[ad_1]

Say you reside in Minnesota: You’re driving alongside consuming your tapioca pudding in your technique to play ice hockey when a deer steps into the highway. You slam on the brakes and the man behind you plows into your trunk.

Now say you reside in Arizona: You’re driving alongside consuming prickly pear jerky in your technique to hike the Sonora when your tire explodes from the scorching asphalt. The man behind you doesn’t cease. Smash.

In Minnesota, your insurance coverage pays on your accidents. In Arizona, the opposite man’s does. Complicated? Yep. It boils right down to no fault insurance coverage. Let’s check out what it’s, the way it works and what states require it.

What Is No Fault Insurance coverage?

No fault insurance coverage is insurance coverage that covers your private accidents irrespective of who’s at fault within the accident.

With a no fault system, all people’s primary accidents or medical bills are coated by their very own no fault insurance coverage, normally known as private damage safety (PIP) insurance coverage (as much as a sure restrict). Individuals typically use no fault insurance coverage and PIP to imply the identical factor, however this could get complicated. Simply keep in mind, no fault can even discuss with the authorized system that lays out who pays for an accident.

The concept behind no fault insurance coverage is to verify everybody can get the medical consideration they want with out ready to determine who brought on the accident (and whose supplier is on the hook for the medical payments).

No fault insurance coverage is a part of the no fault system of legal guidelines many states have that require folks to hold particular insurance coverage to pay for their very own medical remedy in the event that they’re injured in an accident.

One other large cope with no fault legal guidelines is that they prohibit your means to sue the particular person at fault for the accident.

Not each state has no fault legal guidelines, and even in states that do have a no fault system, the legal guidelines nonetheless range. We’ll get into that extra in a minute.

What Does No Fault Insurance coverage Cowl?

This type of insurance coverage covers just about every part that doesn’t should do with the automobile (so no fault will cowl the price to get your again’s slipped disc rehabbed, nevertheless it received’t cowl the price to repair your BMW’s disc rotors).

Right here’s what no fault insurance coverage covers:

- Medical bills

- Funeral bills

- Misplaced revenue (in case you’re injured and might’t work)

- Childcare bills (in case you’re injured and might’t care on your children)

- Survivors’ loss advantages (in case you die and have dependents it will cowl the lack of monetary help you’d’ve supplied—this doesn’t exchange your want for life insurance although)

- Family providers (in case you’re injured and might’t run your family)

Sorts of No Fault Insurance coverage

Simply because your state has no fault insurance coverage doesn’t imply the principles are the identical from state to state. In truth, they are often fairly totally different relying on the place you reside. One of many greatest elements, as you’ll see, is whether or not your state permits you to sue the at-fault driver or not.

Pure No Fault

Like pure Angus beef with no fillers, pure no fault is the true deal. In case your state has it, then each driver should purchase it—no ifs, ands or buts. Drivers aren’t allowed to sue when damage bills fall beneath a certain quantity (states set the quantity). And you’ll’t decide out. There are 9 states with pure no fault legal guidelines.

Alternative No Fault

That is the place the fillers are available in (you could possibly name this your McDonald’s patty). With this type of no fault legislation, you’ll be able to select to purchase no fault insurance coverage or decide out. When you decide out, your premium will be cheaper, and in case you’re in an accident, you’ll be able to sue the opposite particular person concerned. However that additionally means different drivers on the market can sue you too!

Add-On

This sort will get difficult (straight Past Burger stuff). In some states with this label, no fault is solely one in every of many insurance coverage choices accessible. Drivers may select so as to add PIP (aka no fault) to their auto insurance coverage protection as a result of they don’t need the concern of determining who’s at fault earlier than their insurance coverage kicks in to pay their medical prices. In different add-on states, PIP is required, however they don’t restrict lawsuits.

Don’t let car insurance costs get you down! Download our checklist for easy ways to save.

In each instances, the states get labeled add-on, although, as a result of so long as a state doesn’t prohibit your means to sue the at-fault driver, they technically aren’t a no fault state—even when PIP is required. Yeah, complicated.

How Does No Fault Insurance coverage Work?

