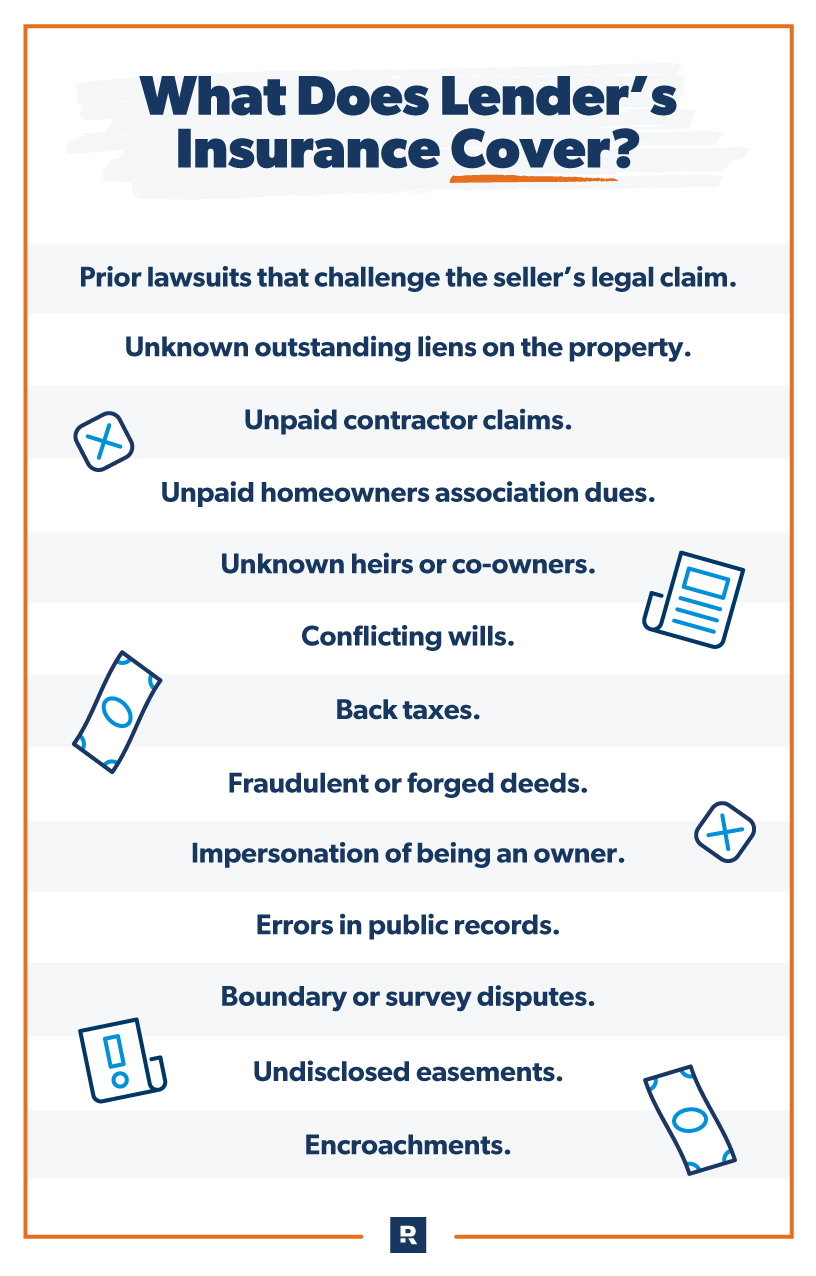

What Does Lender’s Title Insurance coverage Cowl?

To be obnoxiously clear: Lender’s title insurance coverage by no means covers you, the house owner. Though you are the one who has to pay for it while you take out a mortgage, its solely goal is to guard the financial institution. If the title firm advised you the title was clear while you purchased the home, that’s nice! And hopefully it stays that method. Nevertheless it’s additionally price figuring out about among the miserable defects that may floor—typically lengthy after you’ve moved in.

Let’s take a look at just a few of the conditions by which a lender’s title coverage might come into play:

- Prior lawsuits that problem the vendor’s authorized declare

- Unknown excellent liens on the property

- Unpaid contractor claims

- Unpaid householders affiliation dues

- Unknown heirs or co-owners

- Conflicting wills

- Again taxes

- Fraudulent or solid deeds

- Impersonation of being an proprietor

- Errors in public data

- Boundary or survey disputes

- Undisclosed easements

- Encroachments

And also you thought it was only a purchaser and a vendor and a financial institution! Who knew there have been so many sorts of authorized mishaps that would threaten your own home?

