[ad_1]

Think about you’re making an attempt to prepare dinner risotto in your fancy range to impress your date. However you let it boil over whilst you attempt to persuade your neighbor to show down the reggae so you possibly can hear Frank Sinatra. Your entire range bursts into flames.

Whereas insurance coverage won’t cowl the lack of your date, it will pay you $1,000 for the range. However wait, a brand new range prices $1,900! Properly, hopefully you have got insurance coverage with recoverable depreciation, and also you’ll get a second examine to make up the distinction.

If that sounds complicated, don’t fear. Insurance coverage can really feel extra difficult than a risotto recipe. However we’ll go over it step-by-step so you possibly can really feel assured you’ve bought the best owners insurance coverage protection.

What Is Recoverable Depreciation?

For those who’re already dozing off, we get it. Recoverable depreciation sounds about as thrilling as a saltine cracker. However you’ll be glad you realize as soon as you realize. So, what’s recoverable depreciation? Recoverable depreciation is the distinction between the worth of your property whenever you purchased it and its worth when it bought destroyed. The “recoverable” a part of that time period refers as to whether your insurance coverage can pay the distinction or not. So principally, recoverable depreciation is the loss in your stuff’s worth you can get again if in case you have the best insurance coverage.

Understanding Recoverable Depreciation

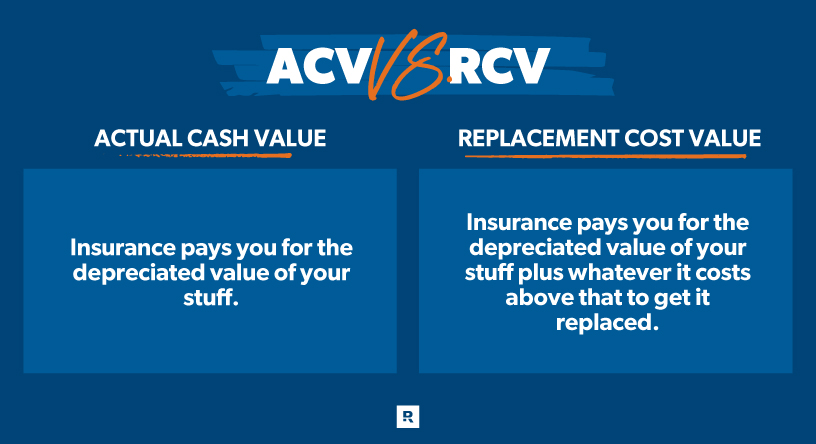

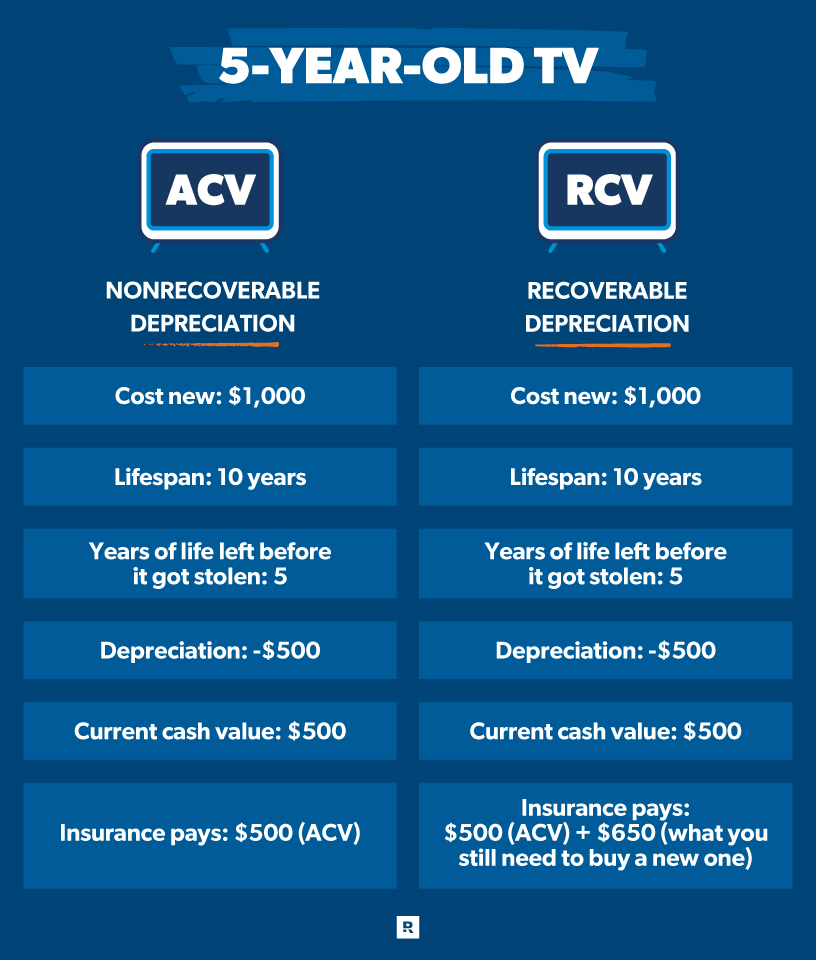

To know recoverable depreciation, it helps to know what the different kinds of coverage are: substitute price worth (RCV) and precise money worth (ACV).

In case you have substitute price worth protection (RCV), your insurance coverage provider can pay you adequate to exchange the loss—which suggests the depreciation is roofed. You’ll get a examine that equals what your broken property was price after which some extra to cowl what it prices to get a brand new one.

ACV protection, then again, solely pays you what your property was price proper earlier than it went kablooey.

Nonrecoverable Depreciation