Let’s return to our Minnesota instance at the start: If somebody rear-ends you and also you get whiplash, your PIP kicks in instantly and pays for an X-ray and no matter different medical consideration you want. If the man who hit you smashes his head, his PIP pays for his ER go to and misplaced wages if he can’t work for some time.

This is one other state of affairs: In Florida (a no fault state), you swerve to maintain a truck from hitting you, however you hit another person. That particular person dies and also you’re critically injured.

The opposite driver’s PIP would pay for his or her funeral bills and likewise pay their partner for the driving force’s misplaced revenue. Your PIP covers your hospital payments, rehab, misplaced wages from not working, and home visits from a nurse to care on your mother as a result of you’ll be able to’t look after her whilst you’re injured.

In each instances, whether or not you’re at fault or not, every drivers’ PIP insurance coverage covers their medical and different associated bills.

What if each events are at fault in an accident?

Automotive accidents aren’t at all times minimize and dry. Generally each drivers share fault for the collision. In relation to bodily damage claims, this doesn’t actually matter in a no fault state. Every driver’s PIP covers them it doesn’t matter what.

If this occurs in a state that isn’t pure no fault, the state’s negligence legal guidelines (guidelines that lay out what’ll occur if somebody doesn’t do what they need to have) will decide how a lot every occasion can pay typically based mostly on percentages of fault.

Isn’t any fault insurance coverage required?

Whether or not you’re required to hold PIP or not is solely as much as the state you reside in. And like we stated earlier than, some states are known as no fault and say PIP is necessary, however there’s nonetheless an choice to waive PIP and decide out of the no fault system. Let’s get into which states don’t have any fault legal guidelines and which don’t, and which of them require PIP.

No Fault Insurance coverage States

You could have heard that Florida is a no fault state—or New Jersey is a no fault state. When you’re like lots of people, you might have questioned, What the heck does that imply? States are labeled no fault and at-fault relying on how they deal with lawsuits and who pays for what in an accident.

In a no fault state, you’re not allowed to file a lawsuit towards the opposite driver in case your medical bills fall beneath a certain quantity (set by the state). In case your accidents and losses are excessive although (better than the set restrict), then you’ll be able to sue their butts (however please don’t be a type of guys firing off frivolous lawsuits).