Is Lender’s Title Insurance coverage Value It?

When you want a mortgage to get into a house, then lender’s title protection is unquestionably price shopping for—the truth is, it’s nonnegotiable! The minute you flip in your paperwork to get the mortgage practice rolling, the title search begins. And the financial institution gained’t approve your mortgage till they know that mortgage’s insured.

However perhaps you couldn’t care much less about defending some financial institution (relatable!) There’s one other huge purpose to make use of a title firm for any dwelling buy—as a result of because the house owner, you need to verify that your new home is admittedly yours. Title firms are the consultants in going by means of all the general public data to find each doable element about your property’s historical past.

And bear in mind, it’s tremendous reasonably priced. The components is often someplace between 0.5% to 1% of the mortgage quantity, and it’s one thing you pay solely as soon as. There are numerous far dearer—and method much less helpful—types of insurance coverage.

What Are the Dangers of Not Having Lender’s Title Insurance coverage?

The primary threat of not having lender’s title insurance coverage is that you just gained’t be capable to get a mortgage. (Really, that’s not a threat, it’s a promise.) If you should purchase a home with 100% money down, that’s stupendous! However don’t count on to get a mortgage except you’re keen to cough up just a few Benjamins for lender’s title insurance coverage.

What Is an Proprietor’s Title Coverage?

All this discuss property disputes and lacking uncles who wish to declare your own home ought to elevate an apparent query in your thoughts—what about defending myself as a home-owner? That’s a complete completely different sort of coverage.

There are two forms of title insurance coverage: proprietor’s and lender’s. And despite the fact that banks would require you to get lender’s title insurance coverage to guard themselves, proprietor’s is non-obligatory—technically! However when you don’t get it, you’re making an enormous mistake.

Proprietor’s title insurance coverage covers you (the proprietor) from being sued if somebody has a beef together with your property. Let’s say the earlier proprietor had a garden care specialist . . . however stopped paying their invoice earlier than they bought the house to you. The garden care firm put a lien in opposition to the house in hopes the proprietor would settle up. When you didn’t get proprietor’s title insurance coverage, the earlier proprietor’s garden care payments at the moment are your downside.

And that huge scary record of potential title defects above? Yeah, all of those self same issues that put the lender in danger might probably influence you as an proprietor sometime too. So despite the fact that getting proprietor’s title insurance coverage is non-obligatory, it will be insane to go with out it.

In fact, as a home-owner you must know that having a homeowners insurance policy is important protection to protect your home. And it’s safety that works alongside your proprietor’s title coverage to protect your property and its worth.

How Do You Purchase Lender’s Title Insurance coverage?

Your lender or actual property agent might have a selected title firm in thoughts they suggest you’re employed with. However you don’t should go together with their suggestion. Buying round, you may like one title firm greater than one other.

Shopping for lender’s title insurance coverage is often a part of the closing course of. Most individuals simply log out on it with out paying a lot consideration—as a result of it’s arduous to note all the things when you’re plowing by means of all of the paperwork they make you signal!

And what about householders insurance coverage to go together with your title protection?

One method to get it’s to buy round and purchase straight from a provider. However this may take a number of time and nonetheless go away you with out the most effective safety. With so many various coverages and add-ons, it’s straightforward to overlook one you want or by chance purchase one you don’t.

What when you might delegate this to another person? You’ll be able to!

Sitting down with a RamseyTrusted insurance coverage professional can take the thriller out of house owners insurance coverage. They’ll make sure you enable you to perceive what’s coated—and what isn’t—whereas getting you all of the protection you’ll want to defend your own home.

Plus, working with an impartial agent who isn’t tied to 1 insurance coverage firm may enable you to lower your expenses on householders insurance coverage. That’s as a result of they will store round for charges from dozens of various firms and discover the most effective deal for you.

Connect with a pro near you today!

Focused on studying extra about householders insurance coverage?

Signal as much as obtain useful steerage and instruments.

[ad_2]

Source link