In case you have an ACV coverage, your property will expertise nonrecoverable depreciation. Prefer it sounds, this implies when your property loses worth, you received’t have the ability to get that worth again by way of insurance coverage if it will get destroyed. They’ll solely pay you what your range (or different property) was price when it went up in smoke (aka the merchandise’s loss in worth over time is nonrecoverable).

How Is Recoverable Depreciation Calculated?

To determine how a lot your stuff is price after depreciation, insurance coverage firms have a look at the lifespan of your merchandise just like the range.

Say your range is meant to final 20 years and also you’ve had it for 5. The insurance coverage firm will take what it’s price new ($1,900) and divide that by the years in its lifespan (20) to get a depreciation worth for annually that passes ($95). So, in the event you’ve had the range 5 years, it’s now price $1,425, based on the insurance coverage firm. A lot for “investing” in a high quality range!

One other issue insurance coverage firms have a look at to find out depreciation is obsolescence. If higher, badder fashions of your range have been made since you obtain yours, that’ll make your mannequin price much less. But when no newer fashions have been launched, that might make your range’s worth go up.

Precise Money Worth Reimbursement

That quantity ($1,425) we simply calculated?—that’s the quantity you’ll see in your ACV examine. Your insurance coverage provider can pay you out based on how a lot life is left in your merchandise.

Recoverable Depreciation Cost

However if in case you have RCV, that signifies that depreciation is—recoverable! Which suggests you’ll be getting extra moolah within the mail. Your provider will reduce you a examine for $1,425 and for that $475 of depreciation your valuable range misplaced within the 5 years you used it. That is undoubtedly a happier state of affairs!

How Insurance coverage Pays for Recoverable Depreciation

Recoverable depreciation appears like a flowery time period—and it’s—nevertheless it’s actually simply particular language used to speak a few specific a part of RCV protection—the half the place you receives a commission for the substitute worth reasonably than simply the precise depreciated worth.

Protect your home and your budget with the right coverage!

One thing chances are you’ll not find out about getting your stuff changed by way of insurance coverage is you’ll truly get two checks. Though you have got RCV, the primary examine would be the precise money worth of the factor (don’t panic—one other one’s coming).