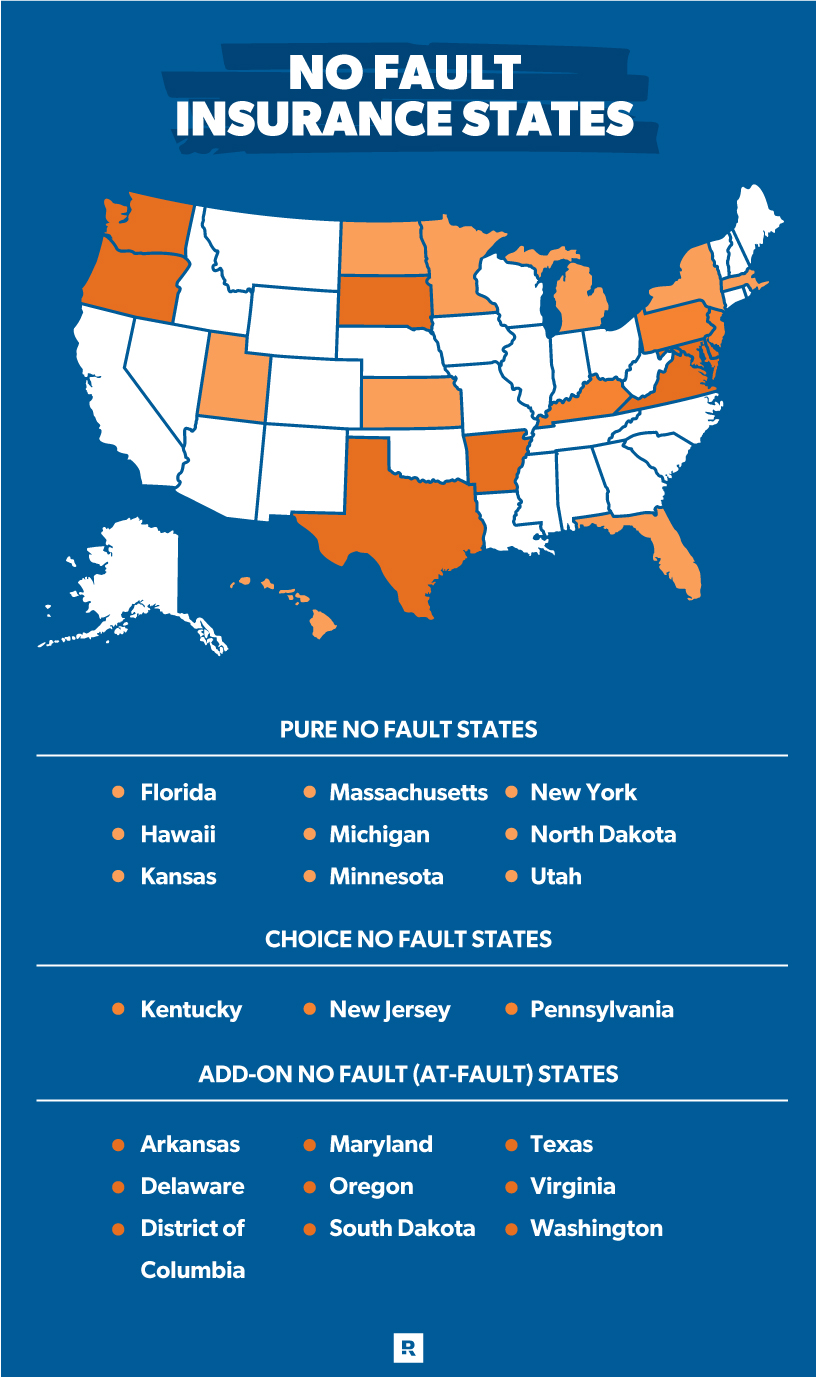

Pure No Fault States

With the intention to hit the roads in these 9 “pure” no fault states, you should carry PIP insurance coverage.

- Florida

- Hawaii

- Kansas

- Massachusetts

- Michigan

- Minnesota

- New York

- North Dakota

- Utah

Alternative No Fault States

The subsequent three are “selection” no fault states, which suggests drivers can select to decide out of the state’s no fault system. This lets drivers who don’t have PIP protection sue different drivers for damages.

- Kentucky

- New Jersey

- Pennsylvania (their no fault system makes use of Medical Advantages insurance coverage reasonably than PIP, however the identical concept applies)

Add-On No Fault (At-Fault) States

The ultimate group is “add-on” no fault states. In a few of these states, drivers can select to hold PIP or not. In others, PIP is necessary. However in all of them, there are not any limitations on whether or not you’ll be able to sue an at-fault driver, and so these states are known as at-fault (yeah, so complicated—Past Burger, keep in mind?).

- Arkansas

- Delaware

- District of Columbia

- Maryland

- Oregon

- South Dakota

- Texas

- Virginia

- Washington

In our Minnesota rear-end instance from earlier, each drivers are required by state legislation to hold PIP as a result of it’s a pure no fault state. In addition they can’t sue one another except their accidents are above a certain quantity. If we transfer our rear-end instance to Texas although, issues are totally different.

If the accident will not be your fault, your insurance coverage will cowl your medical bills instantly—except you selected to waive PIP. In that case, you’d be accountable to pay for medical bills out of your pocket or via your medical health insurance. No matter whether or not you waived PIP or not, you could possibly sue the opposite driver at any level.

If the accident is your fault, you’d be open to a lawsuit from the opposite driver. The opposite driver’s PIP would cowl their medical bills except they waived it—then it will come out of their pocket.

All states not listed within the desk above are known as tort states and don’t supply a no fault system (however some nonetheless supply PIP insurance coverage). We’ll speak about these subsequent.

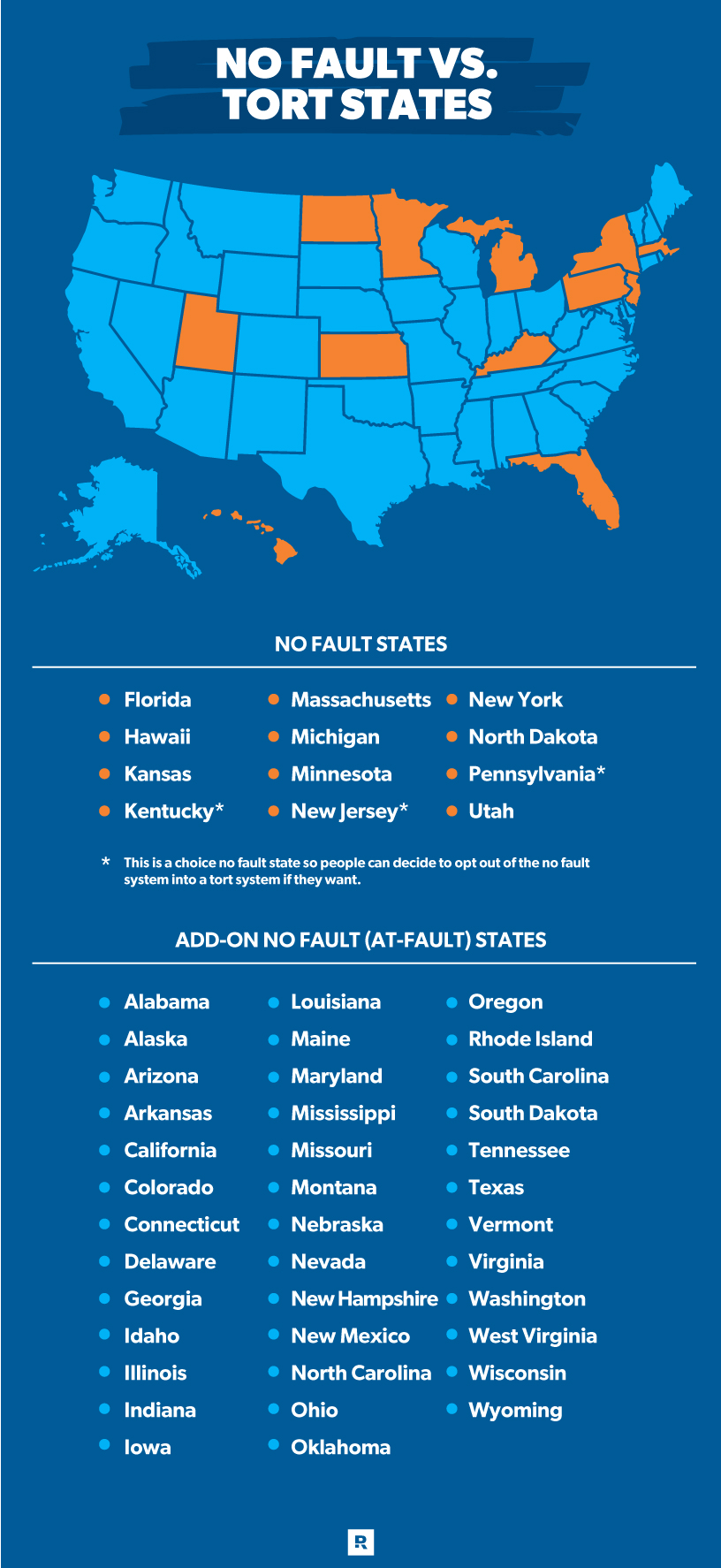

No Fault vs. Tort

A tort system is one other identify for the at-fault system and is the set of state insurance coverage legal guidelines that lays out who has to pay for damages and accidents attributable to a visitors accident. In a tort system, fault is assigned to one of many drivers (or typically break up) and that driver’s insurance coverage should pay for every part (automobile injury, medical bills, and many others.)

If each drivers brought on the accident, fault is doled out in percentages (we talked about this earlier). So, if Suze doesn’t see Damien developing on her left, adjustments lanes and smashes into Damien, however a part of the explanation why Suze didn’t see him is as a result of Damien was dashing 15 mph over the restrict, Suze would pay one thing like 70% of damages and Damien 30%.