Usually, insurance coverage firms pay out simply sufficient to get you began changing or repairing your stuff and anticipate the ultimate invoice to come back in so that they don’t overpay (or underpay) you. So your second examine would be the distinction between the ACV of your stuff and what you paid to switch or restore it. This additionally helps forestall fraud when somebody would possibly invoice insurance coverage for the total price then buy a less expensive choice to make a little bit cash.

Recoverable Depreciation With a Deductible

In case you have a deductible (it is best to!), that first examine you get will truly be the ACV minus your deductible. So say your range is price $1,425 and your deductible is $500. Which means your provider will reduce you a examine for $925. Your second examine will then be the distinction between $1,425 and what you pay for a brand new range. In different phrases, you’ll nonetheless be protecting $500 price of your new range.

How Recoverable Depreciation Impacts a House Insurance coverage Declare

In terms of your property insurance coverage declare, recoverable depreciation received’t change an excessive amount of. It’ll simply contain a little bit extra documentation in your half, and like we stated above, you’ll get two checks as a substitute of 1.

Methods to File a Recoverable Depreciation Declare

Submitting a declare if in case you have recoverable depreciation insurance coverage includes an additional step to get your full cost. Let’s break it down:

After the kitchen fireplace, you’ll need to notify your insurance coverage firm and present them the range injury. They’ll appraise what your range (with depreciation) was price earlier than it went up in smoke and ship you a examine for that quantity minus your deductible.

Subsequent, you’ll exit and discover a new range. For those who choose one which’s cheaper than the one you had, your insurance coverage firm will in all probability base your recoverable depreciation cost on that cheaper complete reasonably than the worth (when brand-new) of the unique range. So, if you’d like essentially the most bang in your premium buck, go forward and get a range that’s nearly as good as your authentic one.

This is the place the additional step is available in: When you’ve purchased your stunning new range (and earlier than you get carried away making ratatouille), make sure that to ship invoices and receipts from the acquisition to your insurance coverage firm to show you obtain it and the way a lot you paid.

If every thing checks out, your provider will then ship you a second examine for the distinction between the ACV (first examine) and the way a lot you paid for the brand new range.

What Will get a Recoverable Depreciation Insurance coverage Examine?

It is possible for you to to get well depreciation on something that’s covered in an RCV policy. This implies if your own home is destroyed in a storm and you’ve got substitute price protection, you’ll get a second examine protecting depreciation for every thing.

This might embody:

- Home equipment (washer/dryer, fridge, the three toasters you bought in your marriage ceremony, and so on.)

- Electronics (TV, computer systems, cameras, and so on.)

- Furnishings (we don’t have to listing these)

- Garments (a few of chances are you’ll be hoping your husband’s garments blow away)

- Home construction

Recoverable Depreciation for Roof Replacements

To this point, we’ve been speaking about recoverable depreciation in reference to stoves as a result of it’s a enjoyable story. However the commonest big-ticket merchandise you’ll run into this situation with is your roof.

For most individuals, their roof is the only greatest merchandise they personal that depreciates with regards to home insurance. Whereas a number of components change the worth, on common, an entire new roof within the U.S. prices $10,000.1

If the heavens open and bestow the present of hail upon your 15-year-old common roof, pummeling it unto destruction, you’ll be getting cozy cozy with recoverable depreciation—or not, relying on whether or not you have got RCV or ACV protection.

However let’s say you do have RCV protection. First, your insurer will calculate the depreciation in your roof. Most asphalt shingle roofs final 20 years. You’ve had yours for 15, which suggests it had 5 years of life left in it. So, based on your provider, your roof was price $2,500. Which means your provider will ship you a examine for 2 and a half grand to begin with.

After you’ve paid for the brand new roof, you’ll ship all of them the invoices and receipts and so they’ll pay you the distinction ($7,500). Now you’re cooking with fuel!—oh wait, it is a roof not a range. . . . Now you’re lined!

It’s in all probability fairly apparent by now what’s going to occur in the event you don’t have RCV protection and solely ACV. You’ll get $2,500 and a sayonara.

Recoverable Depreciation Time Restrict

Caught between the matte graphite or blue end in your range? Simply know you possibly can’t wait perpetually to make your declare on recovering depreciation. Don’t get slowed down whereas looking for the proper substitute or determining repairs for thus lengthy that you simply go previous your insurance coverage firm’s time restrict. That’s proper, there’s a time restrict on how lengthy you possibly can wait earlier than claiming recoverable depreciation.

Whereas it differs by state, the window is usually 180 days or six months however could be as much as two years from the date your stuff bought destroyed.

How Do You Battle Insurance coverage Depreciation?

Typically what an insurer pays out simply doesn’t appear truthful. Possibly you suppose they depreciated your stuff an excessive amount of. If that’s the case, you possibly can battle it—simply be ready to supply proof for why your stuff is price greater than they are saying it’s.

Earlier than you kick up any fuss although, ensure you learn by way of your insurance coverage coverage rigorously. It may very well be that you simply missed one thing in there which means the insurance coverage firm is definitely proper—like possibly you solely have ACV protection whenever you thought you had RCV, or there’s a deadline for submitting that you simply missed, or one thing else.

If after studying your coverage you continue to suppose your provider is underpaying you, discuss with the insurance coverage adjuster who valued your stuff. Be certain they (and also you) perceive the state of affairs and have all the small print.

The next move if that doesn’t work is to file a grievance with the insurance coverage firm and ask for a evaluation. Lastly, if all else fails, you possibly can file a grievance in opposition to your insurance coverage firm together with your state’s insurance coverage division.

How Do You Negotiate a Diminished Worth Declare?

To this point, we’ve been speaking about recoverable depreciation by way of home insurance. However there’s an analogous situation referred to as diminished worth with automobiles and your auto insurance coverage.

In case your automobile will get smashed up in an accident, even after you get the repairs performed, it’s price much less. You’ve in all probability seen this in actual life whenever you went to purchase a automobile (you see a automobile going for an incredible value and discover out it’s been in two accidents).

Insurance coverage will after all pay in your automobile repairs, however typically they’ll additionally pay for the diminished worth of your automobile. So in case your automobile was price $10,000 earlier than the accident and now’s price $8,000, they’ll pay you $2,000!

How this works is completely different in each state, however often you possibly can’t have been at fault and you need to present proof your automobile misplaced worth.2 A technique to do that is to get an appraisal from an authorized car appraiser.

Do I Want Recoverable Depreciation Insurance coverage?

Sure, it’s dearer, however in the event you can afford it, shopping for recoverable depreciation insurance coverage or RCV protection is a extremely good concept. Give it some thought: If your property went up in flames and your insurance coverage supplier solely paid you the ACV of what it and every thing inside is price, would you have got sufficient to cowl the remaining and put your life again collectively?

Usually, the reply is no. And that’s okay. That’s the rationale it is best to get insurance that will cover the cost to replace everything, together with depreciation.

Methods to Discover House Insurance coverage With Recoverable Depreciation

You now know you want it, however how do you get? Properly, many insurance coverage firms provide protection for depreciation or RCV as an choice. It’s going to be dearer, however like we stated earlier than, it’s price it. (It’s a verifiable proven fact that fancy stoves are the solely solution to impress a date.)

Simply because it prices extra, although, doesn’t imply you need to pay by way of the nostril! Going by way of an independent insurance agent to get a recoverable depreciation coverage can prevent a stockpot-load of money. As a result of they be just right for you reasonably than a specific insurance coverage firm, they’re motivated to get you the very best deal round.

Don’t let a house calamity go from unhealthy to worse. Shield your pockets from disasters like storms, floods and cooking.

Discuss to a RamseyTrusted insurance coverage professional about recoverable deprecation protection. Connect with a RamseyTrusted pro today!

[ad_2]

Source link