No Fault States vs. Tort States

One other large distinction between no fault and tort programs is tort states don’t put restrictions on lawsuits. So if Gerry will get in a crash and loses the usage of his pinkie toe, he can sue the opposite driver for medical bills, ache and struggling, and the rest his billboard lawyer can consider.

In a no fault system, drivers can’t sue one another except they meet state-specific thresholds—and even then, you’ll be able to’t sue for issues like ache and struggling or emotional scarring. Some states’ threshold is bodily damage, like in Florida the place it’s essential to both lose necessary physique perform or undergo everlasting damage, scarring disfigurement or loss of life. Different states use a financial threshold, like in Hawaii the place you’ll be able to go to court docket briefcases blazing in case your medical bills exceed $10,000.

No fault states require drivers to buy a certain quantity of PIP, so all people pays for their very own accidents. Tort states don’t require PIP, however they do nonetheless have minimal mandates for different types of insurance, like uninsured motorist and liability.

*It is a selection no fault state so folks can determine to decide out of the no fault system right into a tort system if they need.

Submitting a No Fault Insurance coverage Declare

Because you don’t want to ascertain fault in a no fault state, you’ll be able to file a claim instantly together with your insurance coverage firm. You possibly can file on-line straight away, on an app or name them up similar to you’d with every other declare.

Be sure that to concentrate to any submitting deadlines your provider has. Some have a strict window after an accident through which you could file. After your insurer will get your declare, they’ll look it over and determine whether or not your declare is roofed and the way a lot they’ll pay. They could make you get an examination by a physician they select.

Like we talked about earlier, no fault insurance coverage solely covers medical bills and different injury-related bills and never that huge dent in your candy Mustang.

Since PIP doesn’t cowl injury to your automobile, you’ll should cope with the opposite man’s insurance coverage to get that coated—except it was your fault, after which your collision and liability coverages will kick in.

How A lot Is No Fault Insurance coverage?

Minimal protection required by every no fault state may be very totally different—New York requires $50,000 in protection whereas Utah solely mandates $3,000! These variations make the price to buy PIP fluctuate wildly based mostly on the place you reside.

When you’re in one of many 12 states the place PIP’s required, take a look at your state’s minimal PIP protection quantity to get an concept of how a lot it’ll price you (the upper it’s, the extra it’ll price):

- Florida: $10,0001

- Hawaii: $10,0002

- Kansas: $4,5003

- Kentucky: $10,0004

- Massachusetts: $8,0005

- Minnesota: $40,0006

- Michigan: $50,0007

- New Jersey: $15,0008

- New York: $50,0009

- North Dakota: $30,00010

- Pennsylvania: $5,00011

- Utah: $3,00012

In every state, extra protection is normally accessible if you would like extra safety—that is simply the naked minimal you’re required to buy.

Find out how to Purchase No Fault Insurance coverage

If you go to buy insurance on your car, PIP can be a compulsory a part of your coverage in case you stay in a no fault state or one of many tort states that also mandates PIP.

As you choose your coverages, the one possibility you’ll have on the subject of PIP is how a lot you purchase. In case you have a extremely nice health insurance coverage that may cowl you after an accident, you could possibly go together with the state minimal for PIP protection. If you’d like extra safety or your state minimal may be very low, you may wish to purchase further.

When you stay in a “selection” no fault state and don’t wish to purchase PIP, you’ll should file a no fault rejection kind or waiver together with your state. In Kentucky, for instance, you’ll must file with the Division of Insurance coverage.

For anybody in a state with “selection” or “add-on” no fault insurance coverage, the decision to purchase or move on PIP is as much as you. When you’re attempting to determine in case you want PIP, now could be a great time to do a coverage checkup—as a result of when you’ve got primary health insurance, it’s a good suggestion to get PIP.

Connecting with an independent insurance agent will help you save on automobile insurance coverage—even when your state mandates $50,000 in PIP. As a result of an unbiased agent doesn’t work for any particular firm, they’re free to work for you. By evaluating quotes from throughout, a RamseyTrusted insurance pro can discover you the best deal.

Speak with an independent insurance agent at this time.

Regularly Requested Questions

[ad_2]

Source link